- United States

- /

- Food

- /

- NYSE:HSY

Hershey (HSY): Has the Recent Share Price Rebound Left the Stock Fairly Valued or Still Undervalued?

Reviewed by Simply Wall St

Hershey (HSY) has quietly climbed about 10% over the past month, even as its three year return still lags. That mix of recent momentum and longer term underperformance is where things get interesting.

See our latest analysis for Hershey.

At around $182.46, Hershey’s 1 month share price return near 10 percent has helped lift its year to date share price gain into positive territory. However, the 3 year total shareholder return remains negative, suggesting momentum may be tentatively rebuilding as investors reassess growth and pricing power.

If Hershey’s recent move has you thinking about what else could rerate, this is a good moment to explore fast growing stocks with high insider ownership as potential next wave candidates.

Yet with mid single digit revenue growth, double digit profit gains, and the shares trading only slightly below analyst targets, investors now face a key question: Is Hershey undervalued, or is the market already baking in future growth?

Most Popular Narrative Narrative: 4.9% Undervalued

With Hershey last closing at $182.46 against a narrative fair value near $191.95, the story hinges on modest growth, resilient margins, and a richer future multiple.

Hershey's expansion into sweets and better for you snacks categories alongside salty snacks with new acquisitions indicates strategic diversification beyond just chocolate, poised to capture additional market share and drive incremental revenue growth, potentially improving profitability in the long term.

Curious how steady but unspectacular revenue growth, slightly slimmer margins, and a punchy earnings multiple still add up to upside potential? The full narrative spells it out.

Result: Fair Value of $191.95 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, high cocoa costs and weaker consumer demand could still squeeze margins and slow growth, challenging the idea that Hershey’s recent rerating has further to run.

Find out about the key risks to this Hershey narrative.

Another View on Valuation

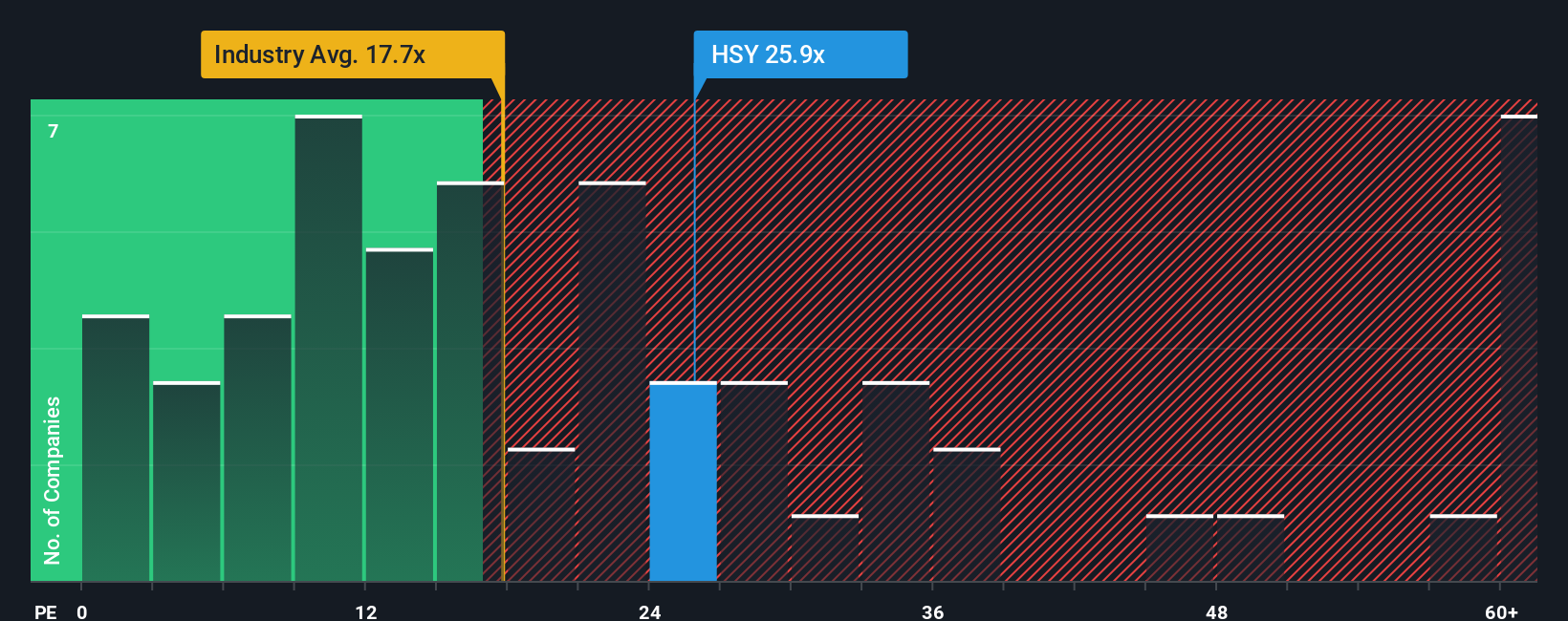

Step away from narratives and Hershey looks far less forgiving on simple earnings math. Its P/E of 27.2 times not only sits above peers at 23.3 times but also above a fair ratio of 23 times, meaning little room for error if growth or margins disappoint.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hershey Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized thesis in minutes with Do it your way.

A great starting point for your Hershey research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before the next move in Hershey’s story unfolds, consider putting your money to work by lining up fresh opportunities using Simply Wall Street’s powerful investing screener.

- Capture potential mispricings early by scanning these 907 undervalued stocks based on cash flows that have strong cash flow support for their market price.

- Capitalize on rapidly evolving innovation by targeting these 26 AI penny stocks positioned at the front line of artificial intelligence adoption.

- Strengthen your income stream by pinpointing these 15 dividend stocks with yields > 3% that combine reliable payouts with solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hershey might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HSY

Hershey

Engages in the manufacture and sale of confectionery products and pantry items in the United States and internationally.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026