- United States

- /

- Food

- /

- NasdaqGS:MZTI

How Does Marzetti Stack Up After a 9.4% Drop and Sluggish 2025 Outlook?

Reviewed by Bailey Pemberton

Wondering what’s next for Marzetti’s stock? You’re not alone. With a closing price of $165.32, investors are sizing up whether now is the right time to make a move or wait it out. After all, Marzetti has shown a bit of everything lately: a relatively flat week at -0.0%, a steeper 9.4% drop in the last month, and a slightly negative trajectory so far this year. But zooming out, things look a touch more positive. Over the past three years, Marzetti returned 4.2% and notched 1.7% over five years. It’s a performance streak that hints at both resilience and uncertainty.

What’s driving this stock’s journey? Recent shifts in the broader market have certainly put the spotlight on defensive, quality names like Marzetti. Investors seem to be recalibrating risk and weighing opportunities in sectors thought to hold up when the economic outlook is less certain. While Marzetti hasn’t surged, its steadier hand may have helped limit deeper losses compared to more volatile peers. Still, with just 1 out of 6 valuation checks suggesting the stock is truly undervalued, you might be wondering how to dig deeper than headline numbers.

Let’s break down the valuation approaches analysts use. Stay tuned, because we’ll also discuss a smarter way to cut through the noise and see Marzetti’s value from a fresh perspective.

Marzetti scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Marzetti Discounted Cash Flow (DCF) Analysis

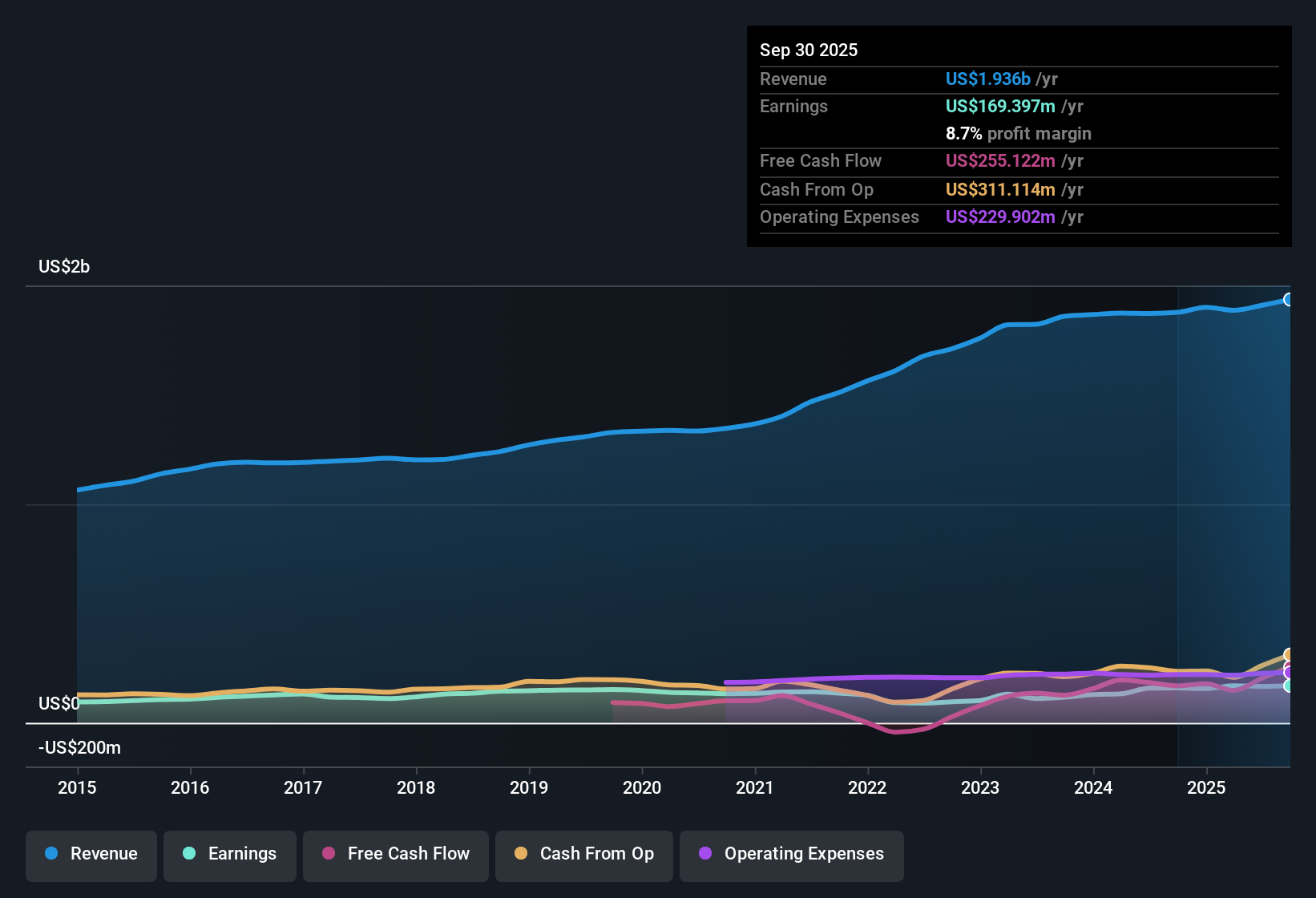

A Discounted Cash Flow (DCF) model estimates what a company is worth today by forecasting its future cash flows, then discounting those values back to present dollars. For Marzetti, analysts use a 2 Stage Free Cash Flow to Equity model, projecting cash added to the company's coffers and adjusting for the time value of money.

Currently, Marzetti’s latest reported Free Cash Flow stands at $188 million. Over the next several years, analysts foresee modest contraction, with projections dipping to $163.1 million by 2027 and, based on extrapolated trends, stabilizing around $179.2 million in 2035. Notably, given that only five years of forecasts come directly from analysts, figures beyond that lean on model-based estimates.

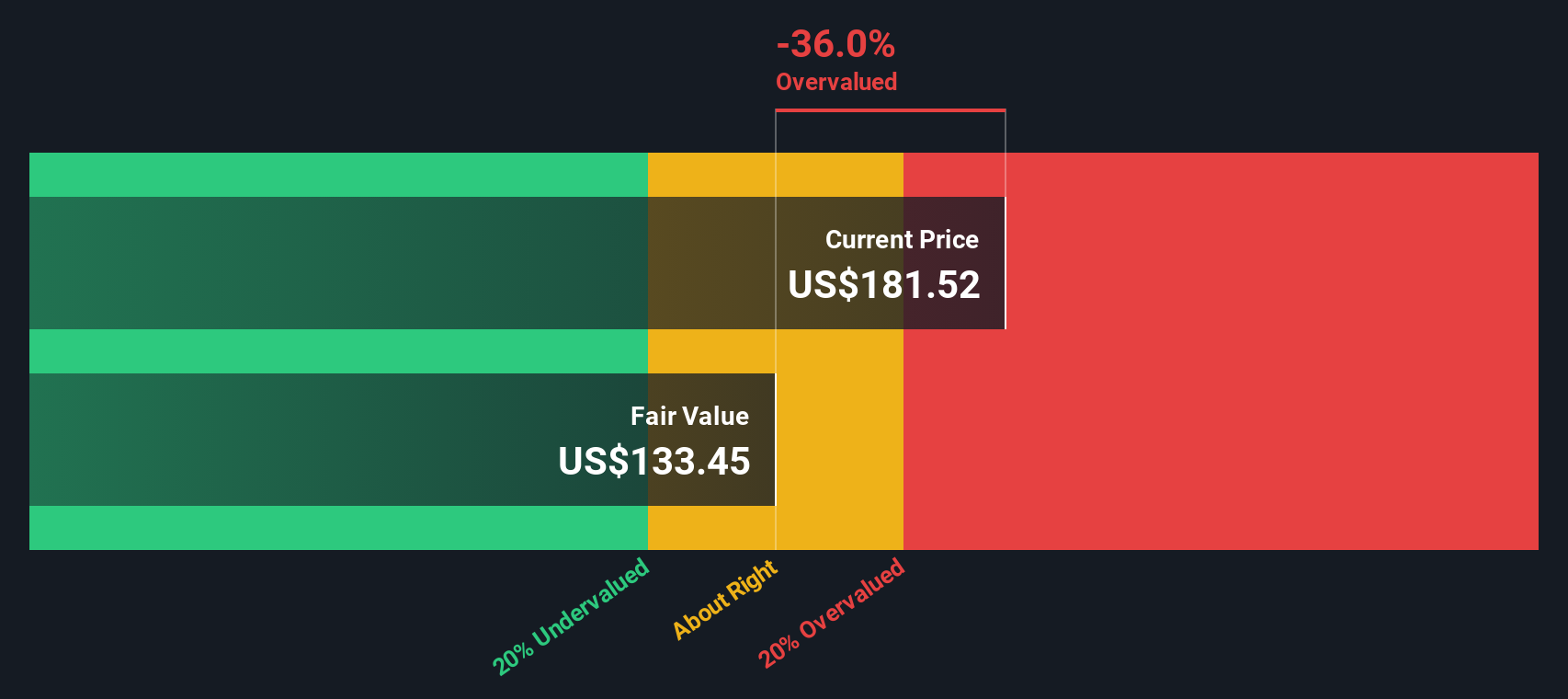

Based on this cash flow outlook and the DCF methodology, Marzetti’s intrinsic value per share is calculated at $137.05. With the current trade price at $165.32, the DCF implies the stock is about 20.6% above its fair value assessment.

Investors relying on DCF may see the stock as overextended at these levels, suggesting caution rather than a strong buy verdict.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Marzetti may be overvalued by 20.6%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Marzetti Price vs Earnings (PE)

For Marzetti, the preferred way to value its shares is by using the Price-to-Earnings (PE) ratio, which is widely considered the standard for profitable companies. The PE ratio is useful because it quickly tells investors how much they are paying for each dollar of profit, making it a powerful tool for comparing established businesses that are consistently generating earnings.

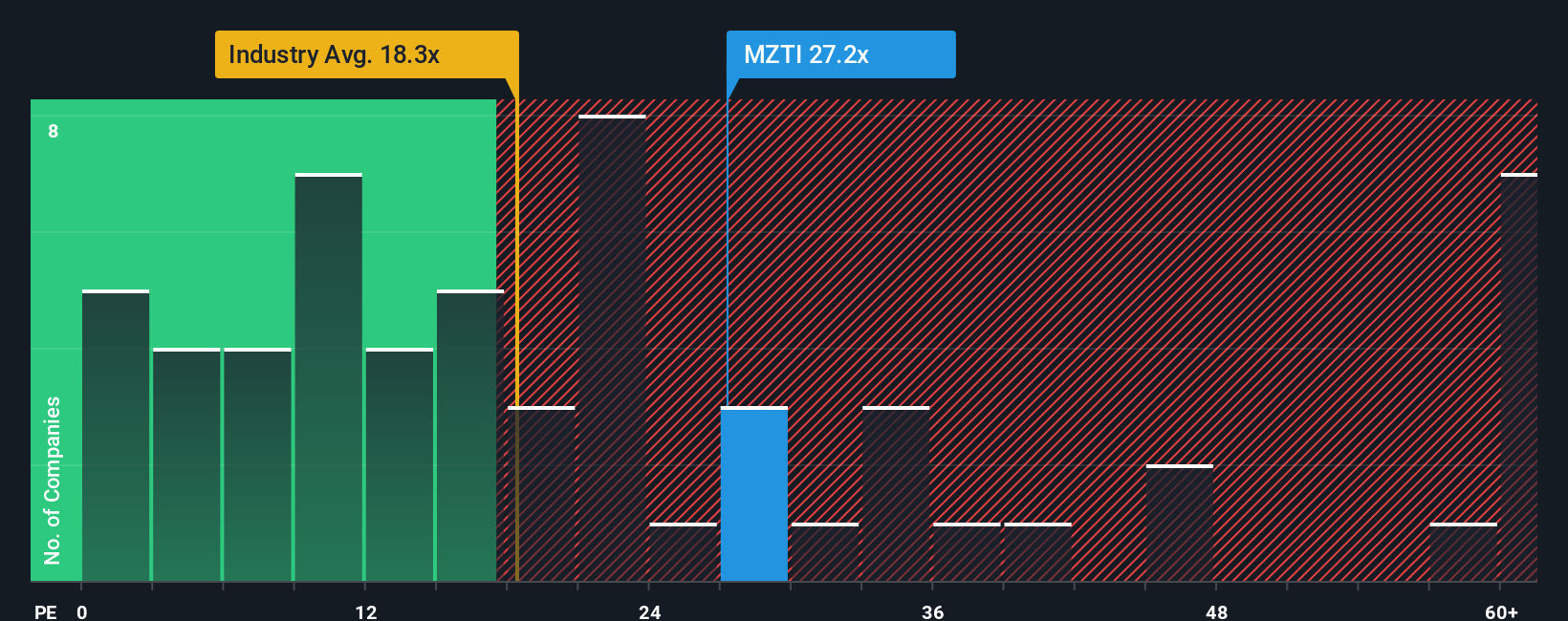

The "right" PE is not universal. Higher growth prospects or stronger profitability often justify richer multiples, while greater risks or industry headwinds can pull expected ratios lower. To make sense of Marzetti’s valuation, let’s look at the numbers: Marzetti is trading at a PE of 27.3x. That is well above both the Food industry average of 17.9x and the average of its direct peers, which sits at 16.4x. At first glance, this could imply the shares are richly valued.

However, Simply Wall St’s proprietary Fair Ratio takes a more tailored approach. Unlike a basic industry or peer comparison, the Fair Ratio weighs not just Marzetti’s earnings, but also its earnings growth, risks, profit margin, market capitalization, and the nuances of its sector. For Marzetti, the Fair PE Ratio is 16.2x, meaning the market is currently demanding a much higher multiple for each dollar of the company’s profit than what the Fair Ratio would imply. With Marzetti’s actual PE of 27.3x compared to its Fair Ratio of 16.2x, this suggests the stock is trading at a significant premium.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Marzetti Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a clear, story-driven investment perspective. You connect your view of a company’s future (such as where you think its revenue, profit margins, and fair value will land) with the numbers behind it.

Instead of relying solely on static ratios or historic averages, Narratives link Marzetti’s business story to a dynamic financial forecast and then to an up-to-date fair value estimate. Narratives are easy to use, available for everyone within the Community page on Simply Wall St, and used by millions of investors who want to make smarter decisions with context.

By comparing your Narrative’s Fair Value with the current share price, you can decide if Marzetti is a buy, hold, or sell for you. Any time fresh news or results emerge, your Narrative updates instantly. For example, some investors see Marzetti’s digital initiatives and health-focused product launches producing steady revenue and boosting fair value to $232.0 per share, while others are more conservative and estimate the fair value at just $180.0. Narratives let you cut through the noise and act on insights that actually fit your outlook.

Do you think there's more to the story for Marzetti? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MZTI

Marzetti

Engages in manufacturing and marketing of specialty food products for the retail and foodservice channels in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion