- United States

- /

- Beverage

- /

- NasdaqGS:PEP

PepsiCo (PEP) Innovates With Launch Of Prebiotic Cola To Meet Modern Tastes

Reviewed by Simply Wall St

PepsiCo (PEP) recently unveiled its Pepsi Prebiotic Cola, marking a significant expansion in their product line aimed at health-conscious consumers. This launch, occurring amid PepsiCo's slight decline in net income despite increased sales, underlines the company's strategy of diversifying its offerings. Moreover, the announcement of a partnership with Cargill and the introduction of their additional innovative products emphasized PepsiCo's investment in sustainability and innovation. These developments occurred while the broader market experienced a correction from record highs, suggesting that PepsiCo's 10% price increase was buoyed by its robust business moves despite challenging market conditions.

PepsiCo's launch of the Pepsi Prebiotic Cola aligns with its narrative of portfolio transformation and operational excellence within Frito, as mentioned in the analysis. This focus on health-conscious products could stimulate revenue growth and enhance consumer frequency, particularly in international markets like India and Brazil. However, economic uncertainties and tariffs pose risks to profit margins as PepsiCo navigates these complex landscapes. The expansion of its product line underlines PepsiCo's commitment to innovation and sustainability amid fluctuating market conditions, potentially impacting future revenue and earnings forecasts positively.

Over the past five years, PepsiCo's total shareholder return, including share price and dividends, was 19.46%. In contrast, the company underperformed the US market over the past year, which returned 13.7%, and also underperformed the US Beverage industry, which decreased by 3.3% in the same period. The company's share performance highlights the impact of economic pressures and regulatory challenges on its financial metrics, particularly net profit margins, which have declined from 10.3% to 8.2% over the last year.

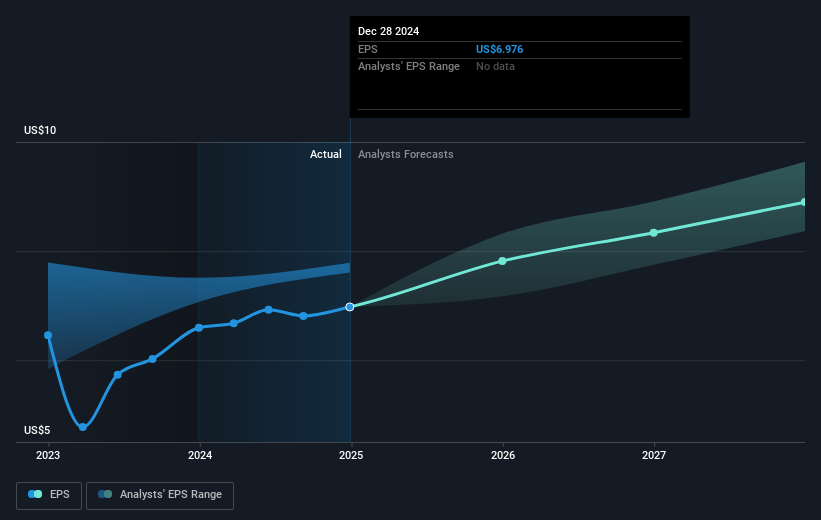

The current share price of US$141.70 is below the consensus analyst price target of approximately US$154.44, reflecting an 8.99% discount. This suggests that investor sentiment might be cautious due to the visible economic challenges and market volatility. However, some analysts foresee a potential increase in both revenue and earnings, which may align with PepsiCo's strategic initiatives and bolster its share price closer to the target. As the company continues to adapt to evolving consumer preferences and operational complexities, its future performance will hinge on successfully navigating these challenges and sustaining profitable growth.

Navigate through the intricacies of PepsiCo with our comprehensive balance sheet health report here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PEP

PepsiCo

Engages in the manufacture, marketing, distribution, and sale of various beverages and convenient foods worldwide.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives