- United States

- /

- Beverage

- /

- NYSE:KO

Coca-Cola (NYSE:KO) Sees Q1 2025 Sales Dip While Earnings Per Share Grows

Reviewed by Simply Wall St

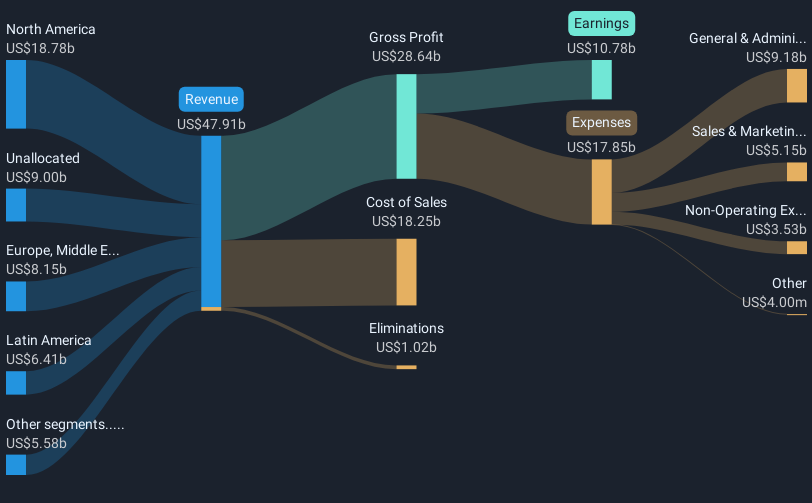

Coca-Cola (NYSE:KO) recently released its Q1 2025 earnings report, which displayed a mixed outcome with a slight decline in sales to USD 11,129 million from USD 11,300 million year-over-year, but a rise in net income and earnings per share. The 15% share price increase over the last quarter reflects this boost in profitability. Additionally, the company's decision to increase quarterly dividends by 5.2% and ongoing share buyback initiatives likely added weight to the stock's upward trajectory amid a broadly rising market, as seen by general optimism in global indices due to strong earnings reports from other major corporations.

The recent earnings report for Coca-Cola, highlighting a decrease in sales but a rise in net income, reflects strategic adjustments such as dividend increases and share buyback initiatives. These measures appear to have contributed to the company’s short-term share price boost of 15%. Over the past five years, Coca-Cola's shares yielded a total return, inclusive of dividends, of 85.44%, showcasing robust long-term performance. However, in the last year, its performance surpassed the US Beverage industry, which saw a decline of 4.7%.

This blend of strategic decisions and market dynamics might bolster revenue projections and earnings forecasts, particularly with initiatives in refillable offerings and digital platforms. Such innovations are poised to support top-line and long-term earnings growth, albeit with challenges from external factors like tariffs and inflation. With the current share price at US$73.90 close to the US$75.68 analyst price target, the stock is perceived as fairly priced against future earnings expectations. Investors are encouraged to evaluate these numbers against their assumptions to form a comprehensive view of Coca-Cola’s potential trajectory.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Coca-Cola, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KO

Coca-Cola

A beverage company, manufactures and sells various nonalcoholic beverages in the United States and internationally.

Average dividend payer with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives