- United States

- /

- Food

- /

- NYSE:CAG

Conagra Brands (CAG): Exploring Valuation After New Slim Jim Chicken Sticks Launch With Buffalo Wild Wings

Reviewed by Simply Wall St

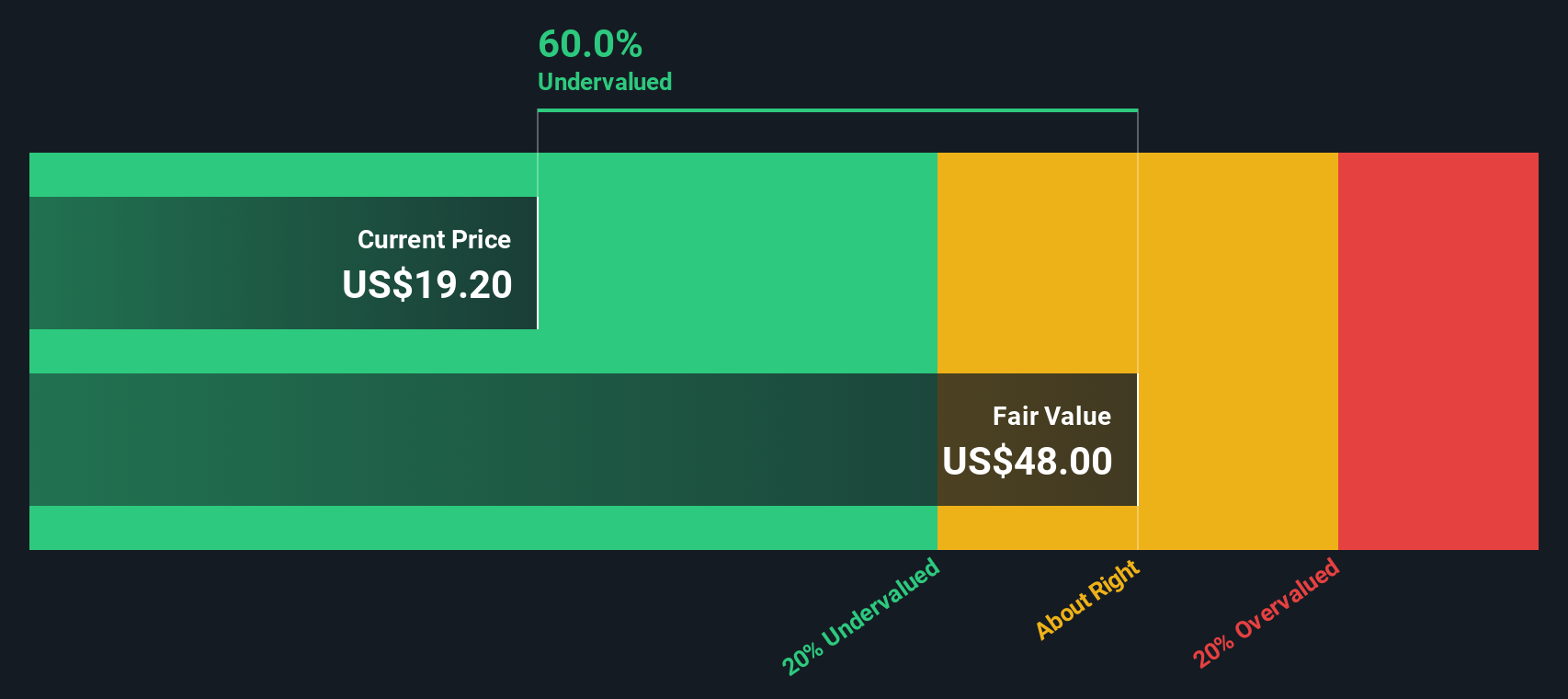

Most Popular Narrative: 9.5% Undervalued

The current prevailing narrative among market watchers is that Conagra Brands is trading at a significant discount to its fair value, with a fair value set above today's price. This narrative leans heavily on projected earnings and margins, despite broader concerns about the company's long-term outlook.

Strong consumer demand and steady consumption trends bode well for future revenue growth. This suggests that the company can maintain its top-line momentum even amidst a challenging economic backdrop. The stabilization of supply chain constraints, particularly in the latter half of next year, is expected to improve operational efficiencies and margins, benefiting overall earnings performance.

What could be powering this bullish outlook? There is one controversial number that anchors the narrative, tied to both future profit projections and an industry-low valuation multiple. Want to see what quantitative leap the analysts expect? Find out if Conagra can really maintain its earnings power when the sector as a whole is slowing. Dig deeper to unlock the assumptions and see if this value call lives up to the hype.

Result: Fair Value of $20.93 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent inflation or shifting consumer sentiment could undermine Conagra's rebound story. This may pressure margins and put downside risk on earnings projections.

Find out about the key risks to this Conagra Brands narrative.Another View: Discounted Cash Flow Approach

When we consider the SWS DCF model, a different angle emerges. This method values Conagra by projecting all its future cash flows. It points to a notable gap between the current price and intrinsic value. Does this cast doubt on the market’s verdict, or does it hint at hidden potential yet to be realized?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Conagra Brands for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Conagra Brands Narrative

If you see the numbers differently or want to dig into the figures on your own terms, crafting a personal take is quick and straightforward. It takes just a few minutes. Do it your way

A great starting point for your Conagra Brands research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Market Opportunities?

Take your investing to the next level by finding companies poised for growth, value, and innovation. Do not let standout opportunities pass you by. These tailored stock lists can help you act ahead of the crowd.

- Target stocks trading below their intrinsic worth and position yourself for future gains by scanning for undervalued stocks based on cash flows.

- Tap into the explosive potential of next-wave technology by searching for leaders in artificial intelligence through AI penny stocks.

- Lock in attractive yields and generate reliable cash flow by selecting from a curated group of dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CAG

Conagra Brands

Operates as a consumer packaged goods food company primarily in the United States.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives