- United States

- /

- Beverage

- /

- NasdaqGS:PEP

PepsiCo (PEP): Exploring Current Valuation Following Recent 4% Share Price Gain

Reviewed by Kshitija Bhandaru

See our latest analysis for PepsiCo.

PepsiCo's recent 4% climb caps off a volatile year, with the 12% share price return over the past quarter highlighting a noticeable rebound. However, its one-year total shareholder return of -11.5% reflects the challenges facing large consumer brands lately. Short-term momentum appears to be building again as the company navigates a choppy environment.

If you're curious about where else momentum is picking up, broaden your search and discover fast growing stocks with high insider ownership.

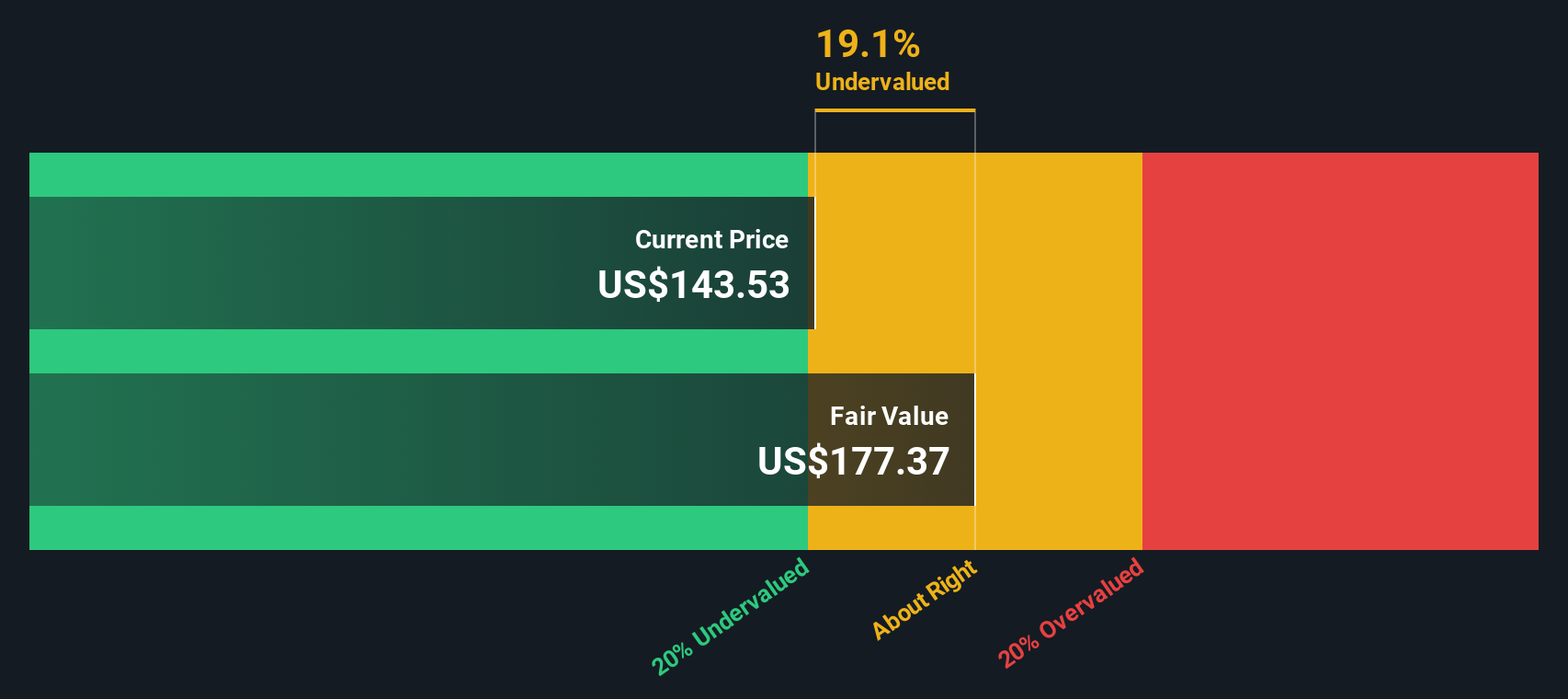

With shares regaining ground after a turbulent stretch, the key question remains: is PepsiCo undervalued at current levels, or has the market already factored in all future growth prospects, leaving little room for upside?

Most Popular Narrative: 1.6% Undervalued

With PepsiCo closing at $150.08 and this narrative pointing to a fair value nearly identical to analyst consensus, there is little room for surprise. Yet, shifting catalysts could change the picture faster than expected.

Sustained investment and strategic focus on international expansion, particularly in emerging markets (such as India, LatAm, and the Middle East), is broadening PepsiCo's addressable market and driving faster, margin-accretive revenue growth. This positions the company to benefit from population growth and rising disposable incomes. (Expected impact: Top-line revenue and geographic diversification.)

Curious what underpins this razor-thin discount? The combination of overseas momentum, potential margin improvements, and the possibility of future earnings upgrades could be more significant than it appears. Want the complete formula behind this valuation? Only the full narrative reveals which numbers truly move the needle.

Result: Fair Value of $152.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slow consumer adoption of healthier products and rising commodity input costs could quickly undermine the optimistic outlook for PepsiCo’s growth and margins.

Find out about the key risks to this PepsiCo narrative.

Another View: Digging Deeper Into Valuation

While our earlier view found PepsiCo slightly undervalued, our SWS DCF model introduces a new perspective by suggesting the stock trades well below its estimated fair value of $223.98. This presents an even larger gap than what multiples analysis reveals. Could this mean the market is overlooking PepsiCo’s long-term cash-generating power?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own PepsiCo Narrative

If you see the story differently, or want to run your own analysis, you can piece together a custom narrative in just a few minutes. Do it your way.

A great starting point for your PepsiCo research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors scan the markets for every edge. Don’t limit your opportunities to just one sector. The right stocks could be just a screener away.

- Tap into the power of compounding with reliable income streams by checking out these 19 dividend stocks with yields > 3%, where steady yields meet solid fundamentals for growing your portfolio.

- Get ahead of the curve as artificial intelligence reshapes the business world by starting your research with these 24 AI penny stocks at your fingertips.

- Uncover stocks trading well below their intrinsic value by exploring these 890 undervalued stocks based on cash flows, a shortcut to finding attractively priced opportunities that others may have missed.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PEP

PepsiCo

Engages in the manufacture, marketing, distribution, and sale of various beverages and convenient foods worldwide.

Mediocre balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

The "End-to-End" Space Prime – The Only Real Competitor to SpaceX

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026