- United States

- /

- Food

- /

- NYSE:INGR

Top Dividend Stocks To Consider In November 2025

Reviewed by Simply Wall St

As the U.S. stock market experiences significant fluctuations, with major indexes closing sharply lower and tech stocks facing volatility, investors are increasingly looking for stability in their portfolios. In such an environment, dividend stocks can offer a reliable income stream and potential for long-term growth, making them an attractive consideration amidst current market uncertainties.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Provident Financial Services (PFS) | 5.40% | ★★★★★★ |

| Peoples Bancorp (PEBO) | 5.77% | ★★★★★★ |

| OceanFirst Financial (OCFC) | 4.65% | ★★★★★★ |

| Interpublic Group of Companies (IPG) | 5.27% | ★★★★★★ |

| Heritage Commerce (HTBK) | 5.10% | ★★★★★★ |

| First Interstate BancSystem (FIBK) | 6.33% | ★★★★★★ |

| Farmers National Banc (FMNB) | 5.26% | ★★★★★★ |

| Ennis (EBF) | 6.11% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.59% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.89% | ★★★★★★ |

Click here to see the full list of 139 stocks from our Top US Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

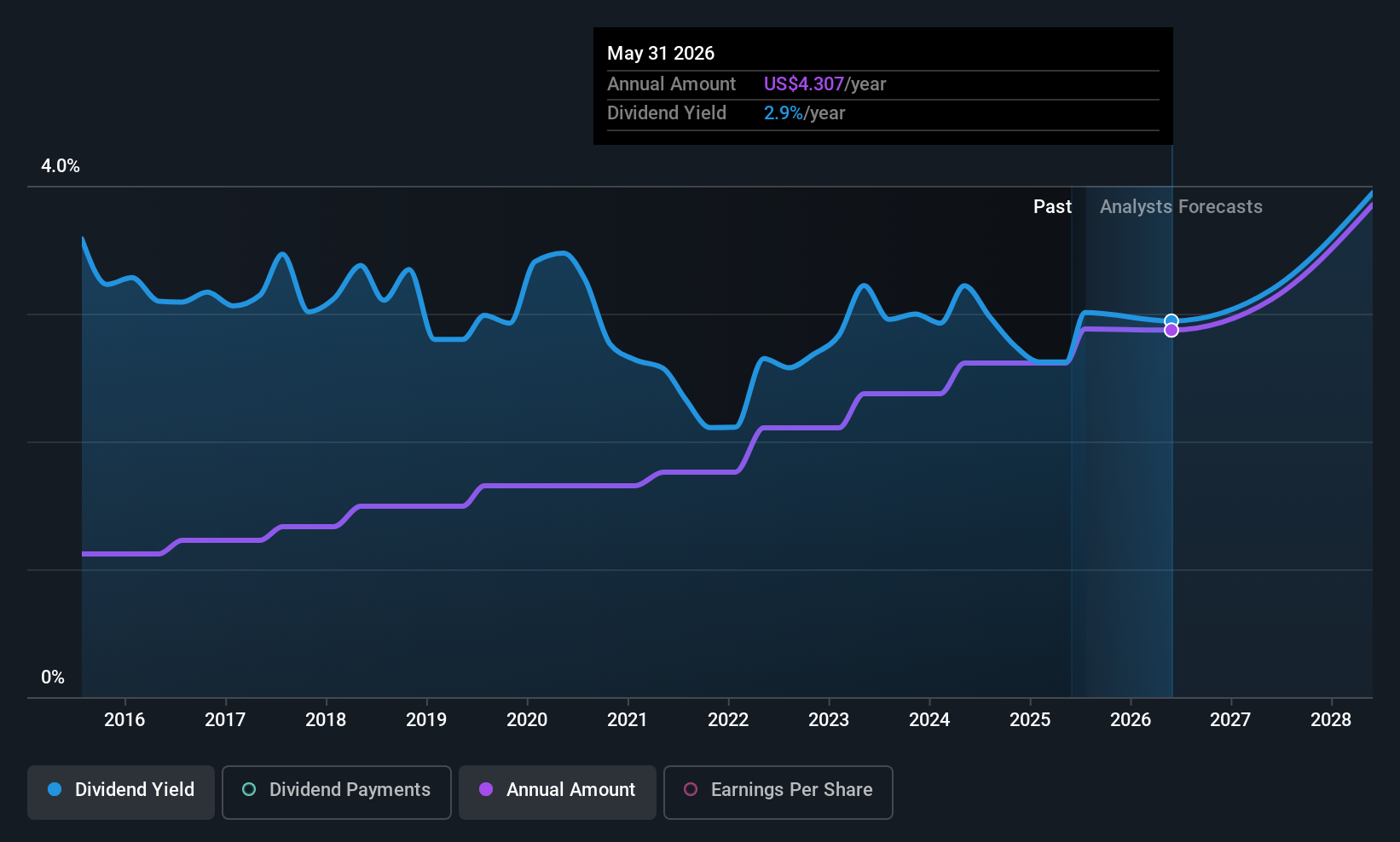

Paychex (PAYX)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Paychex, Inc. offers human capital management solutions, including payroll, employee benefits, HR, and insurance services for small to medium-sized businesses across the United States, Europe, and India with a market cap of approximately $40.34 billion.

Operations: Paychex, Inc.'s revenue primarily comes from its Staffing & Outsourcing Services segment, totaling $5.79 billion.

Dividend Yield: 3.9%

Paychex's dividend reliability is supported by consistent growth over the past decade, though its high payout ratio of 92% raises concerns about sustainability. Recent affirmations of a quarterly dividend at US$1.08 per share reflect its commitment to shareholders, yet the dividend yield of 3.91% remains below top-tier levels in the U.S. market. Despite trading below fair value estimates and forecasted earnings growth, high debt levels could impact future financial flexibility for dividends and buybacks.

- Click to explore a detailed breakdown of our findings in Paychex's dividend report.

- Our comprehensive valuation report raises the possibility that Paychex is priced lower than what may be justified by its financials.

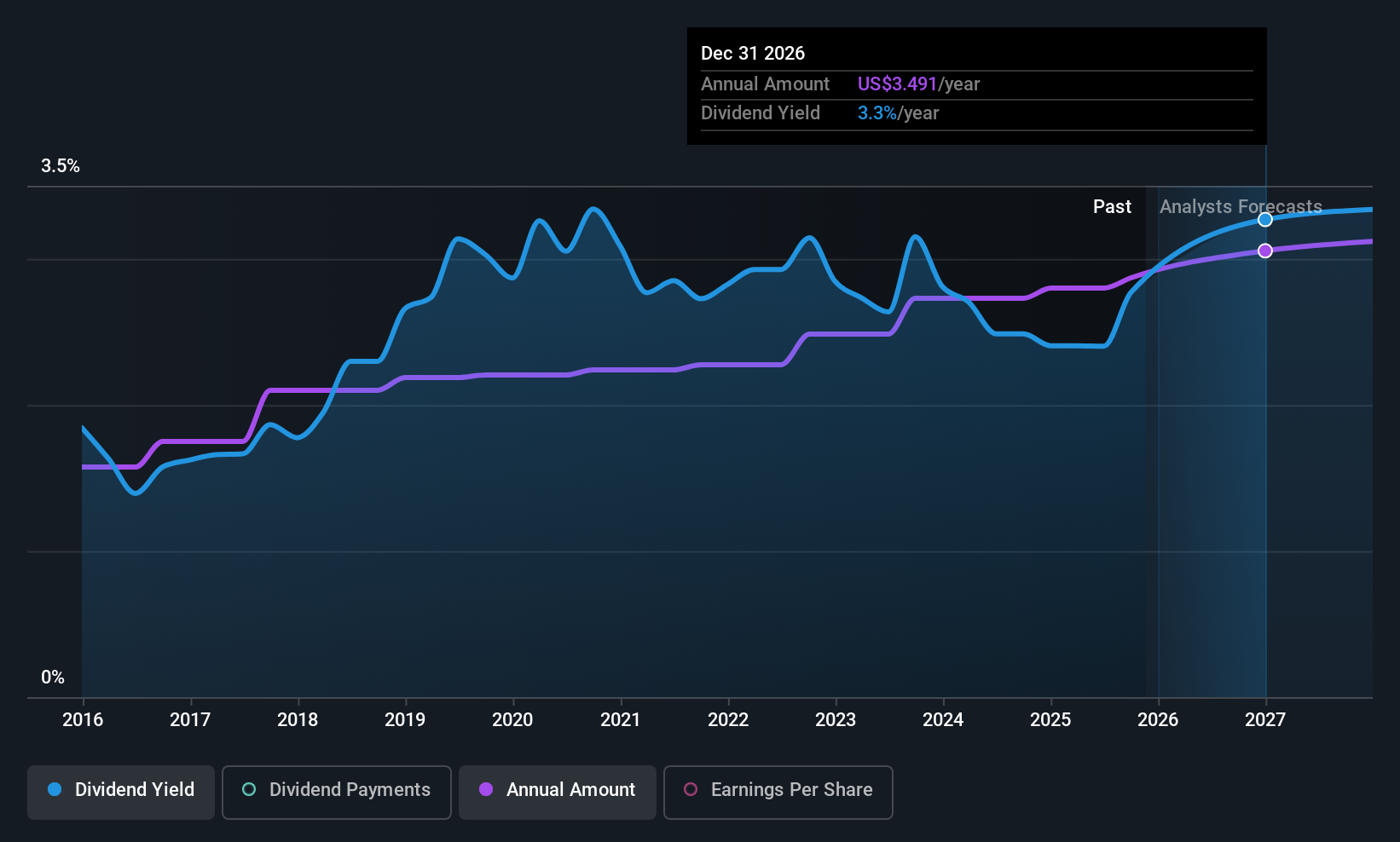

Ingredion (INGR)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Ingredion Incorporated, with a market cap of $6.84 billion, manufactures and sells sweeteners, starches, nutrition ingredients, and biomaterial solutions derived from wet milling and processing corn and other starch-based materials to various industries globally.

Operations: Ingredion's revenue segments include Texture & Healthful Solutions at $2.42 billion, Food & Industrial Ingredients - LATAM at $2.39 billion, and Food & Industrial Ingredients - U.S./Canada at $2.17 billion.

Dividend Yield: 3.1%

Ingredion's dividend stability is bolstered by a decade of consistent growth and a low payout ratio of 31.6%, indicating sustainability. Despite its yield of 3.07% being below top-tier U.S. levels, dividends are well-covered by earnings and cash flows, with recent increases affirming commitment to shareholders. The company trades at an attractive valuation with a price-to-earnings ratio of 10.3x, below the market average, while ongoing share repurchases enhance shareholder value amidst flat sales projections for 2025.

- Click here and access our complete dividend analysis report to understand the dynamics of Ingredion.

- Upon reviewing our latest valuation report, Ingredion's share price might be too pessimistic.

