- United States

- /

- Beverage

- /

- NYSE:KOF

Coca-Cola FEMSA (NYSE:KOF): A Fresh Look at Valuation Following New Shelf Registration and Investor Moves

Reviewed by Kshitija Bhandaru

If you are watching Coca-Cola FEMSA. de (NYSE:KOF), there is plenty to chew on this month. The company just filed a shelf registration, setting itself up to potentially issue new debt securities in the future. At the same time, major investor Rhumbline Advisers reported a sharp 61.9% reduction in its holdings. Along with a recent round of analyst rating updates, it is clear that shifting market perspectives are putting Coca-Cola FEMSA. de in focus for investors weighing their next move.

This slew of activity arrives at a moment when the stock’s momentum is anything but settled. Coca-Cola FEMSA. de has delivered a modest 8% gain year-to-date, though shares dipped about 3% this month and are down over 10% for the past 3 months. Over the past year, the stock has retreated by 4%, but its multi-year performance is a different story, with returns topping 60% for 3 years and more than doubling over 5. Investors may see this as a period of digestion as the market absorbs both short-term churn and the company’s longer-term growth.

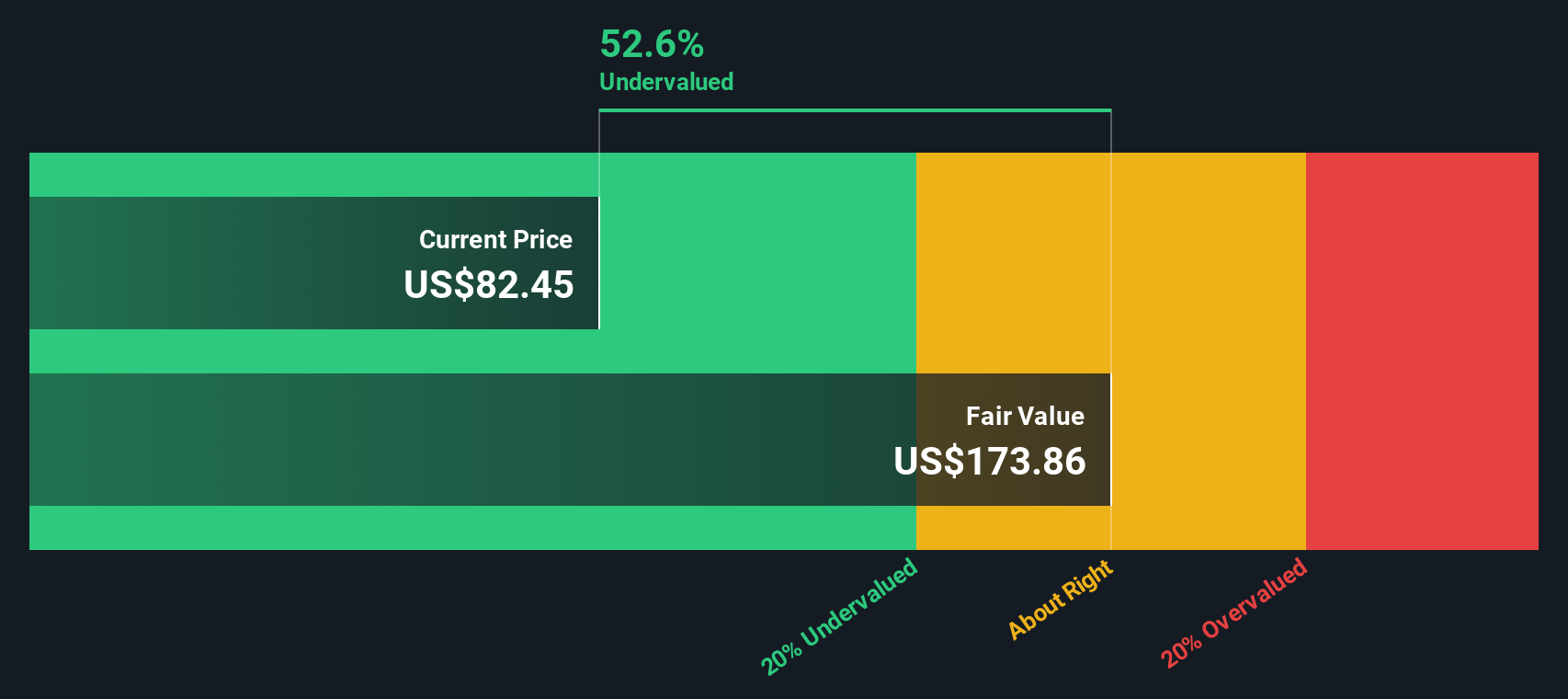

The real question for investors now is whether the current price reflects hidden value or if the market has already factored in Coca-Cola FEMSA. de’s growth outlook. Is there a buying opportunity here or is optimism already priced in?

Most Popular Narrative: 27.7% Undervalued

According to the most widely followed narrative, Coca-Cola FEMSA. de (NYSE:KOF) is currently seen as undervalued, with analysts projecting a significant gap between the fair value and the present share price.

Strategic capacity investments and supply chain adjustments are anticipated to enhance customer service and cost efficiency. This is expected to positively impact net margins and overall earnings in several markets, notably Mexico and Brazil.

Is the market pricing in all the growth ahead? The real surprise is that specific assumptions about future earnings and margins set the bar for KOF’s true value. Want to see what analysts believe will transform the company’s earnings power in the next few years? The details behind this narrative may change how you judge its upside.

Result: Fair Value of $116.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent macroeconomic headwinds in key regions, as well as intensifying competition in Mexico, could cloud the optimistic outlook for Coca-Cola FEMSA. de.

Find out about the key risks to this Coca-Cola FEMSA. de narrative.Another View: Discounted Cash Flow Perspective

Looking at Coca-Cola FEMSA. de through our DCF model gives a very different angle than analyst expectations. This method suggests the current share price may significantly lag behind fair value. Which valuation tells the true story?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Coca-Cola FEMSA. de Narrative

If you have a different perspective or want to dig deeper into the numbers yourself, it takes just a few minutes to build your own view. Do it your way

A great starting point for your Coca-Cola FEMSA. de research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Give your portfolio an upgrade by targeting opportunities others overlook. Use these powerful tools to uncover untapped potential and stay a step ahead of the crowd:

- Tap into emerging technology breakthroughs by evaluating businesses at the forefront of quantum innovation using our quantum computing stocks.

- Unlock steady income streams by finding reliable companies offering yields above 3% with our dividend stocks with yields > 3%.

- Seize value-driven potential by pinpointing companies the market may have underestimated with our undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KOF

Coca-Cola FEMSA. de

A franchise bottler, produces, markets, sells, and distributes Coca-Cola trademark beverages in Mexico, Guatemala, Nicaragua, Costa Rica, Panama, Colombia, Brazil, Argentina, and Uruguay.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives