- United States

- /

- Food

- /

- NasdaqGS:MZTI

A Fresh Look at Marzetti (MZTI) Valuation After Recent Share Price Moves

Reviewed by Kshitija Bhandaru

See our latest analysis for Marzetti.

Marzetti’s 1-year total shareholder return stands at -6.5%, showing that the mild upswing in the last week is not yet a reversal of this year’s broader downtrend. Short-term momentum has faded since last month, but after a resilient run over several years, investors remain alert for signs of renewed strength as the longer-term trend remains positive.

If you’re keeping an eye out for other standout moves in the market, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

With Marzetti still trading nearly 20% below its average analyst price target, is the market overlooking potential upside? Or is recent weakness a sign that all future growth is already reflected in the share price?

Most Popular Narrative: 17% Undervalued

With Marzetti’s fair value estimate now 17% higher than its last close, market expectations may be underestimating key drivers behind the current price target. The most popular narrative weighs recent product launches, digital investments, and sector trends to project where shares could head next. From here, let’s look at a pivotal quote shaping this view.

Expanded marketing investments and data-driven digital initiatives are improving household penetration rates and repeat purchases across core brands, positioning the company to capture a larger share of the continued shift toward at-home meal preparation and fueling sustainable revenue growth.

Curious what’s powering these bold price targets? The narrative hinges on forecasts for accelerating margin expansion, rising brand loyalty, and a valuation multiple usually seen among industry disruptors. Something here is elevating expectations far beyond simple growth. Want to untangle the maths and catalysts behind this optimism?

Result: Fair Value of $199 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising input costs and shifting consumer dietary preferences could quickly undermine these optimistic growth forecasts for Marzetti.

Find out about the key risks to this Marzetti narrative.

Another View: High Valuation in Context

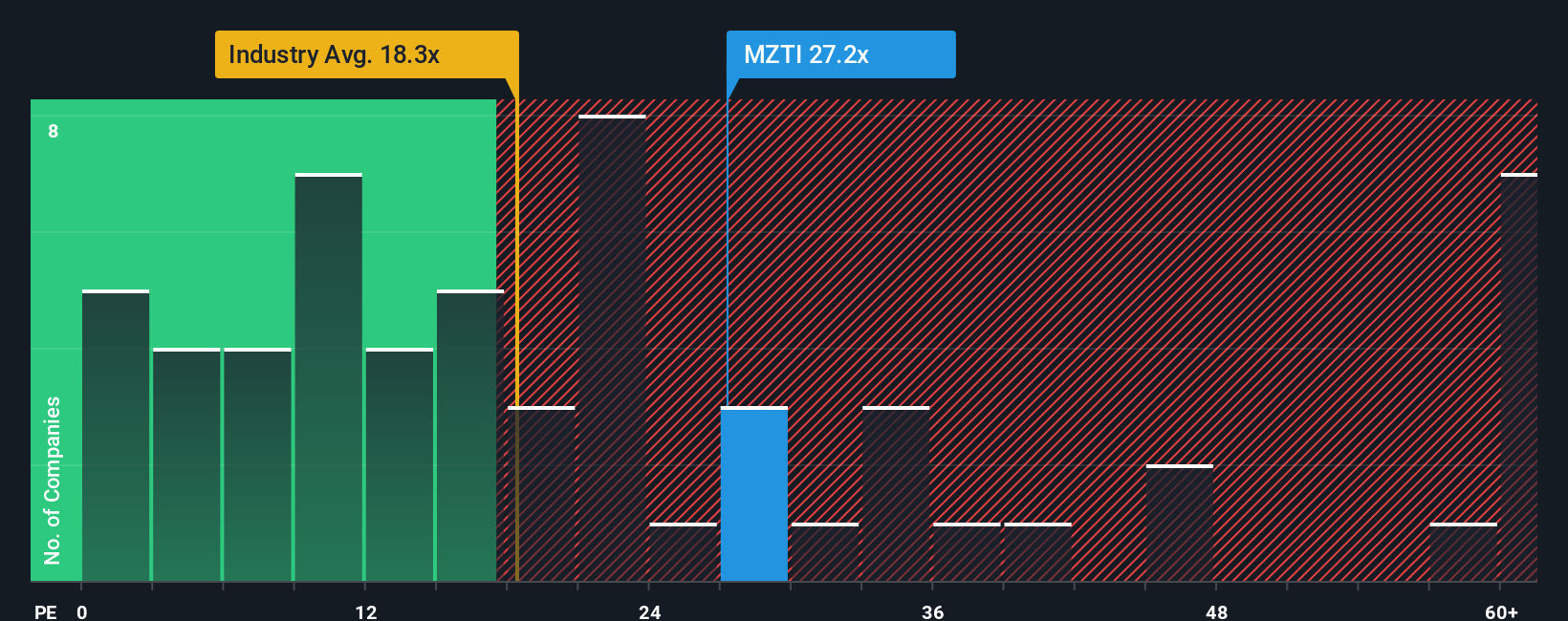

Looking from another angle, Marzetti’s current price-to-earnings ratio stands at 27.2 times earnings. That is not only above the US Food industry’s average of 18.1, but also well above our fair ratio estimate of 16.2. Compared with direct peers at 16.5, the premium is substantial. This suggests investors may be pricing in a lot of optimism and leaving little margin for error. Does this premium signal untapped opportunity, or does it simply raise the bar for what counts as good news going forward?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Marzetti Narrative

If you believe there’s a different story behind these numbers, or just want to dig into the details yourself, you can craft your own view in under three minutes: Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Marzetti.

Looking for More Investment Ideas?

Stay ahead of the curve by tapping into opportunities that others often miss. Smart investing means acting now, not later. Here’s where to start:

- Find rapid-growth companies shaping tomorrow by checking out these 25 AI penny stocks and see which firms are making serious moves in artificial intelligence.

- Secure your portfolio’s future income by reviewing these 18 dividend stocks with yields > 3% with high-yield potential that could boost your returns every year.

- Capitalize on unrealized bargains in the market with these 881 undervalued stocks based on cash flows handpicked for their strong cash flow and compelling value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MZTI

Marzetti

Engages in manufacturing and marketing of specialty food products for the retail and foodservice channels in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives