- United States

- /

- Food

- /

- NYSE:ADM

How Investors May Respond To Archer-Daniels-Midland (ADM) Exploring Sale of Golden Peanut Business

Reviewed by Sasha Jovanovic

- In recent days, Archer-Daniels-Midland announced it is preparing to carve out and potentially sell its Golden Peanut and Tree Nuts group, which it acquired in 2011, with private equity buyers reportedly interested in the business. This move highlights ADM’s ongoing portfolio reshaping as it adapts to industry trends such as rising demand for plant-based proteins and sustainable oils.

- We'll explore how ADM’s decision to divest Golden Peanut and Tree Nuts may influence its investment narrative and future margin focus.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Archer-Daniels-Midland Investment Narrative Recap

To be an Archer-Daniels-Midland (ADM) shareholder, I believe in the company’s ability to adapt its broad agribusiness portfolio to evolving trends in global food, feed, and biofuel markets, while managing volatility from crop cycles and policy change. The pending divestiture of Golden Peanut and Tree Nuts appears consistent with ADM’s ongoing portfolio simplification, but does not meaningfully shift the biggest short-term catalyst, policy clarity on biofuels, nor the most pressing risk, which remains margin pressure in its core Ag Services & Oilseeds segment.

The recent joint venture between ADM and Alltech for North American animal feed, announced in September 2025, aligns with the company’s focus on expanding its Nutrition segment, which is seen as a path to better margin stability. While this move is distinct from the Golden Peanut sale, it reflects ADM’s efforts to shift toward higher-value activities that support the company’s central growth catalysts.

Yet, even as ADM moves to reshape its business, investors should also be mindful of how unresolved biofuel regulation...

Read the full narrative on Archer-Daniels-Midland (it's free!)

Archer-Daniels-Midland's outlook anticipates $88.6 billion in revenue and $2.1 billion in earnings by 2028. This projection is based on 2.3% annual revenue growth and an increase in earnings of $1.0 billion from the current $1.1 billion.

Uncover how Archer-Daniels-Midland's forecasts yield a $58.30 fair value, a 5% downside to its current price.

Exploring Other Perspectives

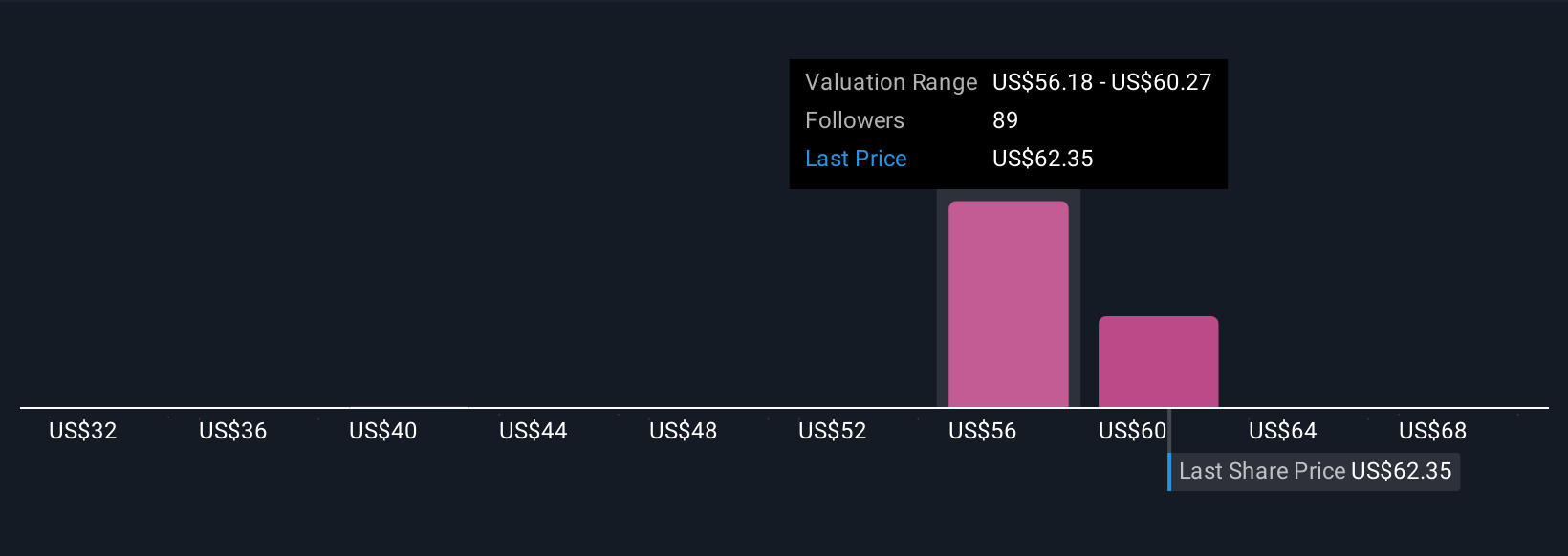

Fifteen members of the Simply Wall St Community set fair value for ADM anywhere from US$31.64 to US$72.54 per share. With biofuel policy uncertainty continuing to cloud margin forecasts, you can see why market participants hold such wide-ranging outlooks.

Explore 15 other fair value estimates on Archer-Daniels-Midland - why the stock might be worth 49% less than the current price!

Build Your Own Archer-Daniels-Midland Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Archer-Daniels-Midland research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Archer-Daniels-Midland research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Archer-Daniels-Midland's overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ADM

Archer-Daniels-Midland

Engages in the procurement, transportation, storage, processing, and merchandising of agricultural commodities, ingredients, flavors, and solutions.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives