- United States

- /

- Food

- /

- NasdaqGS:SFD

Smithfield Foods (SFD): Evaluating Valuation After Mike’s Hot Honey Bacon Launch and Bold New Campaign

Reviewed by Kshitija Bhandaru

Smithfield Foods (SFD) is generating buzz with the launch of its Mike's Hot Honey Bacon, a collaboration supported by an attention-grabbing campaign. This media push includes influencer partnerships and vibrant events in Times Square.

See our latest analysis for Smithfield Foods.

Smithfield Foods’ eye-catching campaign launch arrives after a choppy stretch for its shares, with the latest 1-month share price return at -13.39%. Despite recent volatility, the stock still shows a year-to-date share price return of 7.14%. This result suggests that investor momentum could be rebuilding alongside new brand initiatives and ambitious marketing pushes.

If this kind of bold brand move has you interested in what else is catching investor attention, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

But with Smithfield stock still sitting well below analyst price targets, investors have to wonder whether the market is underestimating the company's renewed momentum or if all the future growth is already reflected in the current price.

Price-to-Earnings of 10.1x: Is it justified?

Smithfield Foods is currently trading at a price-to-earnings (P/E) multiple of 10.1x, while its last close price stands at $21.16. This puts the stock in a position where it looks notably undervalued compared to its sector.

The price-to-earnings ratio measures how much investors are willing to pay for a dollar of earnings. It is a key tool for comparing companies in the same industry. For a staple like Smithfield, the P/E ratio provides insight into how the market sees its earnings potential relative to rivals.

At 10.1x, Smithfield's P/E is substantially lower than both the industry average (17.7x) and its peer group (15.8x). The company is also trading below its fair P/E ratio estimate of 16.5x, suggesting there may be upside potential if the market re-adjusts its outlook. This low multiple raises the possibility that the market is underpricing current and near-term profitability, especially as the company demonstrates solid earnings growth.

Explore the SWS fair ratio for Smithfield Foods

Result: Price-to-Earnings of 10.1x (UNDERVALUED)

However, slower annual revenue growth and lingering short-term share price volatility could challenge the case for a near-term recovery in Smithfield Foods stock.

Find out about the key risks to this Smithfield Foods narrative.

Another View: Discounted Cash Flow Approach

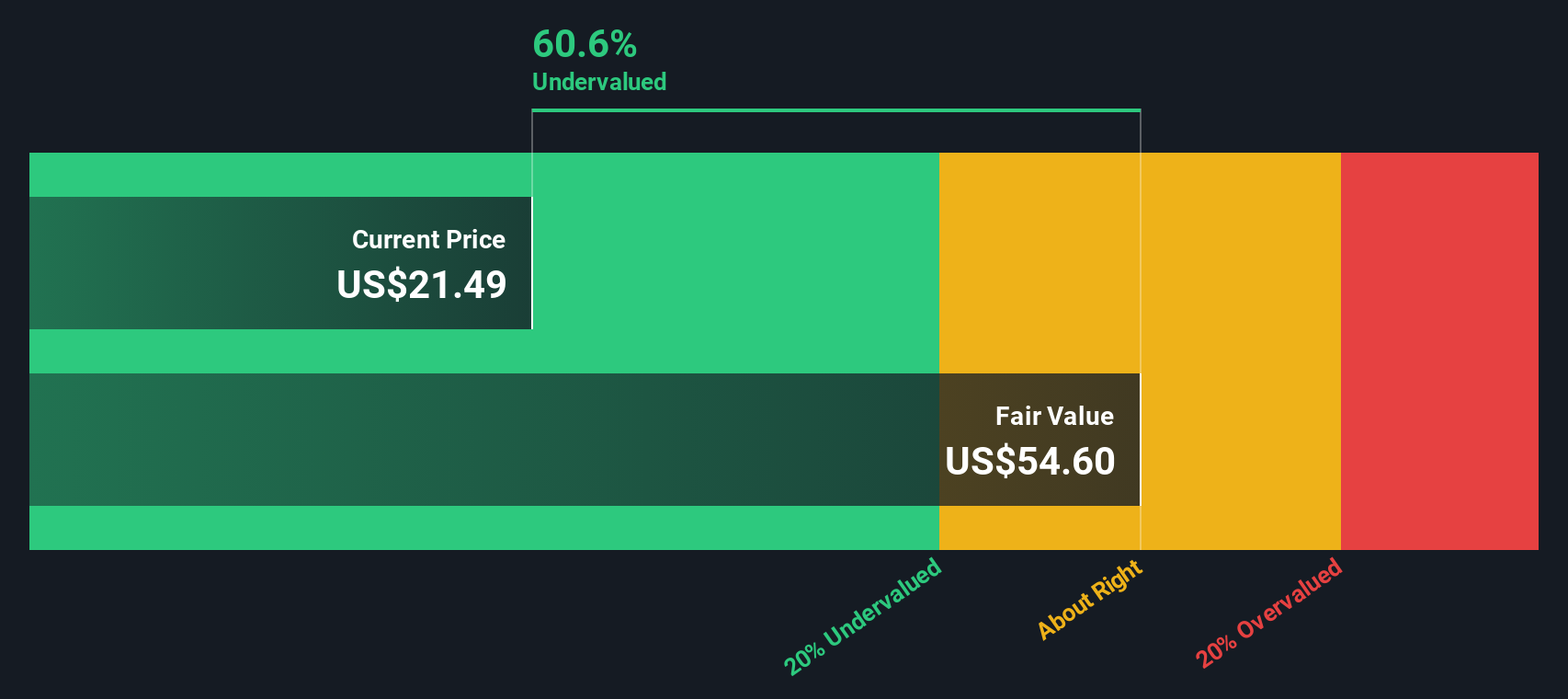

Looking at Smithfield Foods through the lens of our DCF model, a striking result emerges. The SWS DCF model estimates fair value at $54.60. The shares currently trade at just $21.16, which means the stock is priced around 61% below its DCF value and points to significant potential undervaluation.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Smithfield Foods for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Smithfield Foods Narrative

If you find yourself seeking a different outlook or want to dive deeper into the numbers, you can shape your own perspective in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Smithfield Foods.

Looking for more investment ideas?

Stay ahead of the curve and supercharge your portfolio by checking out handpicked opportunities in markets investors are buzzing about. Missing out could mean leaving potential gains behind.

- Uncover high-yield opportunities by reviewing these 19 dividend stocks with yields > 3% with robust payouts and returns above 3% that can boost your income stream.

- Ride the wave of innovation by scanning these 24 AI penny stocks attracting attention for dramatic growth in artificial intelligence and automation sectors.

- Capitalize on emerging tech shifts by investigating these 26 quantum computing stocks, where breakthroughs in quantum computing are setting the stage for tomorrow’s leaders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SFD

Smithfield Foods

Produces packaged meats and fresh pork in the United States and internationally.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives