- United States

- /

- Food

- /

- NasdaqCM:VFF

How Village Farms International's (VFF) Share Buyback Plan Signals a Shift in Its Capital Allocation Strategy

Reviewed by Sasha Jovanovic

- Village Farms International, Inc. recently announced a share buyback program, authorizing the repurchase of up to 5,687,000 common shares for US$10 million, representing 5% of its issued and outstanding shares, funded from cash on hand and operational cash flows.

- This initiative reflects the Board's confidence in Village Farms' balance sheet and future cash generation, while continuing investment in growth projects in Canada and the Netherlands.

- We will examine how the share repurchase plan highlights management’s focus on capital allocation and enhancing long-term shareholder value.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Village Farms International Investment Narrative Recap

For investors to hold Village Farms International, belief in the company's continued global cannabis expansion and its ability to navigate evolving regulations is key. The new US$10 million share buyback adds to this narrative by signaling management’s conviction, but does not materially affect the most immediate catalysts, such as international market scaling, or the primary risk of intensifying competition and margin pressure in emerging export markets.

Among recent developments, the August 2025 decision to convert an additional 550,000 square feet in Delta, British Columbia, to cannabis production aligns directly with current growth initiatives. With new capacity, Village Farms is pushing to maintain its competitive edge in the face of surging international demand, a factor that remains vital as the company funds both expansion and share repurchases from operational cash flows.

By contrast, while buybacks might attract attention, investors should be aware of the ongoing risk posed by global price competition and margin compression, especially if export markets fail to absorb new production as quickly as anticipated...

Read the full narrative on Village Farms International (it's free!)

Village Farms International is projected to reach $304.1 million in revenue and $59.8 million in earnings by 2028. This outlook assumes a 3.7% annual decline in revenue and a $65.6 million increase in earnings from the current level of -$5.8 million.

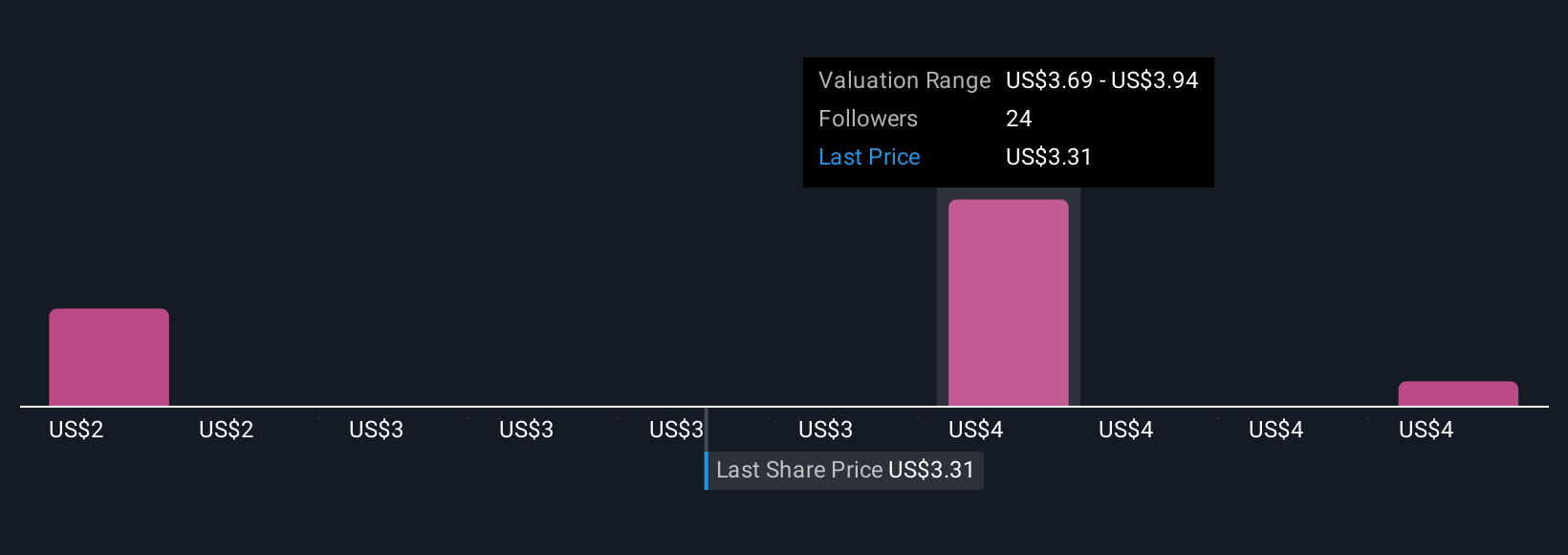

Uncover how Village Farms International's forecasts yield a $3.75 fair value, a 33% upside to its current price.

Exploring Other Perspectives

Five Simply Wall St Community members estimate Village Farms’ fair value between US$2.18 and US$8.24 per share, reflecting a broad range of private investor outlooks. As new production facilities come online, the impact of international competition on profitability remains a focal point for the company’s forward trajectory.

Explore 5 other fair value estimates on Village Farms International - why the stock might be worth over 2x more than the current price!

Build Your Own Village Farms International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Village Farms International research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Village Farms International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Village Farms International's overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:VFF

Village Farms International

Produces, markets, and distributes greenhouse grown tomatoes, bell peppers, cucumbers, and mini-cukes in North America.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives