- United States

- /

- Food

- /

- NYSE:HSY

Hershey (NYSE:HSY) Elects New Directors and Approves Amended Bylaws

Reviewed by Simply Wall St

The Hershey Company (NYSE:HSY) recently saw significant executive and board changes, electing new directors and amending its bylaws, potentially imparting a fresh strategic direction. Over the last quarter, Hershey's share price increased by 10%, a movement that aligns broadly with general market trends. Despite a dip in Q1 earnings and net income, the company's forecast for future earnings remained optimistic. Meanwhile, the S&P 500, Dow, and Nasdaq exhibited minor fluctuations but ended with an overall upward trend. These market conditions, alongside Hershey's updates, likely influenced its performance within the broader market context.

Hershey has 1 weakness we think you should know about.

The recent changes in The Hershey Company's executive and board composition could signal a shift in strategic focus toward innovation and diversification. These developments align with the company's current narrative of expanding into new product categories and improving efficiency to offset potential tariff impacts, particularly in its chocolate segment. While Hershey's share price experienced a 10% rise over the last quarter, its total shareholder return over the past five years highlights a gain of 45.22%, painting a picture of considerable growth and resilience.

In comparison, Hershey's stock has underperformed relative to the broader market's annual return of 8.2% and the US Food industry's return of -11.2% over the past year. This juxtaposition may suggest potential limitations in the company's immediate strategy or market conditions and the impacts of increased competition and consumer spending patterns. Revenue forecasts, such as a projected growth to US$12.2 billion by 2028, may benefit from the company's strategic initiatives, including its innovations in Reese's product line and tariff mitigation efforts.

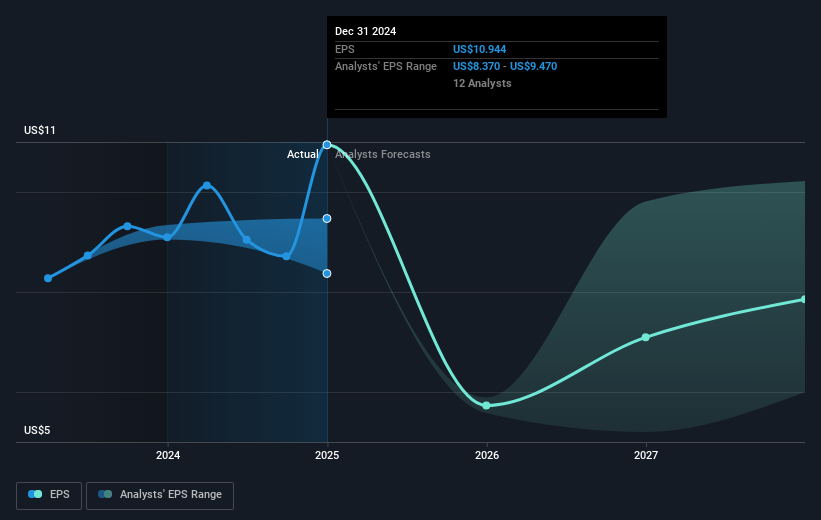

The current share price of US$170.01 slightly exceeds the consensus analyst price target of US$165.73, suggesting potential overvaluation by the market. This difference underscores the need for Hershey to maintain momentum in implementing its strategies effectively to justify its valuation and achieve expected revenue growth. Furthermore, potential challenges like high cocoa prices remain critical considerations in honing future earnings expectations. Overall, the company's recent leadership changes could play a key role in achieving long-term objectives and aligning with market expectations.

Gain insights into Hershey's historical outcomes by reviewing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hershey might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HSY

Hershey

Engages in the manufacture and sale of confectionery products and pantry items in the United States and internationally.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives