Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Coca-Cola FEMSA, S.A.B. de C.V. (NYSE:KOF) does have debt on its balance sheet. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Coca-Cola FEMSA. de

What Is Coca-Cola FEMSA. de's Debt?

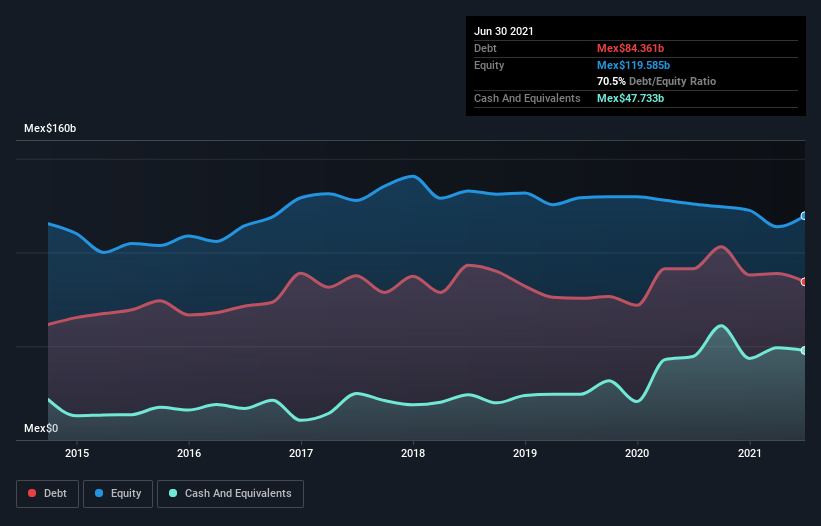

As you can see below, Coca-Cola FEMSA. de had Mex$84.4b of debt at June 2021, down from Mex$91.3b a year prior. However, it also had Mex$47.7b in cash, and so its net debt is Mex$36.6b.

How Strong Is Coca-Cola FEMSA. de's Balance Sheet?

We can see from the most recent balance sheet that Coca-Cola FEMSA. de had liabilities of Mex$48.0b falling due within a year, and liabilities of Mex$97.5b due beyond that. On the other hand, it had cash of Mex$47.7b and Mex$14.2b worth of receivables due within a year. So it has liabilities totalling Mex$83.6b more than its cash and near-term receivables, combined.

This deficit isn't so bad because Coca-Cola FEMSA. de is worth a massive Mex$236.8b, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Looking at its net debt to EBITDA of 0.99 and interest cover of 5.6 times, it seems to us that Coca-Cola FEMSA. de is probably using debt in a pretty reasonable way. So we'd recommend keeping a close eye on the impact financing costs are having on the business. One way Coca-Cola FEMSA. de could vanquish its debt would be if it stops borrowing more but continues to grow EBIT at around 17%, as it did over the last year. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Coca-Cola FEMSA. de's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. During the last three years, Coca-Cola FEMSA. de generated free cash flow amounting to a very robust 87% of its EBIT, more than we'd expect. That puts it in a very strong position to pay down debt.

Our View

The good news is that Coca-Cola FEMSA. de's demonstrated ability to convert EBIT to free cash flow delights us like a fluffy puppy does a toddler. And the good news does not stop there, as its EBIT growth rate also supports that impression! When we consider the range of factors above, it looks like Coca-Cola FEMSA. de is pretty sensible with its use of debt. That means they are taking on a bit more risk, in the hope of boosting shareholder returns. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. To that end, you should be aware of the 1 warning sign we've spotted with Coca-Cola FEMSA. de .

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you’re looking to trade Coca-Cola FEMSA. de, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:KOF

Coca-Cola FEMSA. de

A franchise bottler, produces, markets, sells, and distributes Coca-Cola trademark beverages in Mexico, Guatemala, Nicaragua, Costa Rica, Panama, Colombia, Brazil, Argentina, and Uruguay.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives