- United States

- /

- Tobacco

- /

- NYSE:PM

Does PMI’s IQOS Regulatory Push and US Investment Shift the Smoke-Free Narrative for Philip Morris (PM)?

Reviewed by Sasha Jovanovic

- Philip Morris International recently presented evidence to the FDA's Tobacco Products Scientific Advisory Committee, seeking continued authorization to market its IQOS heated tobacco products in the U.S. as modified risk tobacco products, while also investing US$37 million to expand U.S. manufacturing capabilities for next-generation smoke-free offerings.

- This dual effort highlights the company's push to accelerate smoke-free product adoption through both regulatory engagement and domestic production expansion.

- We'll explore how PMI's regulatory progress with IQOS could impact its investment narrative amid an industry-wide shift toward reduced-risk products.

Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

Philip Morris International Investment Narrative Recap

To be a shareholder in Philip Morris International today, you need to believe in the company’s ability to shift consumers from traditional cigarettes to reduced-risk, smoke-free products like IQOS, driving future growth as cigarette volumes decline. The latest regulatory engagement with the FDA and the US$37 million manufacturing investment signal ongoing progress in this transition, but do not meaningfully alter the short-term catalyst of expanding smoke-free product adoption or address the heightened regulatory and tax risks currently facing the business.

The most relevant recent announcement in this context is the expansion of PMI’s Wilson, North Carolina facility, which underscores the company’s focus on scaling domestic manufacturing for IQOS ILUMA. This move directly supports PMI’s push to secure regulatory approval and accelerate the US rollout of its flagship smoke-free technology, reinforcing the near-term importance of IQOS adoption as a growth driver.

Yet, investors should not overlook that rising regulatory restrictions and potential tax increases, especially in key international markets, remain a concern for PMI’s long-term outlook...

Read the full narrative on Philip Morris International (it's free!)

Philip Morris International's outlook anticipates $49.4 billion in revenue and $14.5 billion in earnings by 2028. This is based on an expected annual revenue growth rate of 8.2% and an increase in earnings of $6.3 billion from the current $8.2 billion.

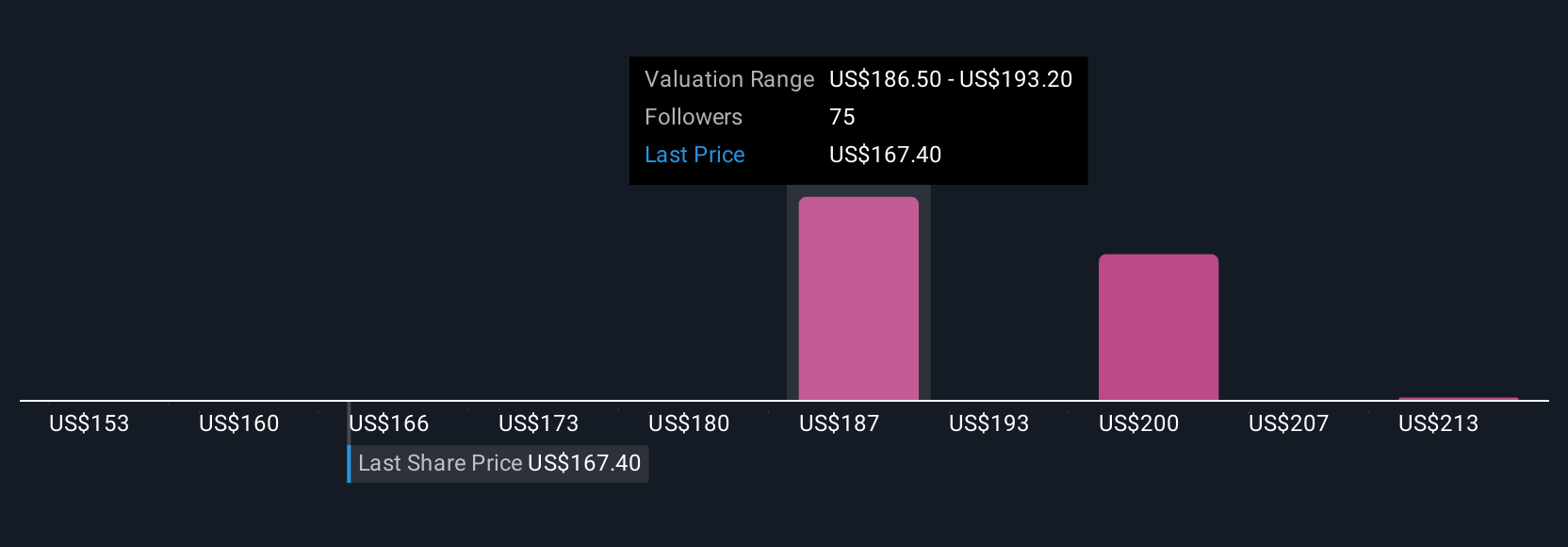

Uncover how Philip Morris International's forecasts yield a $190.20 fair value, a 19% upside to its current price.

Exploring Other Perspectives

On the other hand, some of the lowest analyst estimates before this news projected PMI revenue at US$47.1 billion and earnings of US$14.4 billion by 2028, but they highlight how tougher regulation and shifting public health attitudes could limit product growth. These more cautious voices remind you that views about PMI’s future vary significantly, and this news could change these outlooks quite a bit.

Explore 11 other fair value estimates on Philip Morris International - why the stock might be worth just $153.00!

Build Your Own Philip Morris International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Philip Morris International research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Philip Morris International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Philip Morris International's overall financial health at a glance.

No Opportunity In Philip Morris International?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PM

Fair value second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives