- United States

- /

- Food

- /

- NYSE:MKC

McCormick (MKC): Assessing Valuation After Earnings Beat and Lowered Profit Outlook

Reviewed by Kshitija Bhandaru

McCormick (NYSE:MKC) posted third-quarter earnings and revenue that beat expectations, driven by continued volume growth in its consumer segment. However, management trimmed its full-year profit outlook due to escalating commodity and tariff-related costs.

See our latest analysis for McCormick.

McCormick’s share price recently slipped as the company lowered its full-year earnings outlook. This occurred even though third-quarter results came in better than expected on both revenue and EPS. Over the past year, the total shareholder return is down nearly 16%, reflecting how ongoing cost pressures and cautious guidance are tempering short-term optimism. While operating momentum remains, the stock’s longer-term performance highlights the risks associated with persistent margin headwinds.

If volatility in staples stocks has you curious about what else is out there, it might be a great moment to broaden your watchlist and explore fast growing stocks with high insider ownership

With shares now trading well below their historical highs and profit forecasts dimmed by margin pressures, the real question for investors becomes clear: is McCormick undervalued after its recent slide, or is the market already pricing in every ounce of future growth potential?

Most Popular Narrative: 20.2% Undervalued

The current fair value estimate sits well above McCormick’s latest close, indicating the narrative sees substantial upside from present levels. Let’s look at what’s driving this outlook.

Ongoing global expansion and success in winning new customers in high-growth, health-oriented categories, particularly in Asia-Pacific and through partnerships with innovative beverage and snack brands, are broadening McCormick's addressable market while diversifying revenue streams. This contributes to both top-line growth and future earnings stability.

Curious what powers this bullish outlook? The recipe involves aggressive global growth plans and assumptions about premium margins that are not obvious at first glance. Why do analysts believe this company could soon defy industry sluggishness? See which forward-looking metrics are the backbone of this optimistic fair value.

Result: Fair Value of $82.46 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent input cost inflation and weak demand from key customers could still weigh on McCormick’s growth expectations and threaten the bullish narrative.

Find out about the key risks to this McCormick narrative.

Another View: Market Multiples Raise Questions

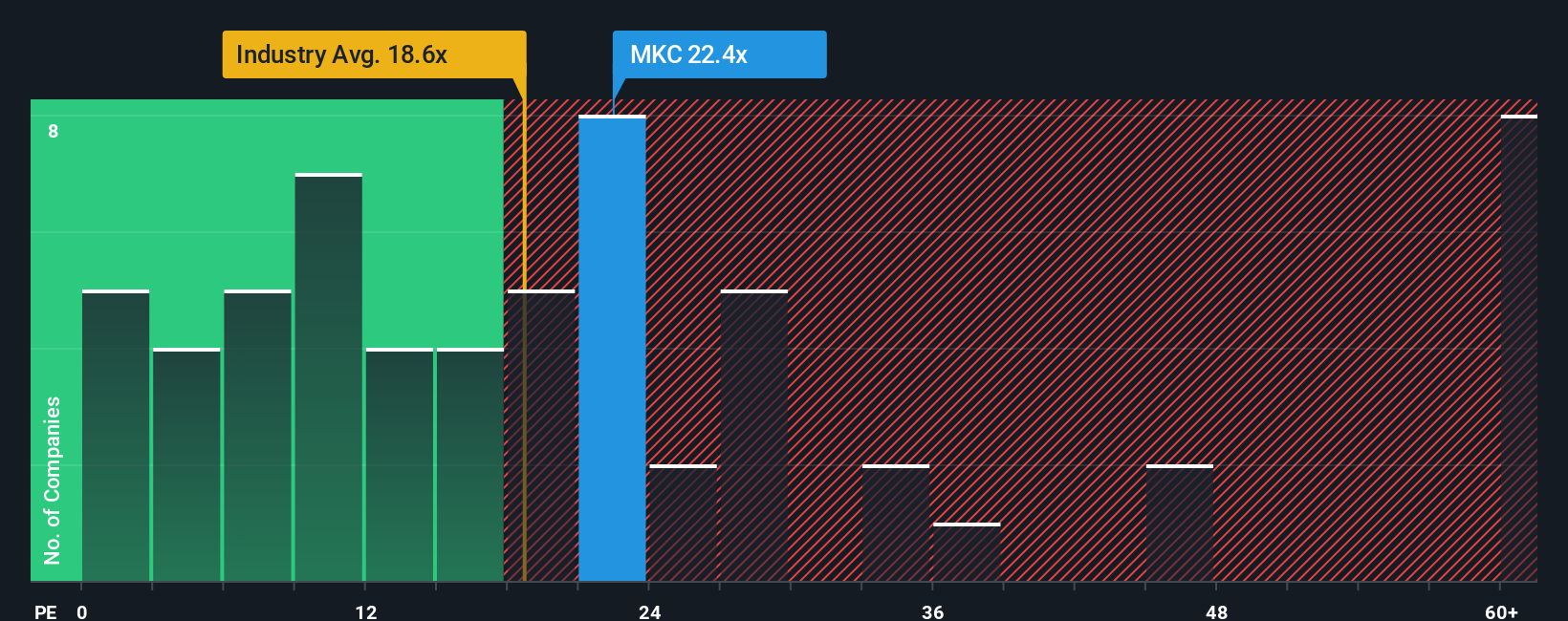

Looking through the lens of earnings multiples, McCormick trades at a 22.7x ratio, which is notably higher than the US food industry average of 17.8x and the peer average of 14.1x. Compared to the fair ratio of 18.6x, this premium may expose investors to valuation risk if growth falls short. Could the share price be too rich, or does the market expect more strength ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own McCormick Narrative

If you see things differently or like to dive deep on your own, you can build your own personalized view of McCormick’s future in minutes. Do it your way

A great starting point for your McCormick research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let opportunity pass you by. Smart investors are always expanding their horizons and seeking out the next strong performer using tailored insights and screeners.

- Catch high yields by tapping into these 19 dividend stocks with yields > 3%, featuring reliable companies offering attractive returns for income-focused portfolios.

- Boost your exposure to innovation and growth with these 25 AI penny stocks, where you’ll find leaders at the forefront of artificial intelligence advancements.

- Unlock potential value in markets others might overlook with these 887 undervalued stocks based on cash flows, highlighting stocks trading well below their intrinsic worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MKC

McCormick

Manufactures, markets, and distributes spices, seasoning mixes, condiments, and other flavorful products to the food industry.

Established dividend payer with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives