- United States

- /

- Food

- /

- NYSE:HSY

Hershey (NYSE:HSY) Stock Climbs 18% Following Fourth-Quarter Earnings Growth

Reviewed by Simply Wall St

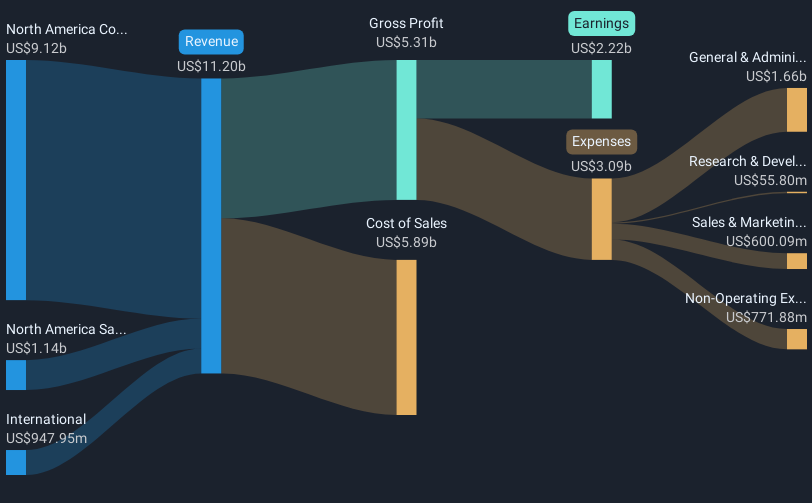

The Hershey Company (NYSE:HSY) recently drew attention with an impressive 18% increase in its stock price over the past month. The announcement of significant growth in fourth-quarter earnings, with net income more than doubling year-over-year to $797 million and a jump in diluted earnings per share to $3.92, likely bolstered investor confidence. This earnings report was closely followed by the company's dividend affirmation, reinforcing consistent shareholder returns with $1.37 per share on Common Stock. Despite offering a cautious corporate guidance that indicated a decline in expected EPS growth, the strong historical earnings report provided a cushion. Furthermore, Hershey's growth stands out amid a challenging backdrop where major indexes such as the S&P 500 and Nasdaq experienced significant declines, with some technology stocks facing particularly tough times. This resilience highlights investor optimism toward Hershey's ability to perform well even as broader market dynamics remain volatile.

Click here and access our complete analysis report to understand the dynamics of Hershey.

The Hershey Company (NYSE:HSY) achieved a total shareholder return of 30.56% over the past five years, showcasing its resilience and appeal to long-term investors. Despite current challenges, several key factors have likely contributed to this performance. One significant aspect includes the company's commitment to shareholder returns through its regular dividend payments, with the 380th consecutive dividend announced recently. Additionally, it's worth noting the annual earnings growth rate of 12.3%, which has been instrumental in supporting the share price over this period.

The last year, however, demonstrated a contrast to the longer-term trend as Hershey underperformed both the broader U.S. market and its own industry peers. While earnings growth in the most recent year exceeded its five-year average, the company also announced changes in leadership, including the upcoming retirement of CEO Michele Buck, indicating potential shifts in strategic direction that could impact future performance. Furthermore, the introduction of new products, such as seasonal favorites, has underlined Hershey's capacity for innovation amidst evolving consumer preferences.

- Analyze Hershey's fair value against its market price in our detailed valuation report—access it here.

- Explore the potential challenges for Hershey in our thorough risk analysis report.

- Are you invested in Hershey already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hershey might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HSY

Hershey

Engages in the manufacture and sale of confectionery products and pantry items in the United States and internationally.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives