- United States

- /

- Tobacco

- /

- NasdaqCM:ISPR

Ispire Technology Inc.'s (NASDAQ:ISPR) Shares Leap 27% Yet They're Still Not Telling The Full Story

Ispire Technology Inc. (NASDAQ:ISPR) shares have had a really impressive month, gaining 27% after a shaky period beforehand. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 59% share price drop in the last twelve months.

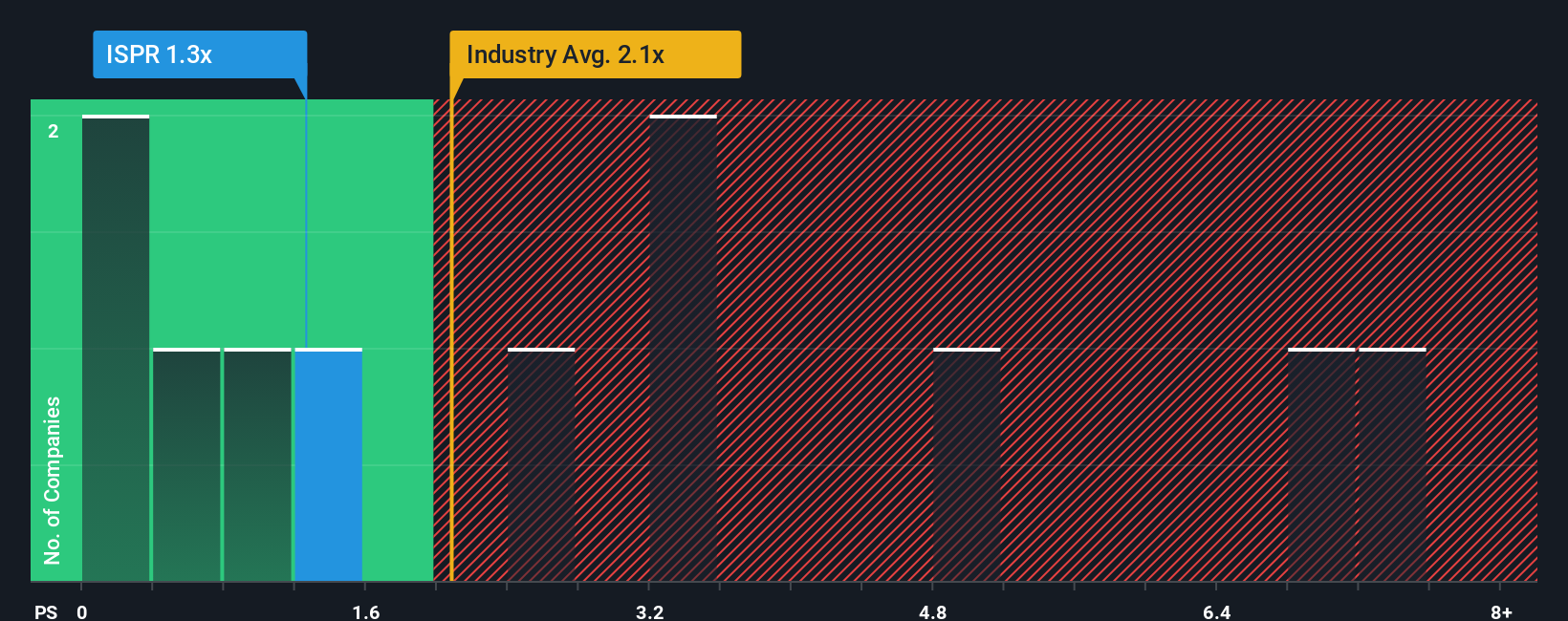

In spite of the firm bounce in price, it's still not a stretch to say that Ispire Technology's price-to-sales (or "P/S") ratio of 1.3x right now seems quite "middle-of-the-road" compared to the Tobacco industry in the United States, where the median P/S ratio is around 0.8x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Ispire Technology

What Does Ispire Technology's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Ispire Technology's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Ispire Technology.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Ispire Technology's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 1.7% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 64% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Shifting to the future, estimates from the one analyst covering the company suggest revenue growth will be highly resilient over the next year growing by 30%. That would be an excellent outcome when the industry is expected to decline by 1.2%.

With this in mind, we find it intriguing that Ispire Technology's P/S trades in-line with its industry peers. It looks like most investors aren't convinced the company can achieve positive future growth in the face of a shrinking broader industry.

The Final Word

Ispire Technology's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Ispire Technology currently trades on a lower than expected P/S since its growth forecasts are potentially beating a struggling industry. We assume that investors are attributing some risk to the company's future revenues, keeping it from trading at a higher P/S. Perhaps there is some hesitation about the company's ability to keep swimming against the current of the broader industry turmoil. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

There are also other vital risk factors to consider and we've discovered 2 warning signs for Ispire Technology (1 is a bit concerning!) that you should be aware of before investing here.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:ISPR

Ispire Technology

Researches, develops, designs, commercializes, sells, markets, and distributes e-cigarettes and cannabis vaping products worldwide under the Ispire and Aspire brands.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives