- United States

- /

- Food

- /

- NasdaqCM:VFF

A Look at Village Farms International (NasdaqCM:VFF) Valuation Following Share Buyback and Global Expansion Moves

Reviewed by Kshitija Bhandaru

Village Farms International (NasdaqCM:VFF) just launched a $10 million share buyback program, grabbing investors’ attention. This move comes as the company scales up international cannabis exports and taps into broader legalization trends overseas.

See our latest analysis for Village Farms International.

Village Farms International’s upward streak has gained serious traction, with a 31% share price return over the last month and a staggering 290% year-to-date surge. Alongside expanding exports and the newly announced buyback, this signals growing optimism. However, after last year’s 260% total return, expectations are running high, and the market appears to be betting on further gains fueled by global legalization momentum.

If you’re watching how cannabis stocks are attracting attention, it might be the right moment to broaden your search and discover fast growing stocks with high insider ownership

With the stock rallying nearly 300% year-to-date and a new buyback plan signaling management’s confidence, investors are now left wondering if Village Farms is still undervalued or if the market has fully priced in its future growth potential.

Most Popular Narrative: 11.7% Undervalued

Village Farms International's fair value, according to the most widely followed narrative, stands at $3.75, compared to a last close of $3.31. The modest gap implies analysts see more upside in the stock, hinging on transformative international growth and operational leverage just starting to play out.

The rapid scaling of international cannabis exports, particularly driven by strong demand in Germany, the UK, and the Netherlands, indicates Village Farms is capitalizing on expanding global legalization and this supports future revenue growth as well as improving earnings visibility.

Wondering what bold financial projections are fueling this upbeat valuation? The narrative hinges on assumptions about growth in new markets, a significant turnaround in profitability, and a notable earnings multiple. These numbers could spark a dramatic re-rating if they materialize. Dive in to discover whether these forecasts are too aggressive, not aggressive enough, or perfectly timed for takeoff.

Result: Fair Value of $3.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent regulatory hurdles or a spike in international competition could quickly undermine growth prospects and challenge the optimistic consensus around Village Farms.

Find out about the key risks to this Village Farms International narrative.

Another View: What About Cash Flows?

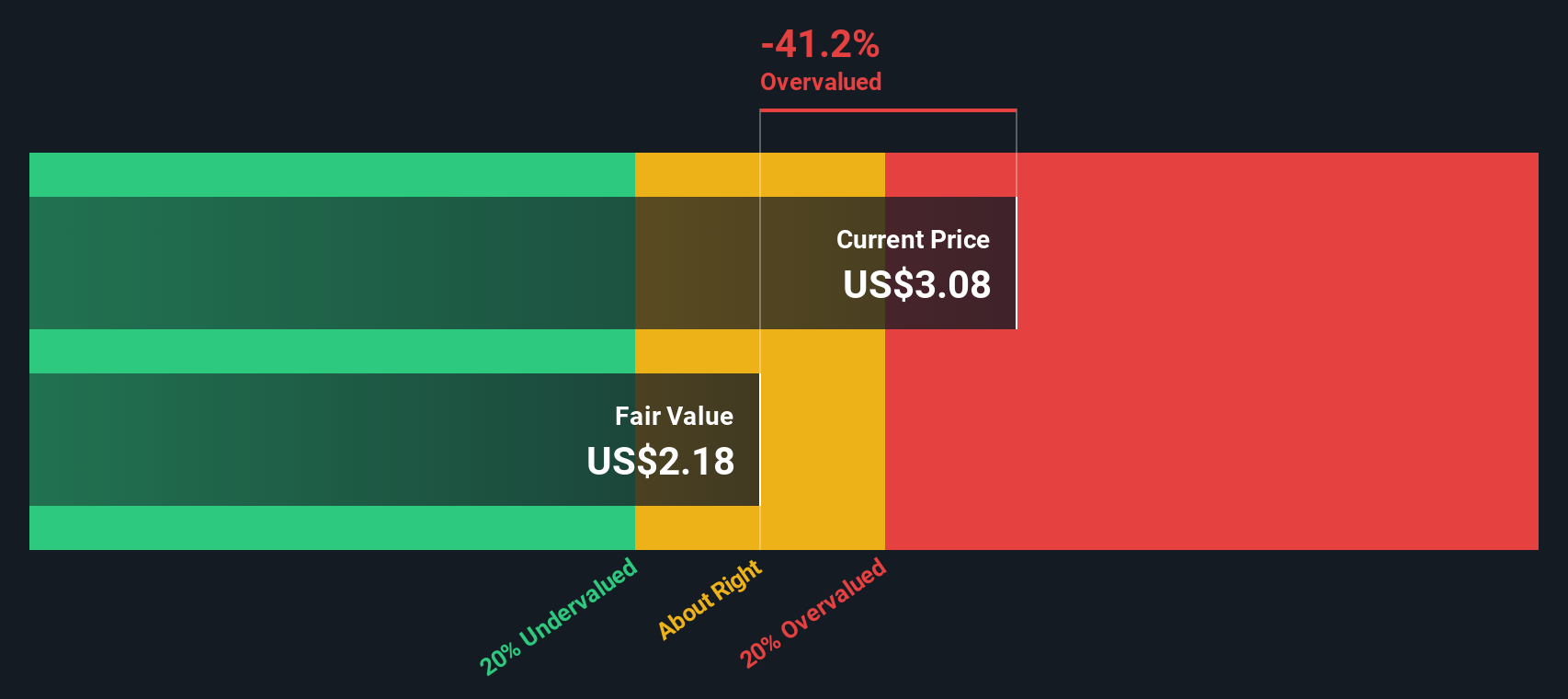

While most analysts lean on profit forecasts and multiples to value Village Farms, the SWS DCF model paints a different picture, suggesting the shares may actually be overvalued when projected cash flows are factored in. Can strong sentiment and international optimism hold if future cash isn’t as robust as expected?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Village Farms International for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Village Farms International Narrative

If you see things differently or want to dig deeper into the numbers yourself, you can craft your own perspective in just a few minutes. Do it your way

A great starting point for your Village Farms International research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let great opportunities pass you by. The Simply Wall Street Screener unlocks unique investment angles you may have overlooked. Give yourself a real edge by checking out these strategies:

- Amplify your search by tapping into these 19 dividend stocks with yields > 3% if you want to secure high yields from companies with consistent payouts and robust cash generation.

- Sprint ahead of the curve with these 24 AI penny stocks and target companies at the intersection of artificial intelligence innovation and rapid growth.

- Unlock value potential overlooked by the market when you zero in on these 898 undervalued stocks based on cash flows focused on stocks trading below their intrinsic worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:VFF

Village Farms International

Produces, markets, and distributes greenhouse grown tomatoes, bell peppers, cucumbers, and mini-cukes in North America.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives