- United States

- /

- Food

- /

- NYSE:FDP

Fresh Del Monte Produce Shares in Focus After 22% Climb Ahead of 2025

Reviewed by Bailey Pemberton

If you’re on the fence about Fresh Del Monte Produce, you’re definitely not alone. With its share price closing at $34.18 and some eye-catching moves in recent months, the stock has caught the attention of plenty of investors looking for reliable growth opportunities or solid value plays. Over the past year, Fresh Del Monte’s stock is up 22.4%, and the long-term five-year climb stands at an impressive 62.5%. That upward trend tells a story. It hints at renewed optimism around the company’s global operations, especially as supply chain bottlenecks began clearing and food producers came back into focus among market-watchers.

Of course, the ride hasn’t been without some bumps. This past month, shares dipped by 4.8%, and the last week alone saw a marginal drop of just 1.0%. Still, zooming out, the year-to-date return is sitting at 3.8%, reinforcing a sense that any recent volatility may be more about short-term jitters than deep, fundamental issues. These oscillations might also reflect changing investor sentiment as markets respond to evolving trade dynamics for global produce and shifting expectations for food exports.

But where does Fresh Del Monte really stand from a value perspective? That’s where things get interesting. Using widely recognized valuation methods, the company scores a 5 out of 6 on our value scale. This indicates that it checks nearly every box for being undervalued in today’s market. Next, let’s break down the different valuation approaches that feed into this score, and consider how investors can go beyond the numbers to make even smarter decisions about Fresh Del Monte’s true value.

Approach 1: Fresh Del Monte Produce Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting those amounts back to their present value. In Fresh Del Monte Produce's case, analysts use the 2 Stage Free Cash Flow to Equity model, which considers both near-term forecasts and longer-term expectations.

For 2023, Fresh Del Monte reported Free Cash Flow (FCF) of $146.1 million. According to analyst projections, FCF is expected to be $127.4 million by the end of 2026. Beyond 2026, future cash flows are extrapolated using moderate growth rates, with estimates tapering off gently over the next decade. For example, projections point to $137.5 million in FCF by 2035, based on the company’s global market position and operational strength. All figures are in U.S. dollars.

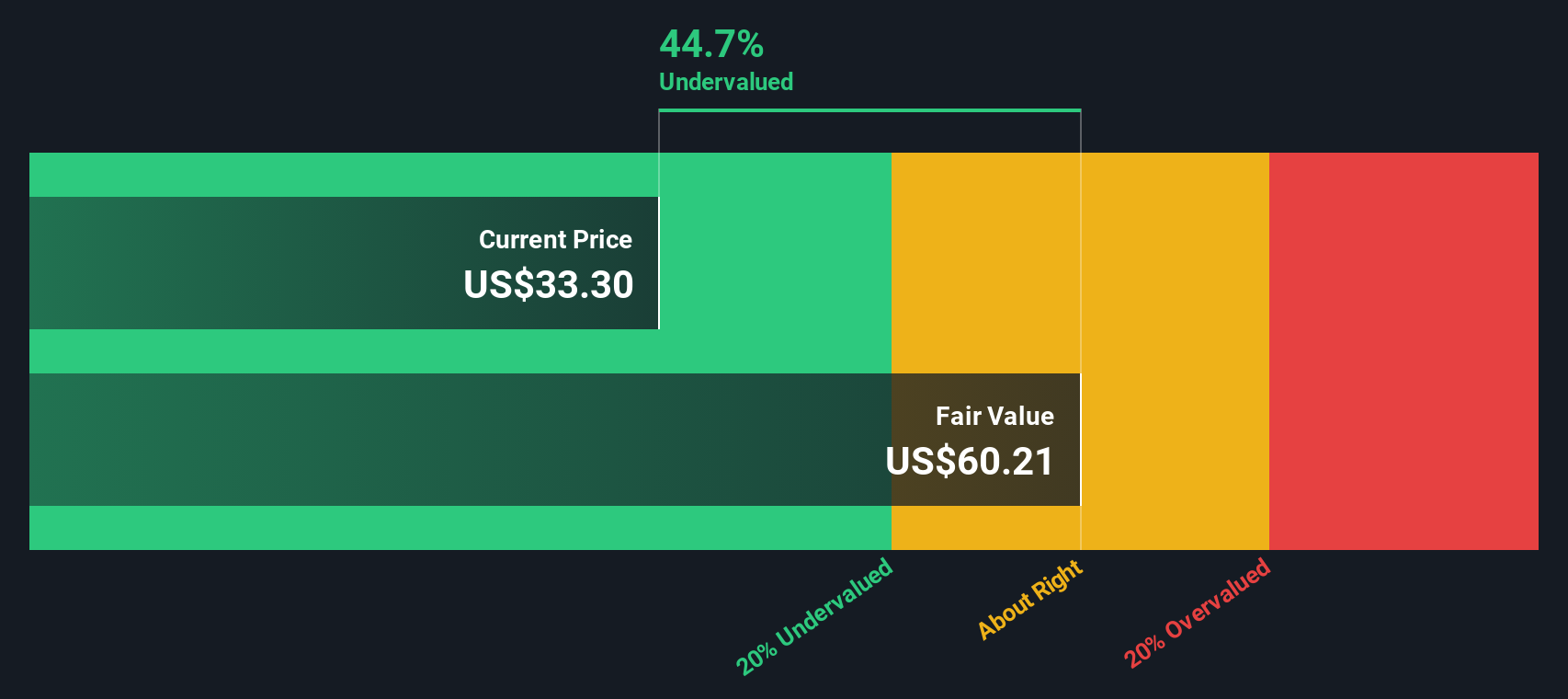

Based on these projections, the DCF analysis calculates an intrinsic value of $60.21 per share for Fresh Del Monte Produce. With the current share price at $34.18, this suggests the stock is trading at an estimated 43.2% discount to its fair value. In other words, the market may be underestimating the company's long-term earnings power and growth prospects.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Fresh Del Monte Produce is undervalued by 43.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Fresh Del Monte Produce Price vs Earnings

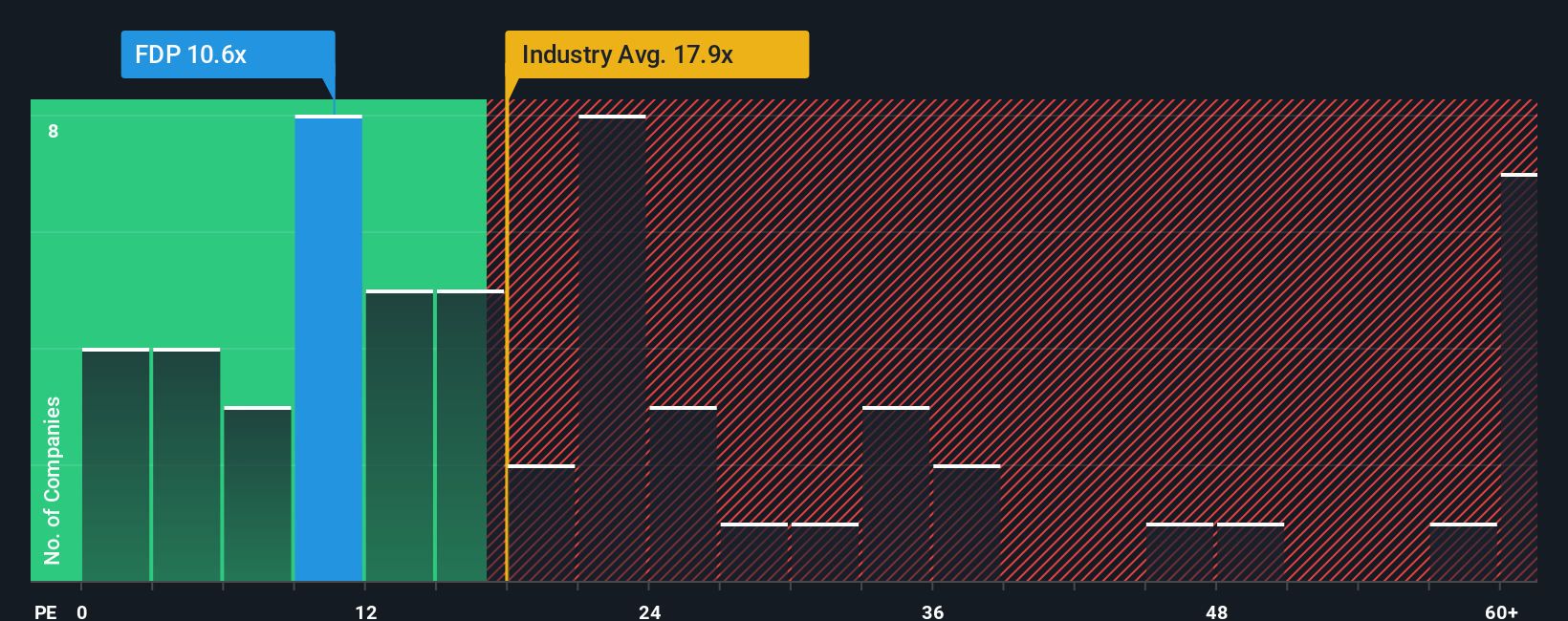

The Price-to-Earnings (PE) ratio is one of the most widely used metrics for valuing profitable companies like Fresh Del Monte Produce. It offers a snapshot of how much investors are willing to pay for each dollar of a company’s earnings, making it especially relevant for businesses with consistent and reliable profits.

Interpreting a company’s PE ratio is not as simple as picking the lowest one in sight. Higher growth expectations typically justify a higher PE, while increased risk or inconsistent profitability often lead to a lower PE. As a result, what counts as “normal” relies on the company’s future prospects and the prevailing sentiment in the sector.

Fresh Del Monte currently trades at a PE ratio of 10.9x. When compared to the Food industry average of 17.7x and a peer average of 24.4x, the company appears discounted on a relative basis. However, Simply Wall St’s proprietary “Fair Ratio” is a tailored benchmark that considers Fresh Del Monte’s unique growth outlook, profitability, risk profile, market cap, and its industry context, and places the fair PE at 11.8x. Unlike generic industry or peer comparisons, this Fair Ratio provides a more holistic picture by factoring in metrics that matter most to Fresh Del Monte specifically.

In this case, with an actual PE of 10.9x and a fair PE of 11.8x, Fresh Del Monte shares appear undervalued based on this methodology.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Fresh Del Monte Produce Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, a simple but powerful approach that gives real meaning to the numbers by letting you tell the story behind your expectations for Fresh Del Monte Produce.

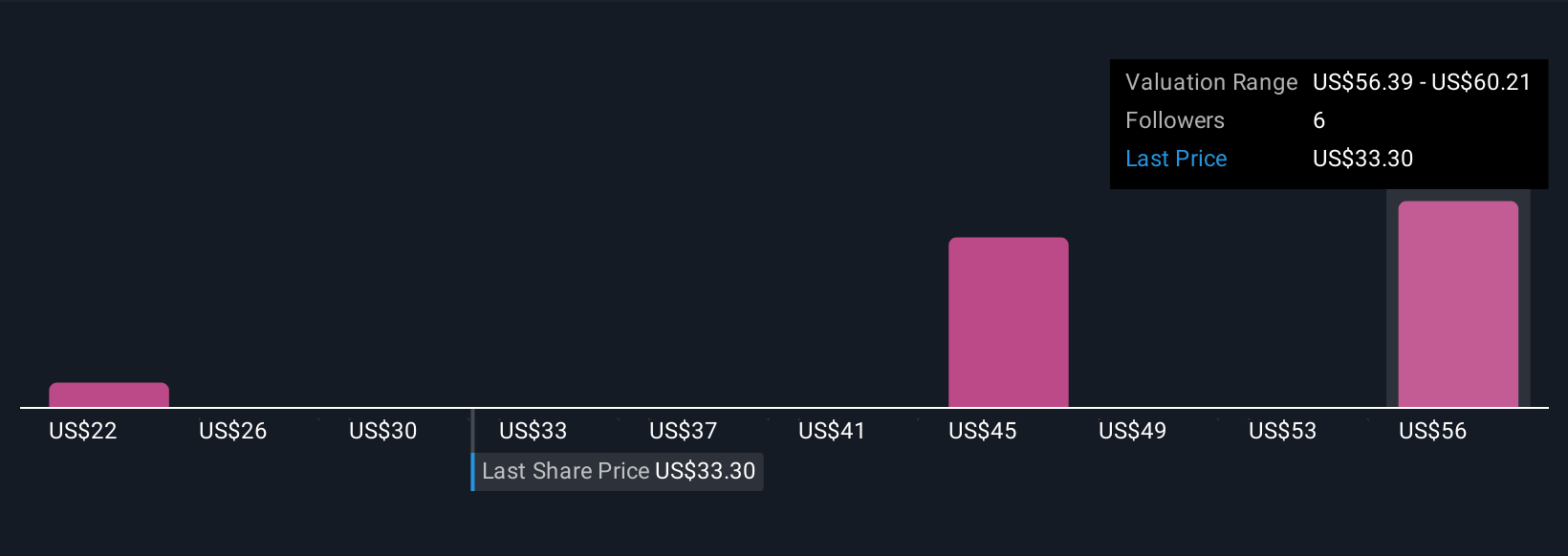

A Narrative links your personal perspective on the company’s future, from its revenue growth and margins to its risks and opportunities, to a financial forecast and then calculates a fair value. This makes abstract numbers feel relevant and actionable.

This method is easy to use and available to millions of investors on Simply Wall St’s Community page, where you can create, explore, and update Narratives alongside others in real time as news or earnings reports come in.

With Narratives, you can see exactly how your assumed fair value for Fresh Del Monte Produce compares to the current share price. This helps you decide when it really makes sense to buy or sell based on your own outlook.

For example, one user’s Narrative might project $4.7 billion in revenue and resilient margins, arriving at a fair value above $46 per share. Another, more cautious investor could focus on climate risks and margin pressure, justifying a much lower fair value. No matter the view, Narratives bring every investing story together on a single, up-to-date platform.

Do you think there's more to the story for Fresh Del Monte Produce? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FDP

Fresh Del Monte Produce

Through its subsidiaries, produces, markets, and distributes fresh and fresh-cut fruits and vegetables in North America, Central America, South America, Europe, the Middle East, Africa, Asia, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives