- United States

- /

- Beverage

- /

- NasdaqGS:COCO

Could Vita Coco’s (COCO) Athlete-Driven Push Signal a New Era in Sports Drink Competition?

Reviewed by Simply Wall St

- Earlier this month, Vita Coco launched its "Major League Hydration" campaign, featuring endorsements from elite athletes across football, tennis, golf, soccer, and pickleball, who cite its naturally sourced electrolytes as their preferred performance fuel over conventional sports drinks.

- This campaign positions Vita Coco as both a natural hydration leader and a direct competitor to traditional sports beverage brands, reflecting a push to capture health-conscious markets through athlete-driven marketing.

- We’ll explore how these headline athlete endorsements may reinforce Vita Coco’s brand positioning and growth outlook within its investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Vita Coco Company Investment Narrative Recap

To be a Vita Coco shareholder, you need to believe in the company’s ability to grow as a health-conscious beverage leader, expanding beyond coconut water through targeted marketing and innovation. The “Major League Hydration” campaign strengthens Vita Coco’s brand position among athletes and health-focused consumers, but its impact on near-term results is unlikely to outweigh the ongoing risks from volatile freight costs, which remain the most significant challenge to margins in the short term.

One of the most relevant recent developments is Vita Coco's raised full-year 2025 net sales guidance to between US$565 million and US$580 million, fueled in part by targeted marketing efforts and product rollouts. This higher forecast ties directly to catalysts around increased coconut water penetration and efforts to accelerate branded growth, even as freight and tariff risks persist.

However, investors should also be aware that, despite new campaign momentum, freight volatility remains a persistent headwind that may affect future results if...

Read the full narrative on Vita Coco Company (it's free!)

Vita Coco Company's narrative projects $755.8 million revenue and $103.0 million earnings by 2028. This requires 10.5% yearly revenue growth and a $38.6 million earnings increase from $64.4 million.

Uncover how Vita Coco Company's forecasts yield a $41.56 fair value, a 8% upside to its current price.

Exploring Other Perspectives

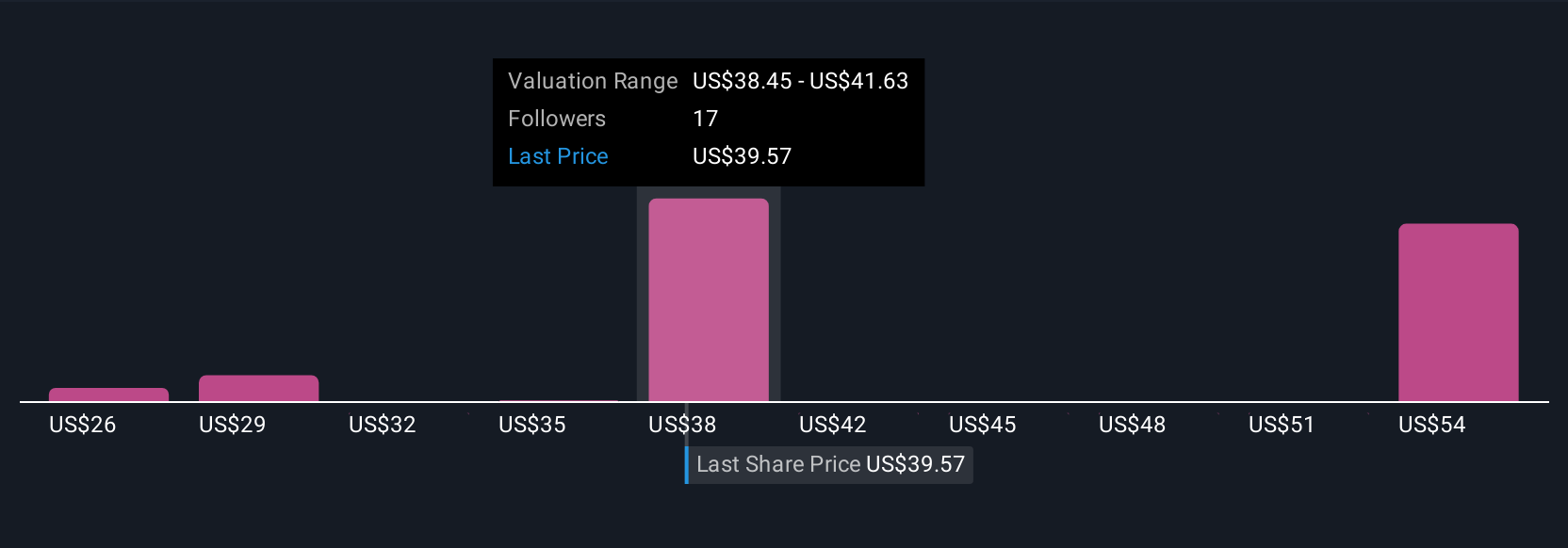

Six fair value estimates from the Simply Wall St Community range widely, from US$25.73 to US$57.52 per share. While some see upside, ongoing gross margin pressures linked to unpredictable freight costs could make a material difference to future returns, readers can compare these contrasting viewpoints to inform their own perspectives.

Explore 6 other fair value estimates on Vita Coco Company - why the stock might be worth 33% less than the current price!

Build Your Own Vita Coco Company Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vita Coco Company research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Vita Coco Company research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Vita Coco Company's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 29 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COCO

Vita Coco Company

Develops, markets, and distributes coconut water products under the Vita Coco brand name in the United States, Canada, Europe, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives