- United States

- /

- Food

- /

- NasdaqCM:SEED

Origin Agritech Limited (NASDAQ:SEED) Stocks Shoot Up 27% But Its P/S Still Looks Reasonable

Origin Agritech Limited (NASDAQ:SEED) shares have continued their recent momentum with a 27% gain in the last month alone. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 29% in the last twelve months.

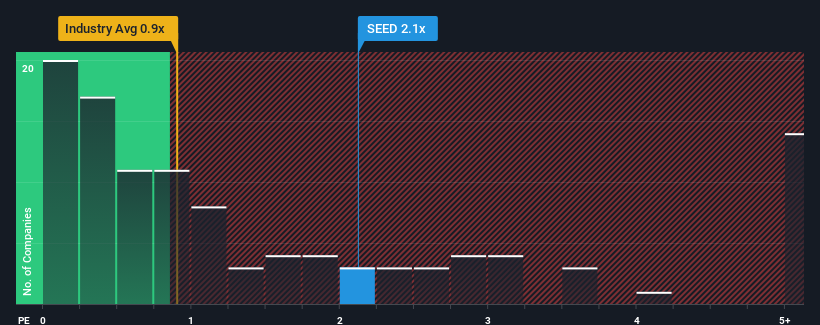

Following the firm bounce in price, given close to half the companies operating in the United States' Food industry have price-to-sales ratios (or "P/S") below 0.9x, you may consider Origin Agritech as a stock to potentially avoid with its 2.1x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Origin Agritech

How Origin Agritech Has Been Performing

With revenue growth that's exceedingly strong of late, Origin Agritech has been doing very well. The P/S ratio is probably high because investors think this strong revenue growth will be enough to outperform the broader industry in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Origin Agritech will help you shine a light on its historical performance.How Is Origin Agritech's Revenue Growth Trending?

Origin Agritech's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Retrospectively, the last year delivered an exceptional 77% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 78% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Comparing that to the industry, which is only predicted to deliver 2.0% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this information, we can see why Origin Agritech is trading at such a high P/S compared to the industry. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

What Does Origin Agritech's P/S Mean For Investors?

The large bounce in Origin Agritech's shares has lifted the company's P/S handsomely. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Origin Agritech revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

Before you settle on your opinion, we've discovered 4 warning signs for Origin Agritech (2 are a bit unpleasant!) that you should be aware of.

If you're unsure about the strength of Origin Agritech's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:SEED

Origin Agritech

Operates as an agricultural biotechnology in the People’s Republic of China.

Slight risk and overvalued.

Market Insights

Community Narratives