- United States

- /

- Beverage

- /

- NasdaqGS:MNST

Monster Beverage Shares Surge 33% in 2025 but Do the Numbers Tell a Different Story?

Reviewed by Bailey Pemberton

If you have been eyeing Monster Beverage stock lately, you are definitely not alone. Investors are weighing their options after a stretch of impressive gains, with the stock jumping 3.6% over the last week, 10.8% in the past month, and an eye-catching 33.1% since the start of the year. Over the last year Monster has climbed 35.7%, and if you zoom out a bit further, we are talking about a 59.3% rise over three years and 72.4% over five years. Numbers like these grab your attention, whether you are a long-term holder or considering a new position.

Behind these moves, Monster’s category-defining brand and expanding global footprint continue to resonate with the market. Some industry watchers have pointed to broader market optimism around consumer staples recently, but the company’s momentum also speaks to persistent demand for energy drinks and the company's knack for adapting to shifting trends.

But stock price isn’t the only story. In fact, it might be just the tip of the iceberg. With Monster currently scoring a 0 out of 6 on our valuation scorecard (meaning it is considered undervalued in none of the six major valuation checks), the question on investors’ minds is whether these gains reflect the true value of the company or if the stock is getting ahead of itself. Let's take a closer look at the most widely used valuation approaches to see what they reveal about Monster’s current price. Be sure to stay tuned, because at the end of this article there is a deeper look at how these numbers fit into the bigger investment picture.

Monster Beverage scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Monster Beverage Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a widely used approach to estimate a company's intrinsic value by forecasting its future free cash flows and discounting them back to today's value. This method provides perspective on what Monster Beverage might be worth based on the cash it is expected to generate in the years to come.

Currently, Monster Beverage’s annual free cash flow is $1.8 Billion. According to analyst estimates, this figure is projected to climb steadily over the next decade, reaching approximately $2.29 Billion by 2029. It is worth noting that while analysts typically supply estimates for up to five years, Simply Wall St extrapolates these cash flows further into the future to construct a more comprehensive long-term view.

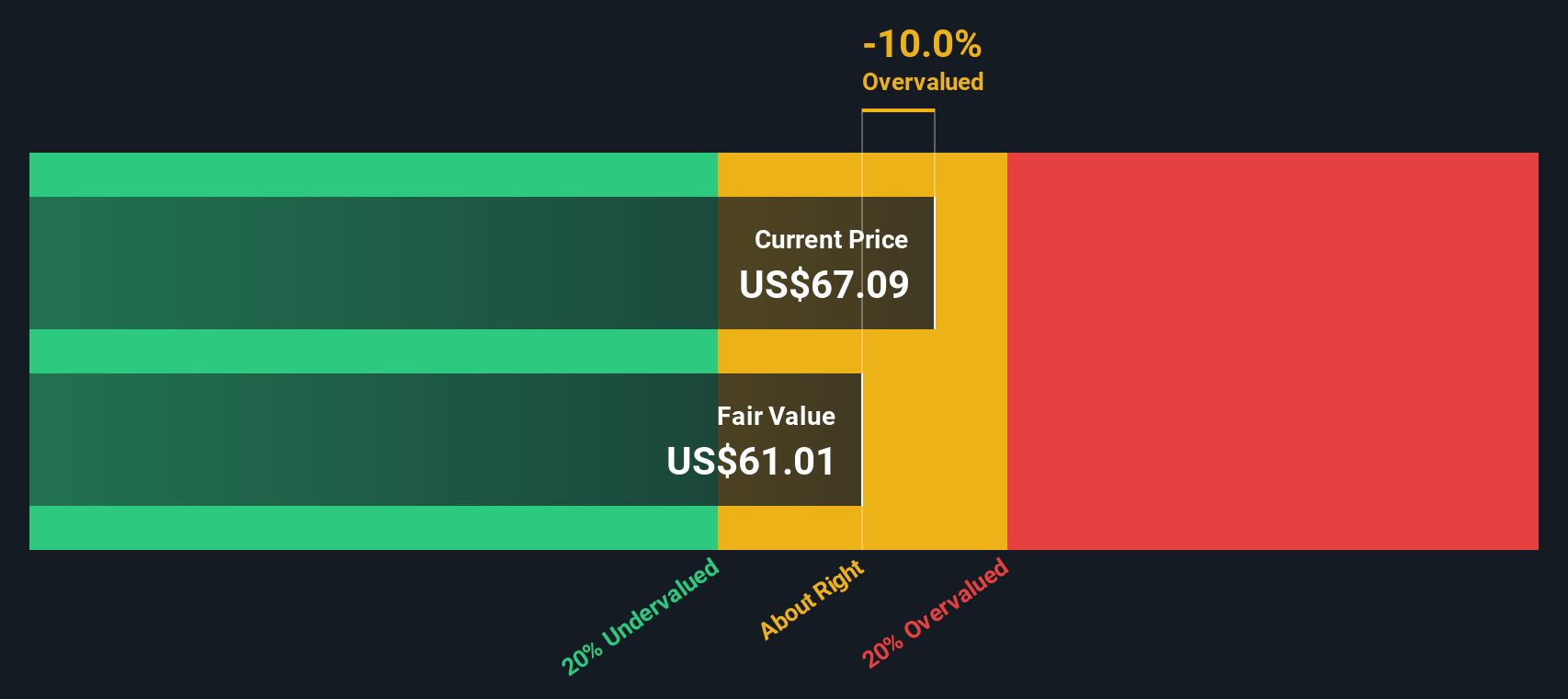

Based on this two-stage free cash flow to equity model, Monster Beverage’s estimated intrinsic value comes to $61.01 per share. However, when comparing this fair value to the current share price, the model suggests the stock is trading at a 14.1% premium, which implies the share price is higher than what the underlying cash flows justify at this point in time.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Monster Beverage may be overvalued by 14.1%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Monster Beverage Price vs Earnings

The Price-to-Earnings (PE) ratio is a time-tested way to value profitable companies like Monster Beverage. Since it compares a company's current share price to its earnings per share, it helps investors gauge what the market is willing to pay for each dollar of profit. For growing and established businesses, the PE ratio is a widely followed benchmark.

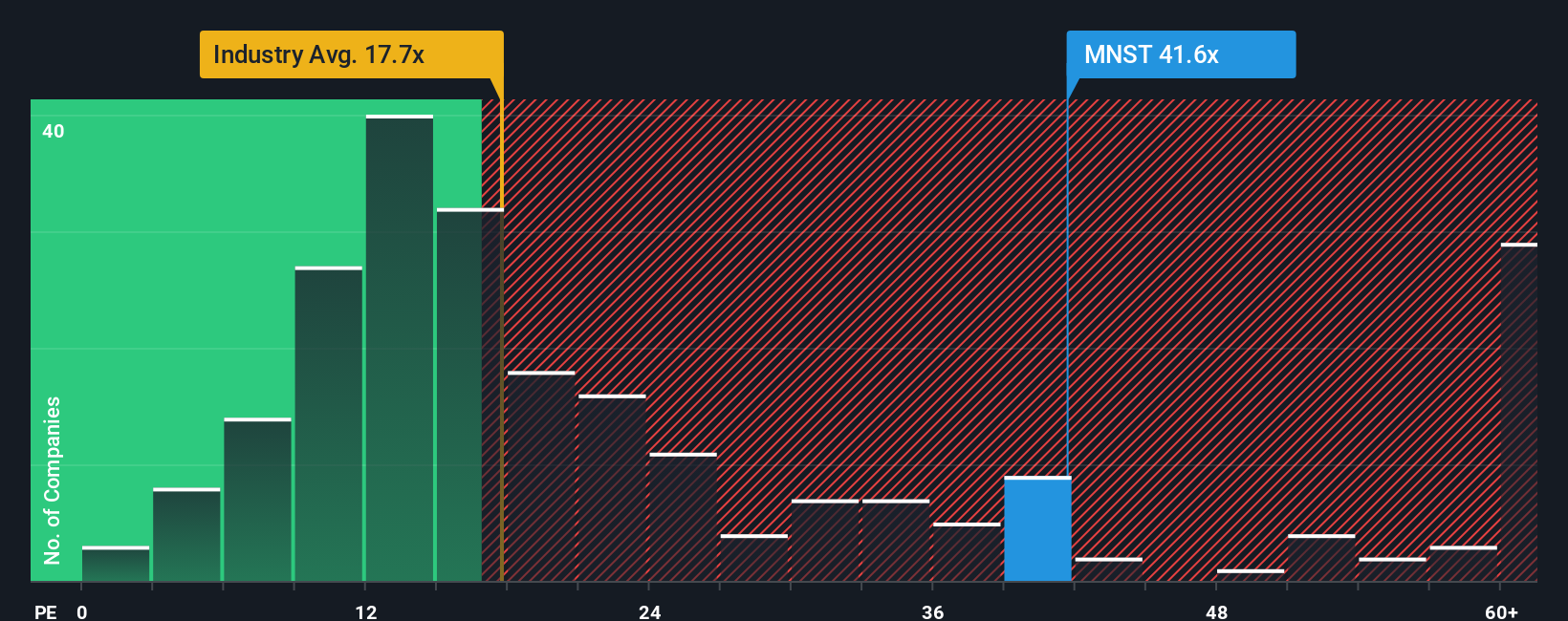

What counts as a “normal” or “fair” PE ratio is influenced by factors such as how quickly a company is growing and the risks it faces. Faster-growing and lower-risk companies tend to justify higher multiples. Monster Beverage currently trades on a PE ratio of 43.2x, which is notably higher than the Beverage industry average of 17.9x, and also surpasses its peer average of 21.8x. This premium indicates the market expects Monster’s earnings to grow at a much faster rate or sees it as less risky than the average competitor.

Simply Wall St’s proprietary “Fair Ratio” model estimates what a reasonable PE should be for Monster, taking into account not only its sector and size, but also its specific growth prospects, margins, and risk profile. These are elements that basic peer or industry comparisons can miss. For Monster, the Fair Ratio is calculated at 24.9x. Given Monster’s current PE of 43.2x is well above this level, the shares appear expensive relative to what is justified by the company’s fundamentals and anticipated growth.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Monster Beverage Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a dynamic and approachable tool that lets you shape a story—your personal perspective—about Monster Beverage by linking your assumptions about future revenue, earnings, and margins directly to a fair value calculation. Simply put, Narratives connect the company's business reality to financial forecasts, helping you turn your views, insights, and expectations into actionable investment decisions.

Narratives are available to everyone on Simply Wall St’s Community page, where millions of investors share their analyses. They empower you to make buy or sell calls by comparing the fair value generated from your Narrative to the current share price. Narratives are always up to date and automatically adjust when news, earnings reports, or business events are released.

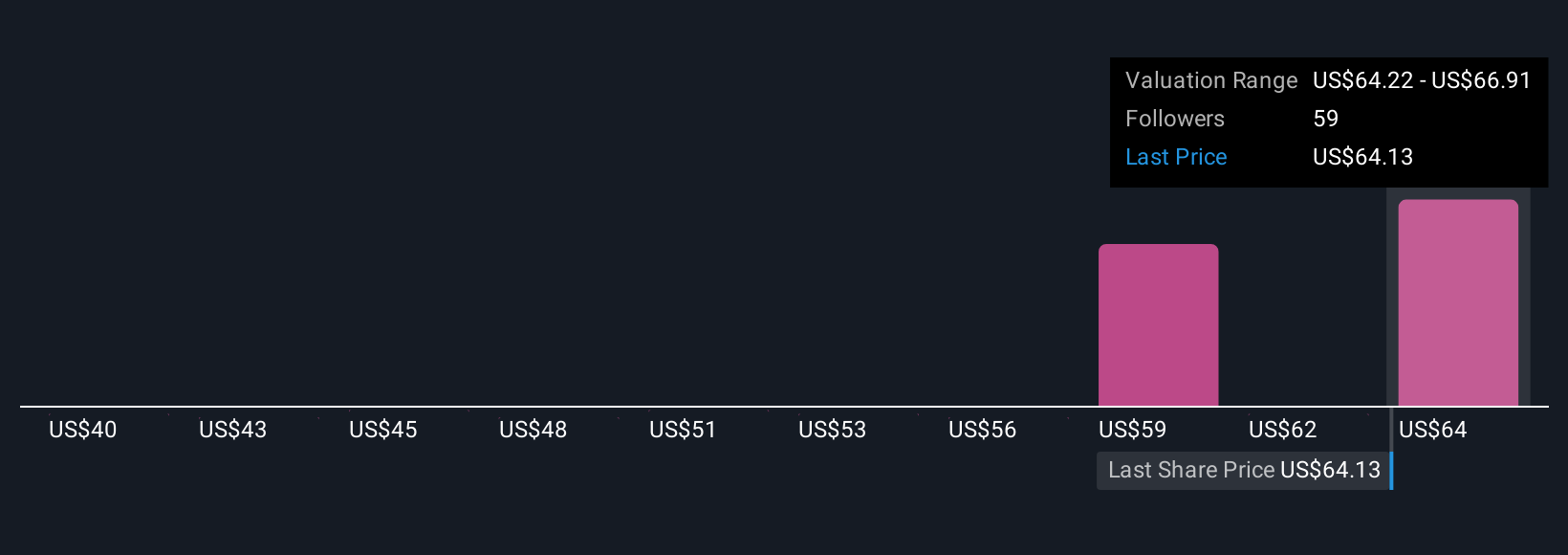

For Monster Beverage, investors using Narratives might reach very different conclusions. One Narrative, focused on international expansion and functional beverages, assumes robust 8.9% annual revenue growth and a $67.68 fair value. Another, more cautious Narrative assumes slower growth and a $50 fair value. Narratives help you make sense of the numbers through the lens of your unique perspective and give you the confidence to act when the price aligns with your story.

Do you think there's more to the story for Monster Beverage? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MNST

Monster Beverage

Through its subsidiaries, engages in development, marketing, sale, and distribution of energy drink beverages and concentrates in the United States and internationally.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives