- United States

- /

- Beverage

- /

- NYSE:KO

Don't Buy The Coca-Cola Company (NYSE:KO) For Its Next Dividend Without Doing These Checks

The Coca-Cola Company (NYSE:KO) stock is about to trade ex-dividend in 4 days. Typically, the ex-dividend date is one business day before the record date which is the date on which a company determines the shareholders eligible to receive a dividend. The ex-dividend date is of consequence because whenever a stock is bought or sold, the trade takes at least two business day to settle. Therefore, if you purchase Coca-Cola's shares on or after the 14th of June, you won't be eligible to receive the dividend, when it is paid on the 1st of July.

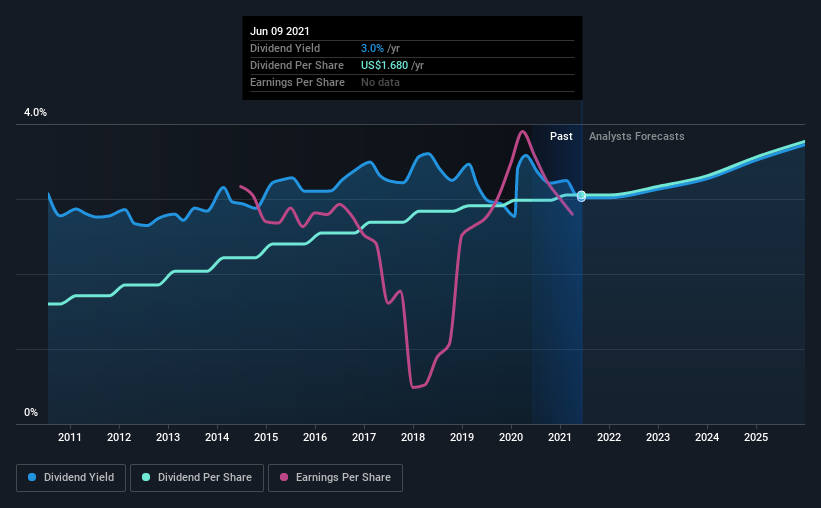

The company's next dividend payment will be US$0.42 per share. Last year, in total, the company distributed US$1.68 to shareholders. Last year's total dividend payments show that Coca-Cola has a trailing yield of 3.0% on the current share price of $55.65. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. We need to see whether the dividend is covered by earnings and if it's growing.

Check out our latest analysis for Coca-Cola

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Last year Coca-Cola paid out 98% of its profits as dividends to shareholders, suggesting the dividend is not well covered by earnings. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution. Over the last year, it paid out more than three-quarters (90%) of its free cash flow generated, which is fairly high and may be starting to limit reinvestment in the business.

It's good to see that while Coca-Cola's dividends were not well covered by profits, at least they are affordable from a cash perspective. Still, if the company continues paying out such a high percentage of its profits, the dividend could be at risk if business turns sour.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies that aren't growing their earnings can still be valuable, but it is even more important to assess the sustainability of the dividend if it looks like the company will struggle to grow. If earnings fall far enough, the company could be forced to cut its dividend. With that in mind, we're not enthused to see that Coca-Cola's earnings per share have remained effectively flat over the past five years. Better than seeing them fall off a cliff, for sure, but the best dividend stocks grow their earnings meaningfully over the long run.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. Since the start of our data, 10 years ago, Coca-Cola has lifted its dividend by approximately 6.7% a year on average.

To Sum It Up

From a dividend perspective, should investors buy or avoid Coca-Cola? Earnings per share have been flat in recent times, which is, we suppose, better than seeing them shrink. Plus, Coca-Cola's paying out a high percentage of its earnings and more than half its cash flow. It's not the most attractive proposition from a dividend perspective, and we'd probably give this one a miss for now.

With that being said, if you're still considering Coca-Cola as an investment, you'll find it beneficial to know what risks this stock is facing. Every company has risks, and we've spotted 3 warning signs for Coca-Cola you should know about.

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

When trading Coca-Cola or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:KO

Coca-Cola

A beverage company, manufactures and sells various nonalcoholic beverages in the United States and internationally.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives