- United States

- /

- Food

- /

- NasdaqGS:MDLZ

Mondelez International (NasdaqGS:MDLZ) Appoints Norberto Chaclin As EVP And Chief Research & Development Officer

Reviewed by Simply Wall St

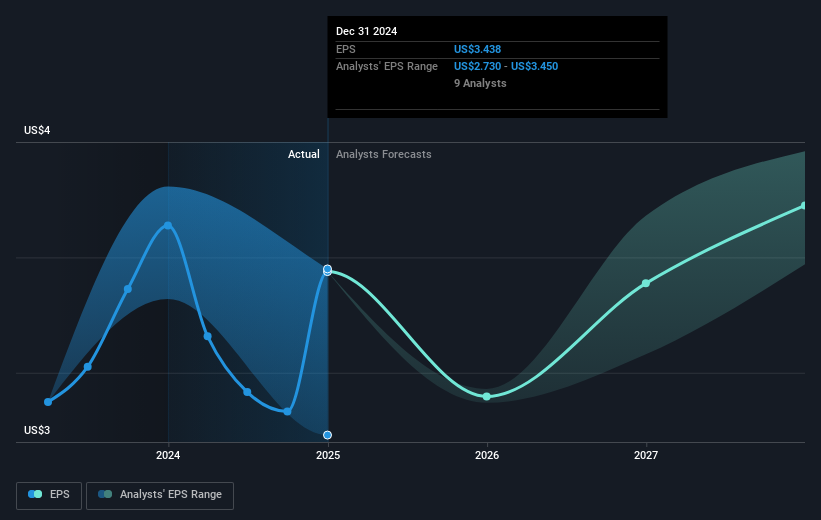

Mondelez International (NasdaqGS:MDLZ) recently experienced a 12% surge in its share price last month, coinciding with significant corporate and market events. The appointment of Norberto Chaclin as Executive Vice President and Chief Research & Development Officer could bolster investor confidence in the company's R&D capabilities, fueling this growth. Additionally, Mondelez's collaboration with Sargento to launch Sargento® Cheese Bakes and its new partnership with Inter Miami CF indicate an active strategy to expand its brand footprint and product offerings, appealing to snack-focused consumers. Market conditions, such as benign inflation data, boosted investor optimism, contributing to a market uptick despite overall monthly declines. This optimism helped offset the general market's 1% decline last week. Moreover, the company's robust Q4 earnings report further solidified its financial standing, demonstrating resilience amidst broader economic concerns. In an environment where many tech stocks faced pressure, Mondelez's momentum points to strong adaptability and strategic positioning within the snacking industry.

Click here to discover the nuances of Mondelez International with our detailed analytical report.

Over the past five years, Mondelez International's total shareholder return, including share price and dividends, was 29.76%. This performance reflects various strategic decisions and market conditions impacting the company's long-term trajectory. A key development was its partnership with Lotus Bakeries, enhancing the Lotus Biscoff brand's presence in India, potentially broadening Mondelez's market reach. Additionally, Mondelez affirmed its commitment to shareholder returns with consistent quarterly dividends, most recently awarded at US$0.47 per share in early 2025.

In terms of financials, Mondelez reported Q4 2024 sales of US$9.6 billion, affirming robust performance. The company also repurchased 19.52 million shares between October and December 2024, underlining its commitment to returning value to shareholders. However, these efforts come amid a year in which Mondelez underperformed compared to the wider US Food industry and US Market, with the company's stock not keeping pace with general market gains, highlighting challenges despite its steady growth strategy.

- Analyze Mondelez International's fair value against its market price in our detailed valuation report—access it here.

- Understand the uncertainties surrounding Mondelez International's market positioning with our detailed risk analysis report.

- Are you invested in Mondelez International already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Mondelez International, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MDLZ

Mondelez International

Through its subsidiaries, manufactures, markets, and sells snack food and beverage products in the Latin America, North America, Asia, the Middle East, Africa, and Europe.

Established dividend payer and fair value.