- United States

- /

- Food

- /

- NYSE:K

Here's Why Kellogg Company's (NYSE:K) CEO Compensation Is The Least Of Shareholders' Concerns

Under the guidance of CEO Steve Cahillane, Kellogg Company (NYSE:K) has performed reasonably well recently. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 30 April 2021. Based on our analysis of the data below, we think CEO compensation seems reasonable for now.

View our latest analysis for Kellogg

Comparing Kellogg Company's CEO Compensation With the industry

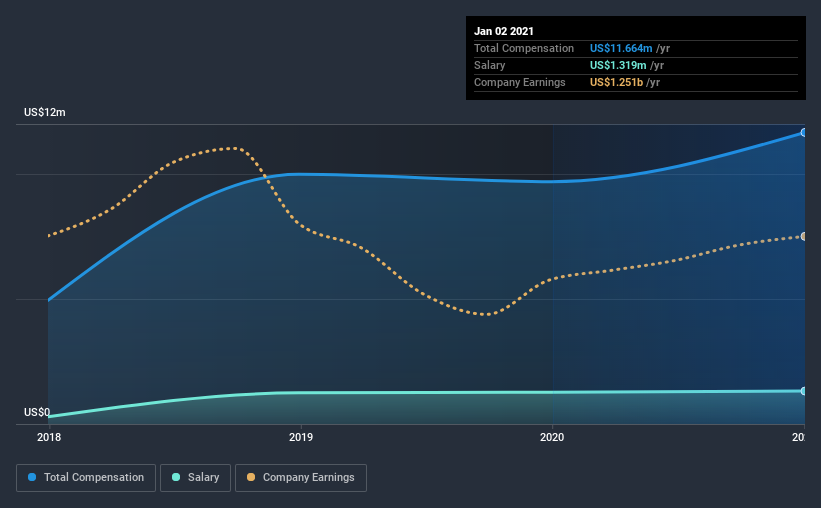

Our data indicates that Kellogg Company has a market capitalization of US$22b, and total annual CEO compensation was reported as US$12m for the year to January 2021. We note that's an increase of 20% above last year. We think total compensation is more important but our data shows that the CEO salary is lower, at US$1.3m.

On comparing similar companies in the industry with market capitalizations above US$8.0b, we found that the median total CEO compensation was US$12m. So it looks like Kellogg compensates Steve Cahillane in line with the median for the industry. What's more, Steve Cahillane holds US$7.4m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2021 | 2019 | Proportion (2021) |

| Salary | US$1.3m | US$1.3m | 11% |

| Other | US$10m | US$8.4m | 89% |

| Total Compensation | US$12m | US$9.7m | 100% |

Speaking on an industry level, nearly 30% of total compensation represents salary, while the remainder of 70% is other remuneration. It's interesting to note that Kellogg allocates a smaller portion of compensation to salary in comparison to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at Kellogg Company's Growth Numbers

Earnings per share at Kellogg Company are much the same as they were three years ago, albeit with slightly higher. It achieved revenue growth of 1.5% over the last year.

We'd prefer higher revenue growth, but it is good to see modest EPS growth. Considering these factors we'd say performance has been pretty decent, though not amazing. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Kellogg Company Been A Good Investment?

Kellogg Company has served shareholders reasonably well, with a total return of 17% over three years. But they probably wouldn't be so happy as to think the CEO should be paid more than is normal, for companies around this size.

To Conclude...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. However, we still think that any proposed increase in CEO compensation will be examined closely to make sure the compensation is appropriate and linked to performance.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 1 warning sign for Kellogg that investors should think about before committing capital to this stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

When trading Kellogg or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Kellanova might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:K

Kellanova

Manufactures and markets snacks and convenience foods in North America, Europe, Latin America, the Asia Pacific, the Middle East, Australia, and Africa.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives