- United States

- /

- Beverage

- /

- NasdaqGS:PEP

PepsiCo (PEP): Revisiting Valuation After Analyst Update on Earnings Pressures and Strategic Shift Toward Healthier Products

Reviewed by Simply Wall St

Piper Sandler’s latest update on PepsiCo (PEP) put fresh attention on the company’s recent earnings slump, with modest 1% organic sales growth still accompanied by lower EPS and falling volumes across key categories.

See our latest analysis for PepsiCo.

Those softer earnings have also weighed on sentiment, with the share price now at $148.06 and a 1 year total shareholder return of negative 4.18% signalling that momentum has cooled, even though the 30 day share price return of 3.61% hints at some stabilising confidence.

If PepsiCo’s slower patch has you rethinking your defensive picks, it could be a good moment to explore fast growing stocks with high insider ownership as potential higher growth alternatives.

With earnings under pressure but a modest discount to analyst targets and a far steeper gap to some intrinsic value estimates, are investors getting a defensive staple on sale, or is the market already pricing in PepsiCo’s next leg of growth?

Most Popular Narrative: 3% Undervalued

With the narrative fair value sitting just above PepsiCo’s last close, the story hinges on whether modest growth and margin gains can compound meaningfully.

Operational efficiencies from technology investments, including AI, ERP systems, and the integration of North American businesses, are enabling ongoing multiyear productivity gains, lowering fixed and variable costs, and supporting net margin improvement. (Expected impact: Operating margins and long-term earnings.)

Want to see the math behind that confidence? The narrative leans on carefully staged revenue growth, rising margins, and a future earnings multiple that might surprise you.

Result: Fair Value of $152.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower uptake of healthier products and execution risks around aggressive cost cutting could derail the growth and margin improvements that underpin this valuation.

Find out about the key risks to this PepsiCo narrative.

Another View: Multiples Point to a Richer Price

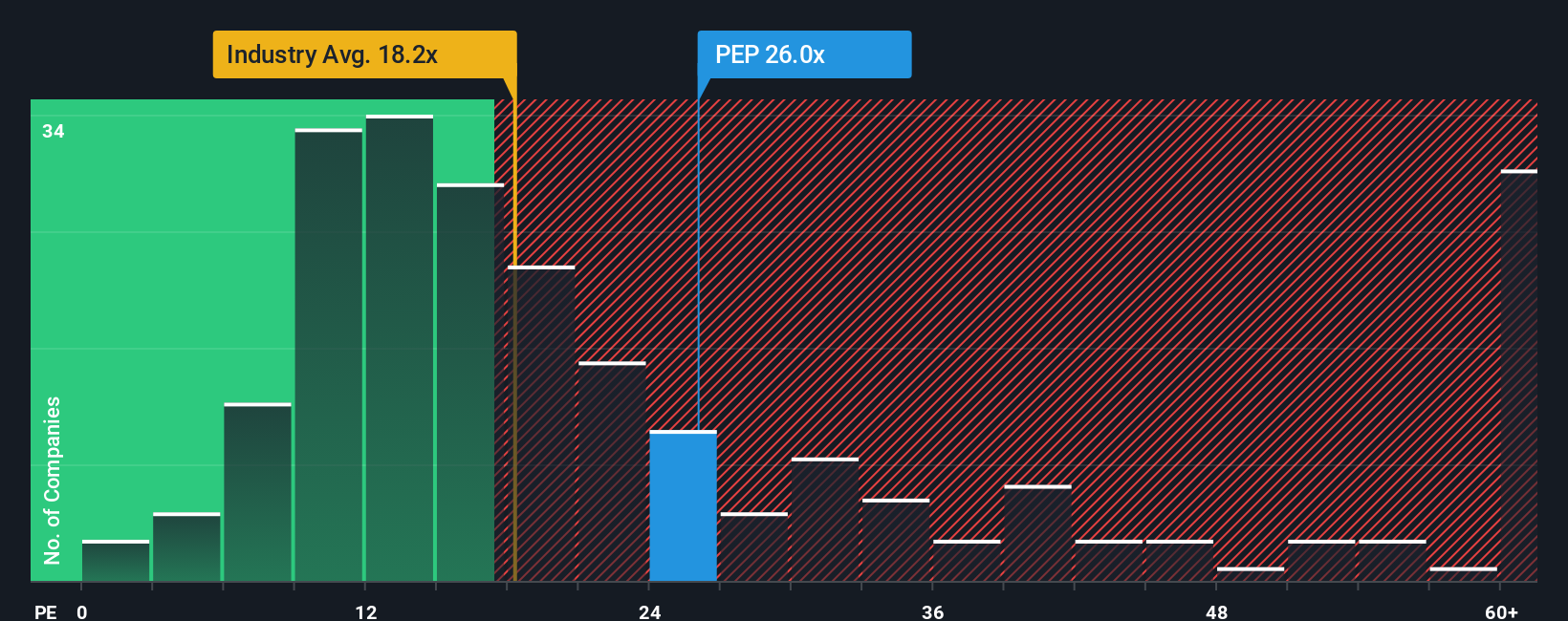

While narratives and fair values suggest PepsiCo is about 3% undervalued, its current price to earnings ratio of 28.4 times tells a tougher story. That is richer than peers at 26 times, well above the global beverage average of 17.6 times, and even above a fair ratio of 27 times that the market could drift toward over time. If growth stays modest, are investors paying up for stability that might already be fully priced in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own PepsiCo Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a complete PepsiCo narrative in minutes: Do it your way.

A great starting point for your PepsiCo research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next opportunity by using the Simply Wall St Screener to pinpoint stocks that match your exact strategy and risk profile.

- Capture value opportunities early by scanning these 919 undervalued stocks based on cash flows that the market may be overlooking despite strong underlying cash flows.

- Tap into powerful long term income potential with these 14 dividend stocks with yields > 3% that already offer yields above 3% and may keep rewarding patient holders.

- Position yourself ahead of the next technological shift by targeting these 27 quantum computing stocks building real businesses around breakthrough computing capabilities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PEP

PepsiCo

Engages in the manufacture, marketing, distribution, and sale of various beverages and convenient foods worldwide.

Mediocre balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026