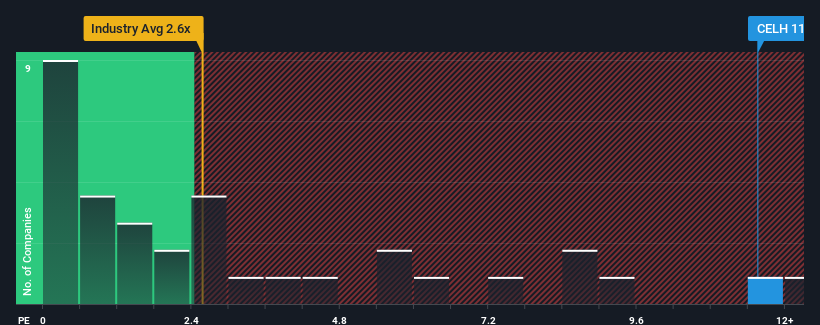

Celsius Holdings, Inc.'s (NASDAQ:CELH) price-to-sales (or "P/S") ratio of 11.6x may look like a poor investment opportunity when you consider close to half the companies in the Beverage industry in the United States have P/S ratios below 2.6x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Celsius Holdings

How Celsius Holdings Has Been Performing

Recent times have been advantageous for Celsius Holdings as its revenues have been rising faster than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Celsius Holdings' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Celsius Holdings' to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 98% last year. This great performance means it was also able to deliver immense revenue growth over the last three years. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 31% per annum over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 5.7% each year, which is noticeably less attractive.

In light of this, it's understandable that Celsius Holdings' P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Celsius Holdings' P/S Mean For Investors?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look into Celsius Holdings shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Celsius Holdings (1 is a bit concerning!) that you need to be mindful of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:CELH

Celsius Holdings

Develops, processes, markets, distributes, and sells functional energy drinks and liquid supplements in the United States, Australia, New Zealand, Canadian, European, Middle Eastern, Asia-Pacific, and internationally.

Flawless balance sheet with high growth potential.