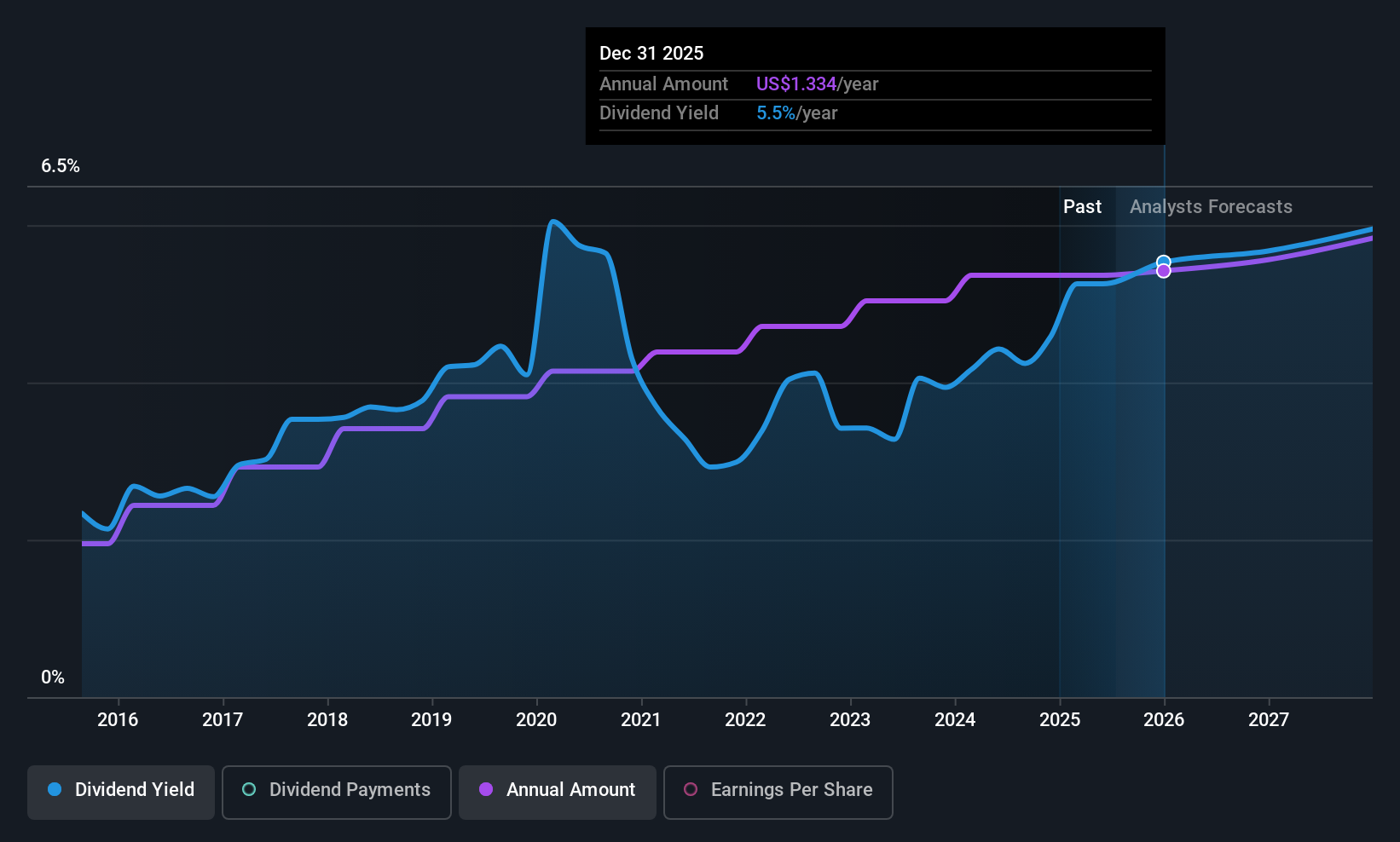

Interpublic Group of Companies (IPG)

Simply Wall St Dividend Rating: ★★★★★★

Overview: The Interpublic Group of Companies, Inc. offers advertising and marketing services globally, with a market cap of approximately $9 billion.

Operations: Interpublic Group of Companies generates revenue through three primary segments: Media, Data & Engagement Solutions ($3.94 billion), Integrated Advertising & Creativity Led ($3.39 billion), and Specialized Communications & Experiential Solutions ($1.41 billion).

Dividend Yield: 5.3%

Interpublic Group of Companies offers a high dividend yield of 5.27%, placing it among the top 25% in the U.S. market, with stable payments over the past decade. Despite a high payout ratio of 89.3%, dividends remain covered by earnings and cash flows, suggesting sustainability. Recent earnings showed mixed results, with decreased sales but improved net income and EPS year-over-year. Ongoing share buybacks and an impending merger with Omnicom could impact future dividend dynamics.

- Unlock comprehensive insights into our analysis of Interpublic Group of Companies stock in this dividend report.

- According our valuation report, there's an indication that Interpublic Group of Companies' share price might be on the cheaper side.

Where To Now?

- Reveal the 139 hidden gems among our Top US Dividend Stocks screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:INGR

Ingredion

Manufactures and sells sweeteners, starches, nutrition ingredients, and biomaterial solutions derived from wet milling and processing corn, and other starch-based materials to a range of industries worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives