- United States

- /

- Food

- /

- NYSE:GIS

General Mills (NYSE:GIS) Launches Festive Ornaments To Capture Holiday Spirit

Reviewed by Simply Wall St

General Mills (NYSE:GIS) announced a partnership with Old World Christmas to produce nine new ornaments inspired by its popular brands such as Cinnamon Toast Crunch and Pillsbury Doughboy. This collaboration aims to tap into consumer nostalgia during the holiday season, potentially enhancing brand engagement. Despite the excitement, the company’s stock remained largely flat over the past week. This aligns with broader market trends, where indexes like the Dow and Nasdaq also experienced minimal movement following their recent rallies. Such brand initiatives could add positive sentiment but did not significantly impact General Mills' share performance during the period.

The partnership between General Mills and Old World Christmas could potentially reinforce brand loyalty and foster engagement through consumer nostalgia. While recent short-term movements in its stock remain flat, it’s essential to analyze the longer-term performance for context. Over the past five years, General Mills' total shareholder return, inclusive of share price and dividends, stood at 7.79%. When examining performance relative to the market, General Mills underperformed the U.S. Food industry and broader market over the past year.

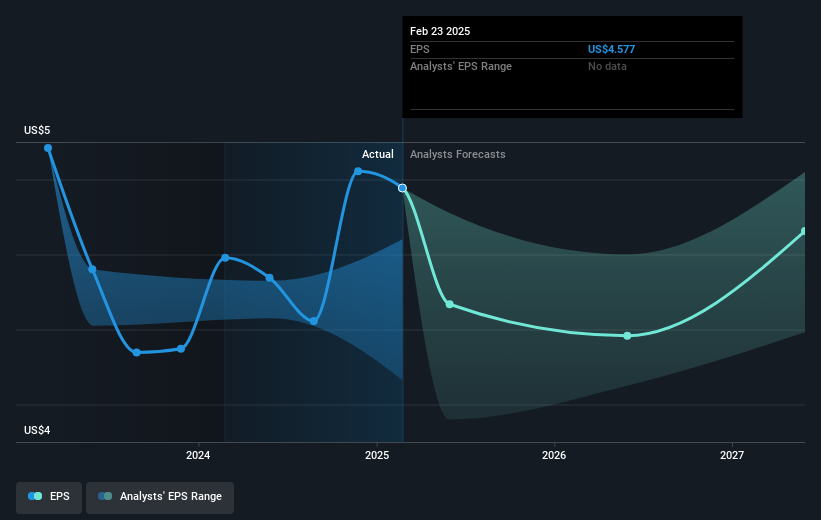

The introduction of branded ornaments is unlikely to dramatically alter revenue and earnings forecasts immediately. The initiative is more aligned with long-term brand enhancement strategies rather than near-term financial impact. With General Mills focusing on reinvestment and innovation amidst challenges like potential Yoplait business closure, revenue growth may still face some pressure. Analysts project a revenue decline and contracting margins which could influence future earnings projections.

Regarding price movement, General Mills currently trades at US$58.06, close to the consensus analyst price target of US$62.48. This slight premium suggests that the market perceives the stock to be fairly valued relative to its longer-term growth potential. Investors are advised to compare this target with their expectations, as the shares remain attractive in certain valuation metrics, such as the Price-To-Earnings ratio relative to both the industry and its peers.

Examine General Mills' past performance report to understand how it has performed in prior years.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GIS

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives