- United States

- /

- Food

- /

- NYSE:DAR

Shareholders in Darling Ingredients (NYSE:DAR) are in the red if they invested three years ago

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But if you try your hand at stock picking, you risk returning less than the market. Unfortunately, that's been the case for longer term Darling Ingredients Inc. (NYSE:DAR) shareholders, since the share price is down 49% in the last three years, falling well short of the market return of around 27%. And over the last year the share price fell 26%, so we doubt many shareholders are delighted. More recently, the share price has dropped a further 9.7% in a month.

With that in mind, it's worth seeing if the company's underlying fundamentals have been the driver of long term performance, or if there are some discrepancies.

View our latest analysis for Darling Ingredients

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

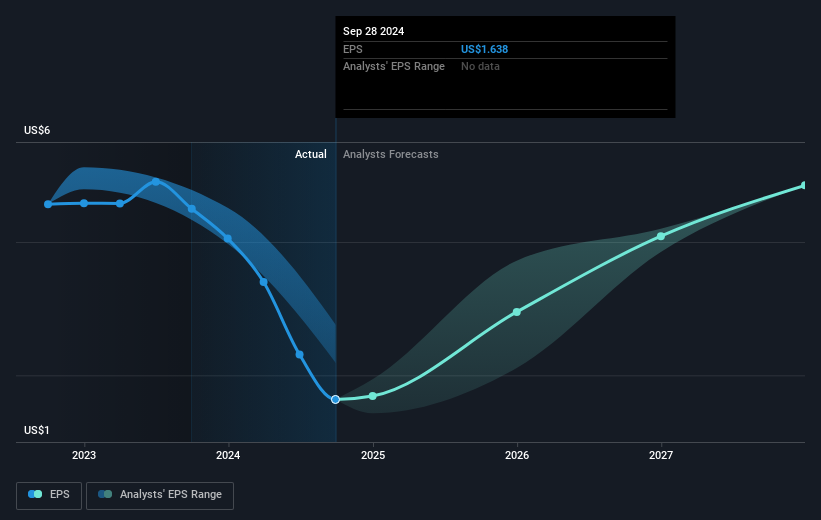

During the three years that the share price fell, Darling Ingredients' earnings per share (EPS) dropped by 21% each year. So do you think it's a coincidence that the share price has dropped 20% per year, a very similar rate to the EPS? We don't. That suggests that the market sentiment around the company hasn't changed much over that time, despite the disappointment. It seems like the share price is reflecting the declining earnings per share.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. This free interactive report on Darling Ingredients' earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Darling Ingredients shareholders are down 26% for the year, but the market itself is up 25%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 3% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Darling Ingredients has 3 warning signs (and 1 which is concerning) we think you should know about.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of undervalued small cap companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:DAR

Darling Ingredients

Develops, produces, and sells natural ingredients from edible and inedible bio-nutrients in North America, Europe, China, South America, and internationally.

Good value with limited growth.

Similar Companies

Market Insights

Community Narratives