- United States

- /

- Beverage

- /

- NYSE:KO

Coca-Cola (KO): Assessing Valuation After a Steady 15% One-Year Climb

Reviewed by Simply Wall St

Coca-Cola (KO) has quietly climbed about 15% over the past year, even after a mild pullback this week, and that kind of steady, low drama performance always gets income focused investors paying attention.

See our latest analysis for Coca-Cola.

That recent 7 day share price pullback sits against a much sturdier backdrop, with a year to date share price return of 13.2% and a 1 year total shareholder return of 15.3%, suggesting momentum is still gently building rather than fading.

If Coca-Cola’s steady climb has you thinking about what else could quietly compound in the background, it is worth exploring fast growing stocks with high insider ownership for more ideas.

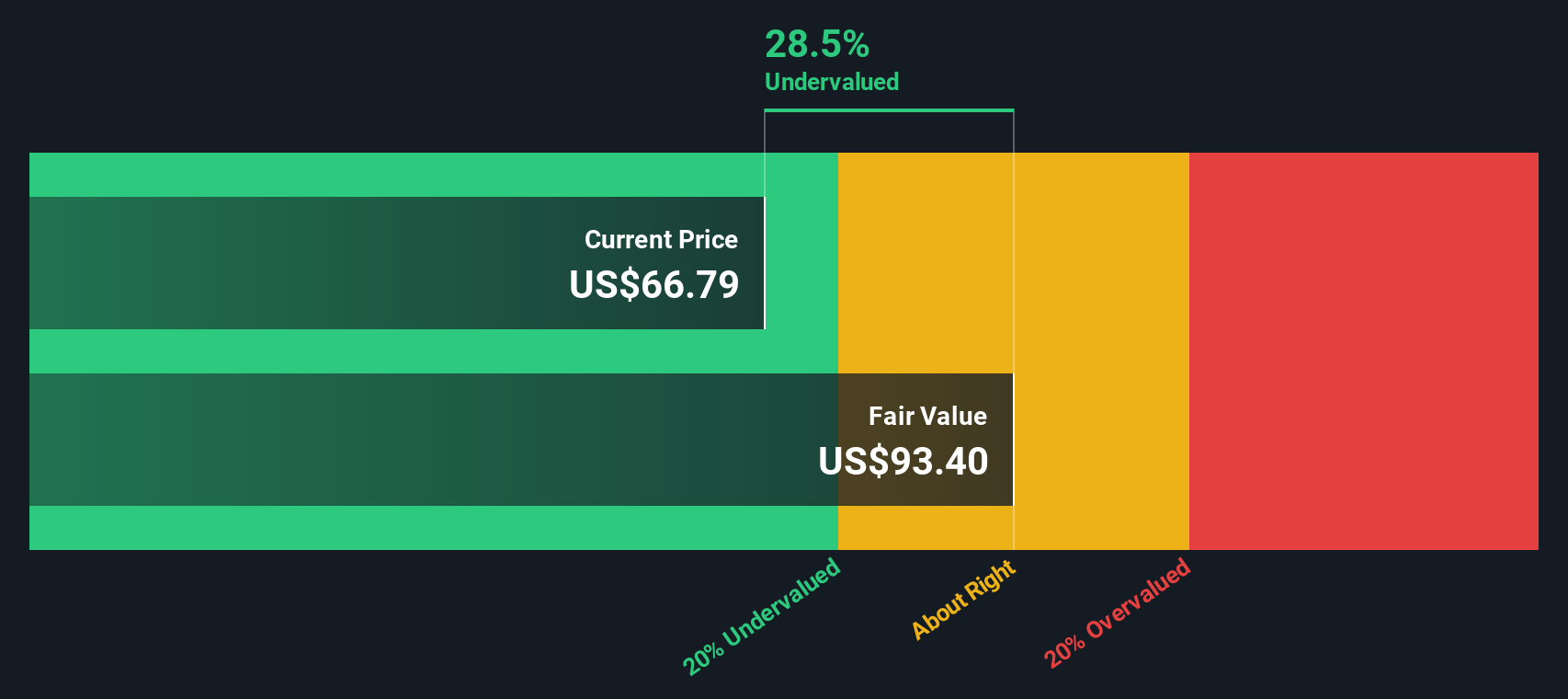

Yet with the shares still trading at a discount to analyst targets and estimates of intrinsic value, investors face a familiar dilemma: is Coca-Cola quietly undervalued, or is the market already baking in years of future growth?

Most Popular Narrative Narrative: 3.7% Overvalued

With Coca-Cola last closing at $70 against a narrative fair value of $67.50, the story leans toward a gently premium price for its cash flows.

The Federal Reserve’s recent 25 basis point cut may appear modest, but for Coca-Cola (NYSE: KO), it carries meaningful implications for valuation. As a consumer staples giant with steady free cash flows and a reputation as a dividend aristocrat, KO is highly sensitive to discount rates in long-term models.

Curious how a small shift in the discount rate turns slow and steady revenue growth, expanding margins, and premium valuation multiples into a long term compounding engine? Dive in.

Result: Fair Value of $67.50 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, regulatory pressure on sugar consumption and shifting consumer preferences toward healthier beverages could compress margins and challenge Coca-Cola’s long term premium valuation.

Find out about the key risks to this Coca-Cola narrative.

Another Angle on Value

Our SWS DCF model paints a very different picture. On this view, Coca-Cola’s fair value sits near $89.90, which would make the current $70 price look meaningfully undervalued. When a cash flow model clashes with narrative pricing, which signal do you trust?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Coca-Cola Narrative

If you would rather dig into the numbers yourself and shape your own view of Coca-Cola’s story, you can build one in just a few minutes, Do it your way.

A great starting point for your Coca-Cola research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more investment ideas?

If Coca-Cola looks solid but you want a few more smart options on your radar, use the Simply Wall St Screener to uncover focused, data backed opportunities.

- Seize potential breakout candidates by zeroing in on these 3576 penny stocks with strong financials that already have strong financial foundations instead of fragile speculation.

- Explore structural trends in automation and machine learning by targeting these 26 AI penny stocks that pair real revenue momentum with compelling growth runways.

- Seek value driven opportunities by focusing on these 906 undervalued stocks based on cash flows where discounted cash flows may indicate upside the market has not fully recognized.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KO

Coca-Cola

A beverage company, manufactures and sells various nonalcoholic beverages in the United States and internationally.

Solid track record average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026