- United States

- /

- Consumer Services

- /

- NasdaqGM:HERE

US Undiscovered Gems to Watch in November 2025

Reviewed by Simply Wall St

In the wake of a robust Black Friday session, U.S. markets are experiencing their best week since June, with major indices like the Dow Jones and S&P 500 showing notable gains despite recent tech outages. As investors navigate these dynamic conditions, identifying promising small-cap stocks becomes crucial for those looking to capitalize on potential growth opportunities in a fluctuating market environment.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| First Bancorp | 57.63% | 1.47% | -2.43% | ★★★★★★ |

| Southern Michigan Bancorp | 113.59% | 8.48% | 3.73% | ★★★★★★ |

| Morris State Bancshares | 1.99% | 2.14% | 1.63% | ★★★★★★ |

| Tri-County Financial Group | 102.20% | -2.69% | -15.63% | ★★★★★★ |

| Affinity Bancshares | 43.06% | 2.84% | 3.44% | ★★★★★★ |

| Metalpha Technology Holding | NA | 75.66% | 28.60% | ★★★★★★ |

| FineMark Holdings | 115.37% | 2.22% | -28.34% | ★★★★★★ |

| Pure Cycle | 4.76% | 6.42% | -1.58% | ★★★★★☆ |

| FRMO | 0.10% | 35.28% | 40.61% | ★★★★★☆ |

| Union Bankshares | 369.65% | 1.12% | -7.45% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Here Group (HERE)

Simply Wall St Value Rating: ★★★★★☆

Overview: Here Group Limited, with a market cap of CN¥293.13 million, operates in China where it focuses on designing and selling pop toys.

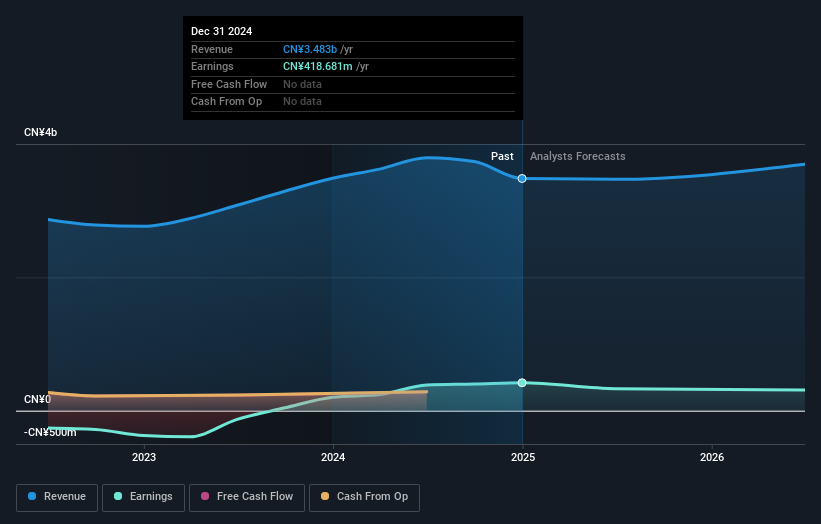

Operations: Here Group generates revenue primarily from three segments: Learning Service and Others (CN¥2.45 billion), Consumer Business (CN¥213.20 million), and Pop Toy Business (CN¥65.78 million).

Here Group, previously known as QuantaSing Group, has been navigating a strategic shift towards high-quality growth and cost efficiency. Despite facing a 7% earnings dip last year, the company is expanding into the wellness sector with products aimed at seniors. This move offers promising diversification but comes with execution risks. The firm reported CNY 617.84 million in sales for Q4 2025, down from CNY 1 billion the previous year, while net income was CNY 110.14 million compared to CNY 196.61 million earlier. Recently, Here repurchased shares worth $5 million and trades at about 31% below its estimated fair value.

Calavo Growers (CVGW)

Simply Wall St Value Rating: ★★★★★★

Overview: Calavo Growers, Inc. is a company that markets and distributes avocados and other perishable foods globally to various retail and wholesale customers, with a market cap of $362.42 million.

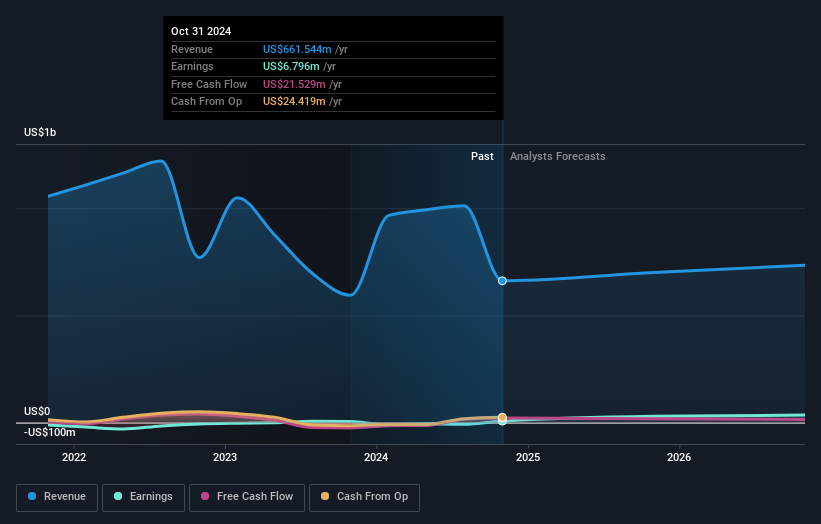

Operations: Calavo Growers generates revenue primarily from its Fresh segment, which accounts for $624.93 million, and its Prepared segment, contributing $68.78 million.

Calavo Growers, a nimble player in the food industry, has seen impressive earnings growth of 192.8% over the past year, outpacing its sector's 4.6%. With no debt on its books now compared to a debt-to-equity ratio of 9.1% five years ago, financial health seems robust. Despite trading at 56.4% below estimated fair value, it boasts high-quality earnings and positive free cash flow. Recent leadership changes include B. John Lindeman stepping up as CEO from December 8, 2025, following Lee E. Cole's retirement—a move that might influence strategic direction and future performance positively or negatively depending on execution.

- Click here and access our complete health analysis report to understand the dynamics of Calavo Growers.

Gain insights into Calavo Growers' past trends and performance with our Past report.

China Yuchai International (CYD)

Simply Wall St Value Rating: ★★★★★☆

Overview: China Yuchai International Limited manufactures, assembles, and sells diesel and natural gas engines for various applications including trucks, buses, construction equipment, and marine uses with a market cap of approximately $1.33 billion.

Operations: The company generates revenue primarily from the sale of diesel and natural gas engines used in trucks, buses, construction equipment, and marine applications. It focuses on manufacturing and assembly operations to support its diverse product offerings.

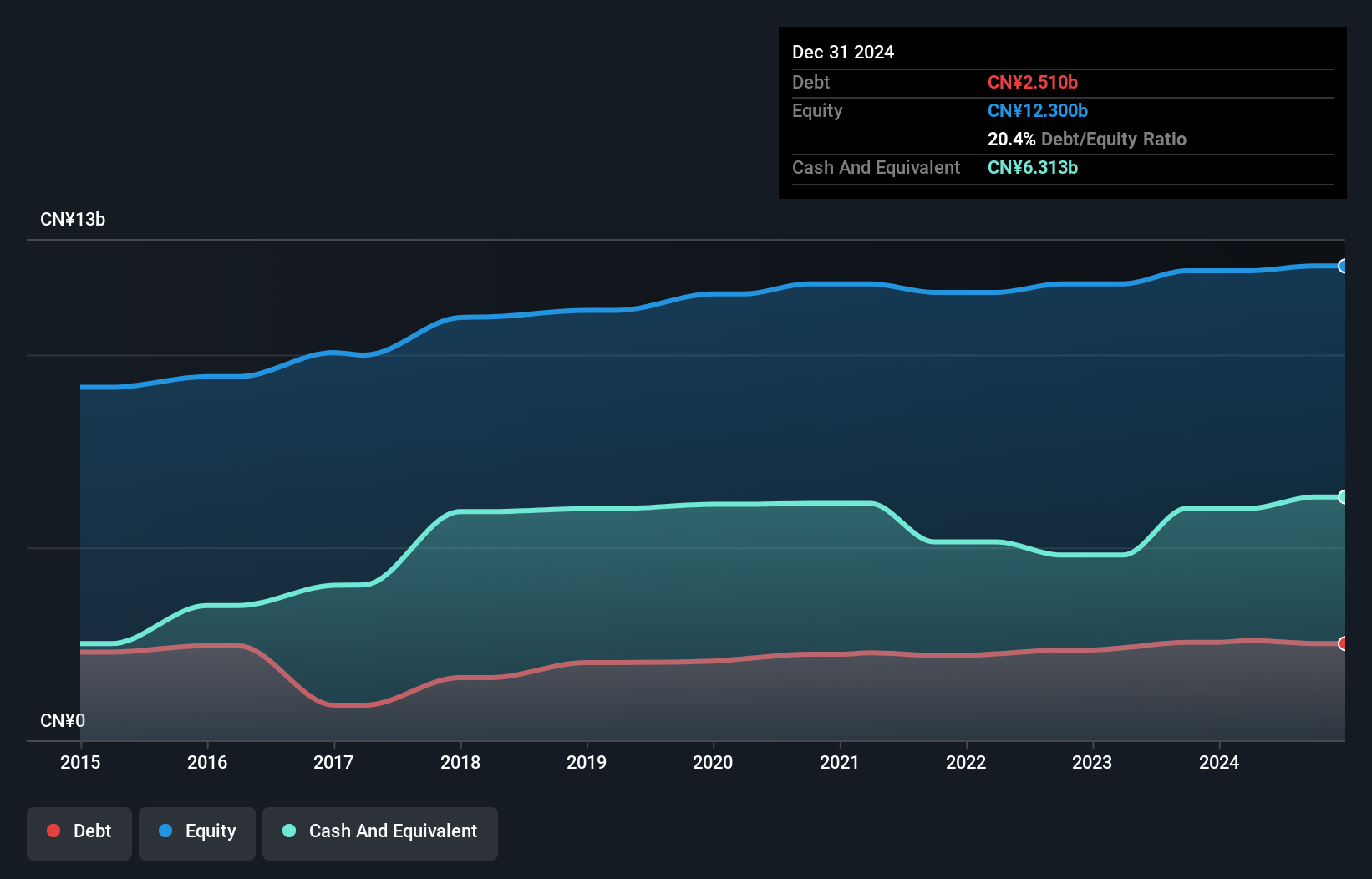

China Yuchai International, a key player in diesel and natural gas engines, navigates a challenging market with both opportunities and hurdles. The firm has seen earnings growth of 29% over the past year, outpacing the Machinery industry which saw a 2.5% negative growth. Despite trading at about 80% below its fair value estimate, its debt to equity ratio rose from 18% to nearly 21% over five years. While strong cash flow and strategic partnerships offer resilience against the backdrop of shifting towards electric powertrains, potential investors should weigh these dynamics carefully given current market valuations may not fully reflect future earnings expectations.

Next Steps

- Embark on your investment journey to our 296 US Undiscovered Gems With Strong Fundamentals selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Here Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:HERE

Undervalued with excellent balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026