- United States

- /

- Food

- /

- NasdaqGM:VITL

Vital Farms, Inc.'s (NASDAQ:VITL) Popularity With Investors Under Threat As Stock Sinks 26%

Vital Farms, Inc. (NASDAQ:VITL) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. Longer-term shareholders will rue the drop in the share price, since it's now virtually flat for the year after a promising few quarters.

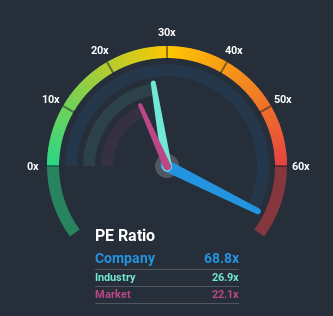

Although its price has dipped substantially, given close to half the companies in the United States have price-to-earnings ratios (or "P/E's") below 22x, you may still consider Vital Farms as a stock to avoid entirely with its 68.8x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Vital Farms certainly has been doing a good job lately as it's been growing earnings more than most other companies. The P/E is probably high because investors think this strong earnings performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Vital Farms

Is There Enough Growth For Vital Farms?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Vital Farms' to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 232% last year. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 9.2% each year during the coming three years according to the six analysts following the company. With the market predicted to deliver 16% growth per annum, the company is positioned for a weaker earnings result.

With this information, we find it concerning that Vital Farms is trading at a P/E higher than the market. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Bottom Line On Vital Farms' P/E

Vital Farms' shares may have retreated, but its P/E is still flying high. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Vital Farms currently trades on a much higher than expected P/E since its forecast growth is lower than the wider market. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings aren't likely to support such positive sentiment for long. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

It is also worth noting that we have found 1 warning sign for Vital Farms that you need to take into consideration.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a P/E below 20x.

If you decide to trade Vital Farms, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGM:VITL

Vital Farms

A food company, packages, markets, and distributes shell eggs, butter, and other products in the United States.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives