- United States

- /

- Tobacco

- /

- NYSE:PM

Assessing Philip Morris International (NYSE:PM) Valuation Following Recent Share Price Movements

Reviewed by Simply Wall St

Philip Morris International (NYSE:PM) has been making subtle moves on the market’s radar, with its shares recently experiencing some ups and downs that might have investors wondering about what lies ahead. There is no single headline-grabbing event behind the latest price movements. This makes it a situation where curiosity about the company’s underlying value comes to the front. For those keeping an eye on the tobacco giant, the question is whether this activity is signaling something new about the stock’s long-term appeal, or if it is just noise in an otherwise steady trajectory.

Over the past year, Philip Morris International stock has delivered a total return of 49%, far outpacing the broader market, boosted by steady revenue and net income growth. While momentum softened somewhat over the past 3 months, performance this year has been strong, with gains largely building throughout the first half. The company’s upward trajectory has been supported by its position in the global tobacco space and ongoing efforts to shift towards smoke-free products.

After such a run, investors face the classic question: is Philip Morris International undervalued at these levels, or has the market already priced in its growth story?

Most Popular Narrative: 7.9% Undervalued

According to community narrative, Philip Morris International is currently viewed as undervalued, with analysts setting a fair value that is notably above the current share price. This outlook reflects strong conviction in the company's future earnings potential and the durability of its evolving business model.

The accelerating global adoption of smoke-free alternatives, driven by increasing health awareness and regulatory moves away from combustibles, is fueling strong double-digit volume and margin growth in PMI's IQOS, ZYN, and VEEV platforms. This secular shift enables the company to capture new consumer segments, expand its addressable market, and structurally boost net revenues and operating margins over time.

Is Philip Morris International set to break away from the industry pack? This narrative points to bold shifts and upward projections, hinting at a transformation underpinned by significant future financials. Just what supports that impressive price target? Take a closer look and discover the figures driving this analyst consensus.

Result: Fair Value of $186.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent declines in cigarette demand and ongoing regulatory uncertainty could challenge Philip Morris International’s path, putting pressure on growth and future margins.

Find out about the key risks to this Philip Morris International narrative.Another View: Market-Based Comparison

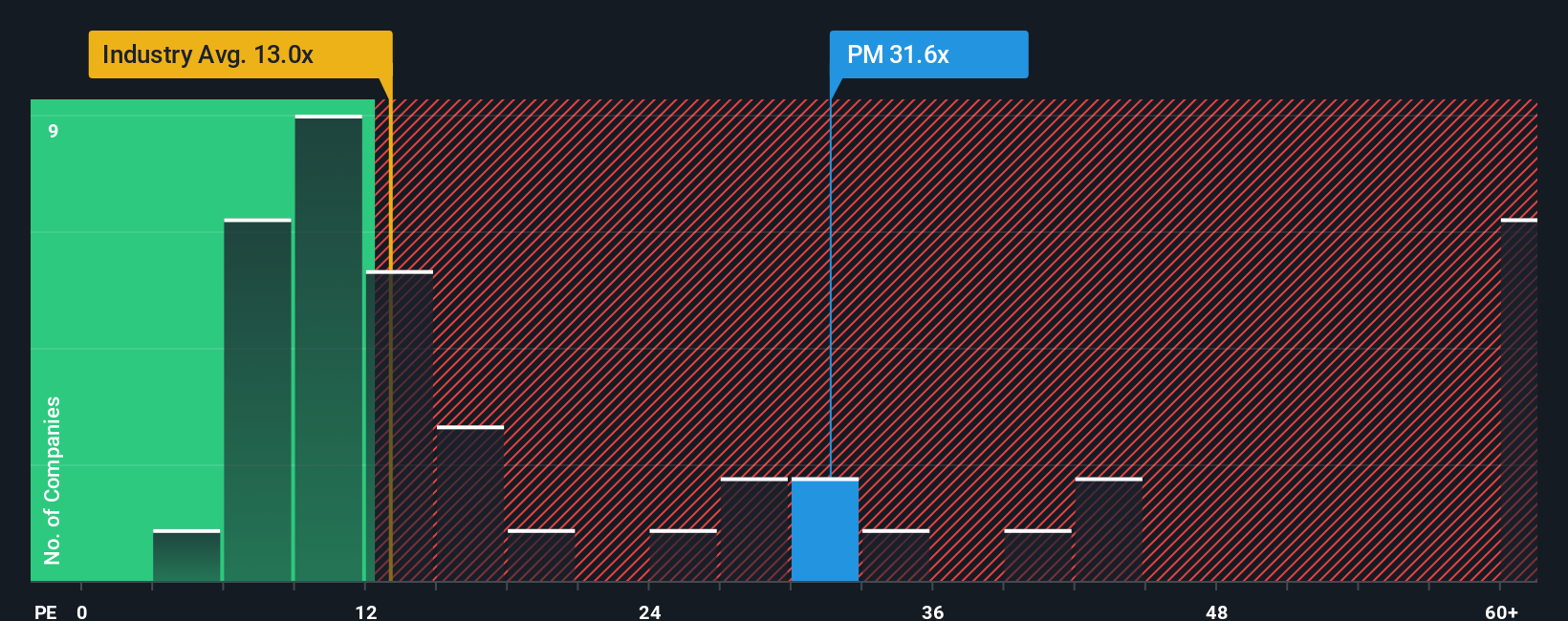

While analyst consensus sees Philip Morris International as undervalued, a market-based comparison to the industry average tells a different story. Using this approach, shares actually look expensive. Could the situation be more complex than it first appears?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Philip Morris International Narrative

If you see things differently or want to dive into the details yourself, you can easily build your own perspective in just a few minutes. do it your way.

A great starting point for your Philip Morris International research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors keep their eyes open for tomorrow’s top opportunities. Use the Simply Wall Street Screener to put powerful tools at your fingertips and take charge of your portfolio’s growth. Don’t let these unmissable ideas pass you by. Seize your next big win today with standout picks like these:

- Boost your income potential by zeroing in on companies offering dividend stocks with yields > 3% and build a steady stream of returns into your portfolio.

- Jump ahead of tech trends by uncovering AI penny stocks that are reshaping the future with innovation and disruptive breakthroughs.

- Supercharge your search for value by pinpointing undervalued stocks based on cash flows and capitalize on attractive entry points others might overlook.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PM

Second-rate dividend payer with limited growth.

Similar Companies

Market Insights

Community Narratives