- United States

- /

- Beverage

- /

- NasdaqGS:COKE

We Ran A Stock Scan For Earnings Growth And Coca-Cola Consolidated (NASDAQ:COKE) Passed With Ease

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Coca-Cola Consolidated (NASDAQ:COKE). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for Coca-Cola Consolidated

Coca-Cola Consolidated's Improving Profits

Coca-Cola Consolidated has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. Thus, it makes sense to focus on more recent growth rates, instead. Coca-Cola Consolidated's EPS skyrocketed from US$35.23 to US$48.11, in just one year; a result that's bound to bring a smile to shareholders. That's a commendable gain of 37%.

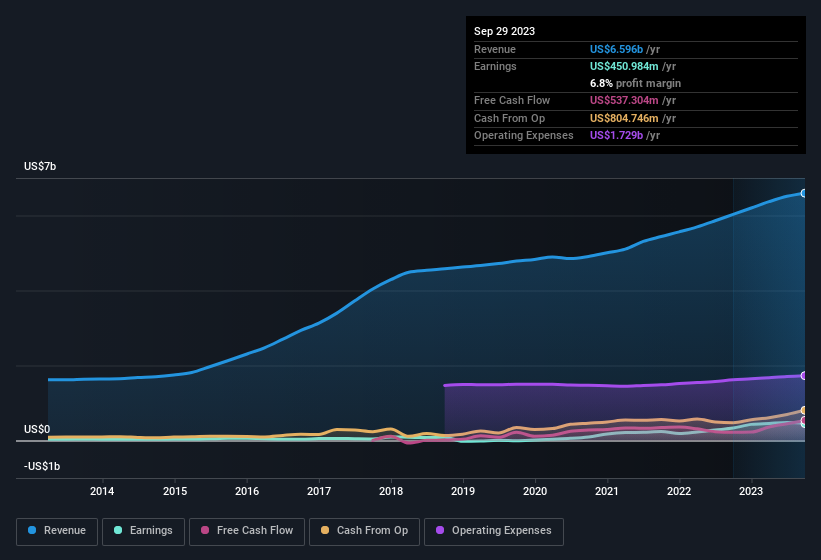

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The good news is that Coca-Cola Consolidated is growing revenues, and EBIT margins improved by 3.2 percentage points to 12%, over the last year. Ticking those two boxes is a good sign of growth, in our book.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Coca-Cola Consolidated's balance sheet strength, before getting too excited.

Are Coca-Cola Consolidated Insiders Aligned With All Shareholders?

Since Coca-Cola Consolidated has a market capitalisation of US$7.9b, we wouldn't expect insiders to hold a large percentage of shares. But thanks to their investment in the company, it's pleasing to see that there are still incentives to align their actions with the shareholders. Notably, they have an enviable stake in the company, worth US$1.4b. That equates to 18% of the company, making insiders powerful and aligned with other shareholders. Looking very optimistic for investors.

Should You Add Coca-Cola Consolidated To Your Watchlist?

You can't deny that Coca-Cola Consolidated has grown its earnings per share at a very impressive rate. That's attractive. With EPS growth rates like that, it's hardly surprising to see company higher-ups place confidence in the company through continuing to hold a significant investment. Fast growth and confident insiders should be enough to warrant further research, so it would seem that it's a good stock to follow. However, before you get too excited we've discovered 1 warning sign for Coca-Cola Consolidated that you should be aware of.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in the US with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:COKE

Coca-Cola Consolidated

Manufactures, markets, and distributes nonalcoholic beverages primarily products of The Coca-Cola Company in the United States.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives