- United States

- /

- Beverage

- /

- NYSE:KOF

Can Coca-Cola FEMSA, S.A.B. de C.V.'s (NYSE:KOF) Weak Financials Pull The Plug On The Stock's Current Momentum On Its Share Price?

Coca-Cola FEMSA. de's (NYSE:KOF) stock is up by a considerable 5.9% over the past month. We, however wanted to have a closer look at its key financial indicators as the markets usually pay for long-term fundamentals, and in this case, they don't look very promising. Particularly, we will be paying attention to Coca-Cola FEMSA. de's ROE today.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

Check out our latest analysis for Coca-Cola FEMSA. de

How Do You Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Coca-Cola FEMSA. de is:

8.5% = Mex$10b ÷ Mex$122b (Based on the trailing twelve months to December 2020).

The 'return' is the profit over the last twelve months. That means that for every $1 worth of shareholders' equity, the company generated $0.08 in profit.

Why Is ROE Important For Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Coca-Cola FEMSA. de's Earnings Growth And 8.5% ROE

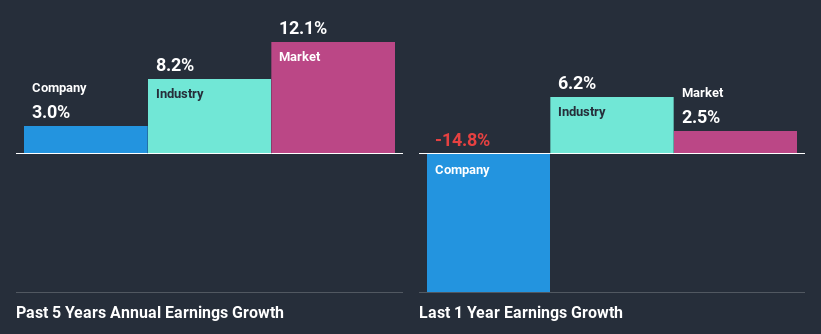

On the face of it, Coca-Cola FEMSA. de's ROE is not much to talk about. A quick further study shows that the company's ROE doesn't compare favorably to the industry average of 20% either. Accordingly, Coca-Cola FEMSA. de's low net income growth of 3.0% over the past five years can possibly be explained by the low ROE amongst other factors.

We then compared Coca-Cola FEMSA. de's net income growth with the industry and found that the company's growth figure is lower than the average industry growth rate of 8.2% in the same period, which is a bit concerning.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). Doing so will help them establish if the stock's future looks promising or ominous. What is KOF worth today? The intrinsic value infographic in our free research report helps visualize whether KOF is currently mispriced by the market.

Is Coca-Cola FEMSA. de Making Efficient Use Of Its Profits?

With a high three-year median payout ratio of 64% (or a retention ratio of 36%), most of Coca-Cola FEMSA. de's profits are being paid to shareholders. This definitely contributes to the low earnings growth seen by the company.

Moreover, Coca-Cola FEMSA. de has been paying dividends for at least ten years or more suggesting that management must have perceived that the shareholders prefer dividends over earnings growth. Upon studying the latest analysts' consensus data, we found that the company is expected to keep paying out approximately 71% of its profits over the next three years. However, Coca-Cola FEMSA. de's ROE is predicted to rise to 11% despite there being no anticipated change in its payout ratio.

Conclusion

In total, we would have a hard think before deciding on any investment action concerning Coca-Cola FEMSA. de. The company has seen a lack of earnings growth as a result of retaining very little profits and whatever little it does retain, is being reinvested at a very low rate of return. That being so, the latest analyst forecasts show that the company will continue to see an expansion in its earnings. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

When trading Coca-Cola FEMSA. de or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Coca-Cola FEMSA. de, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:KOF

Coca-Cola FEMSA. de

A franchise bottler, produces, markets, sells, and distributes Coca-Cola trademark beverages in Mexico, Guatemala, Nicaragua, Costa Rica, Panama, Colombia, Brazil, Argentina, and Uruguay.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives