- United States

- /

- Tobacco

- /

- NYSE:MO

Altria Group (MO) Valuation: Examining Whether Recent Gains Reflect Its True Long-Term Potential

Reviewed by Kshitija Bhandaru

See our latest analysis for Altria Group.

Momentum for Altria Group has been gathering pace, with the stock’s 15.1% share price return over the last 90 days outpacing many peers and drawing in renewed attention. While shorter-term moves have also been positive, its long-term track record is even more impressive. The company boasts a 43.2% total shareholder return over the past year and an eye-catching 149% total return over five years.

If strong long-term gains have you curious about what else is out there, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

But with shares rebounding so strongly, investors are left to wonder if Altria’s current price reflects untapped potential or if the market has already factored in all the future growth. Is this a true buying opportunity?

Most Popular Narrative: 4.2% Overvalued

Altria Group’s most widely followed narrative suggests the recent closing price sits slightly above what analysts view as fair value. The narrative’s fair value estimate is $63.83, just under the last close at $66.54, placing the stock in mild overvalued territory by this analysis.

Altria faces challenges in the e-vapor category due to the prevalence of illicit products, which constitute over 60% of the market. This limits their ability to generate revenue from legitimate e-vapor products, impacting future revenue growth.

Why do forecasts land at this figure? Unlock the full narrative to see how nuanced regulatory challenges, profit assumptions, and evolving market dynamics shape Altria’s projected future. Analysts still disagree on which way the price will ultimately swing.

Result: Fair Value of $63.83 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Altria’s resilient smokeable segment and growth in oral products could help offset regulatory pressures and support stronger earnings than some anticipate.

Find out about the key risks to this Altria Group narrative.

Another View: What Does the DCF Model Say?

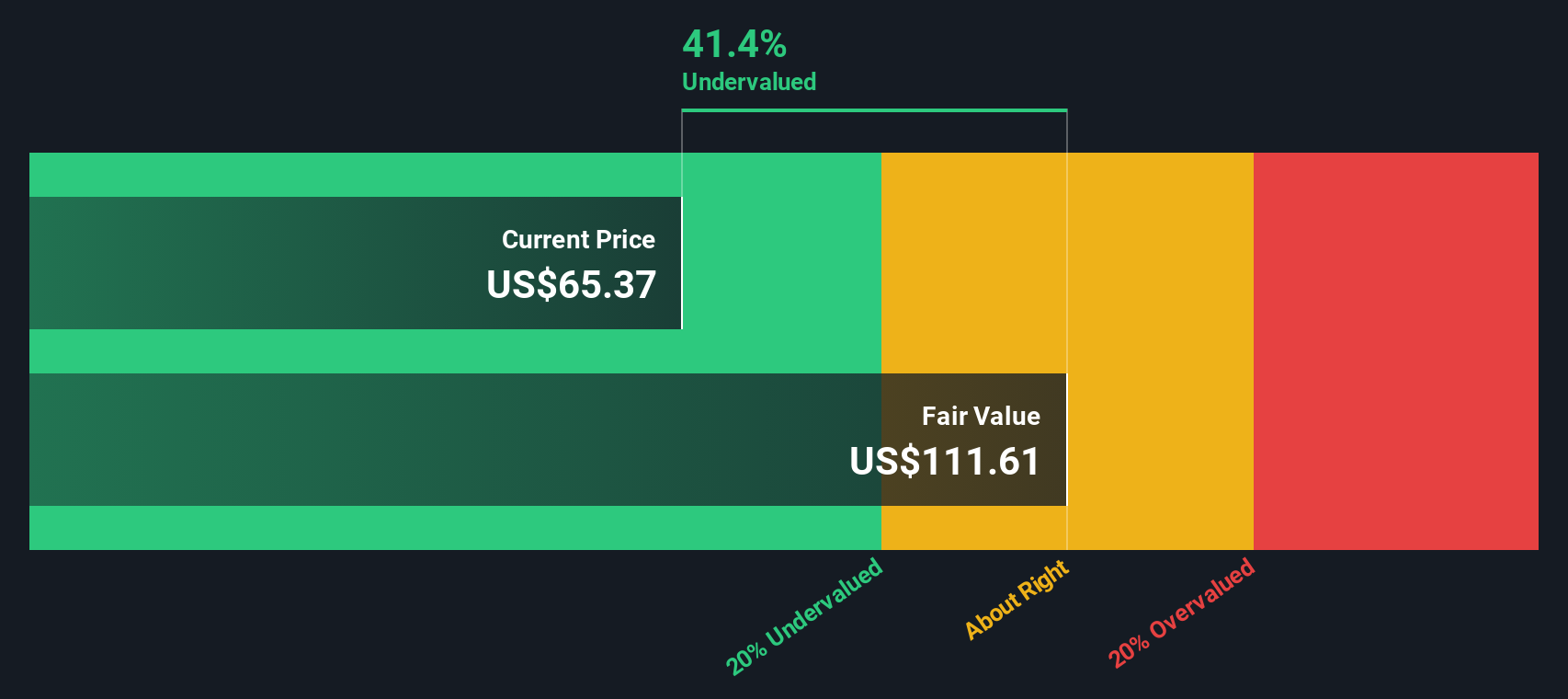

While most analysts see Altria Group as slightly overvalued at current prices based on price targets, our SWS DCF model offers a different perspective. According to this cash flow-based analysis, Altria may actually be trading below its estimated fair value. Could the market be underestimating long-term earnings power?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Altria Group Narrative

If you would rather draw your own conclusions or dive deeper into the numbers, it’s quick and easy to build your own narrative in just a few minutes. Do it your way

A great starting point for your Altria Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t sit on the sidelines when smarter opportunities are just a click away. The Simply Wall Street Screener makes it easy to act quickly on high-potential ideas tailored to your interests.

- Find outstanding yields fast by checking out these 19 dividend stocks with yields > 3% with a track record of solid payouts and attractive return potential.

- Power up your portfolio with real innovation when you target these 24 AI penny stocks making waves in artificial intelligence-driven markets.

- Unlock potential bargains with these 898 undervalued stocks based on cash flows that show strong cash flow value while still trading at compelling prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MO

Altria Group

Through its subsidiaries, manufactures and sells smokeable and oral tobacco products in the United States.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives