- United States

- /

- Food

- /

- NasdaqGS:BYND

Taking Stock of Beyond Meat (BYND) After Its Steep Share Price Slide

Reviewed by Simply Wall St

Assessing Beyond Meat after a steep slide

Beyond Meat (BYND) shares keep grinding lower, recently closing near 1 dollar, and that kind of drop naturally raises the question: is this a value opportunity or a value trap for patient investors?

See our latest analysis for Beyond Meat.

The latest slide to around 1.09 dollars caps a brutal stretch, with a roughly 72 percent 1 year total shareholder return loss and even steeper multiyear declines in the share price return, signaling fading momentum and rising skepticism about a turnaround.

If Beyond Meat's struggles have you rethinking your watchlist, this could be the right moment to look for more resilient consumer names or fast growing stocks with high insider ownership that might better align with your risk appetite.

To answer that, investors need to weigh Beyond Meat's beaten down valuation against its shrinking revenues and persistent losses, and ask whether this slump hides a contrarian buying opportunity or simply reflects markets already discounting future growth.

Most Popular Narrative Narrative: 32.3% Undervalued

With Beyond Meat last closing at 1.09 dollars versus a narrative fair value of 1.61 dollars, the story hinges on a demanding profitability turnaround.

Continued emphasis on manufacturing cost reduction and operational right sizing, aided by the newly appointed Interim Chief Transformation Officer, supports a path to structurally lower costs of goods sold and enhanced fixed cost absorption, directly improving gross and net margins.

Curious how flat revenues, rising margins, and a future earnings multiple are meant to coexist in a shrinking category, all under an 8.3 percent discount rate? The most followed narrative lays out a detailed path from deep losses today to positive earnings, higher margins, and a valuation multiple that still undercuts the wider Food sector. Want to see exactly which financial levers have to click into place for that upside to materialize? Read on to unpack the full blueprint behind that 1.61 dollar fair value.

Result: Fair Value of $1.61 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in plant based demand and heavy debt related dilution could still derail any hoped for margin recovery and valuation re rating.

Find out about the key risks to this Beyond Meat narrative.

Another View, Sales Based Valuation Looks Much Less Forgiving

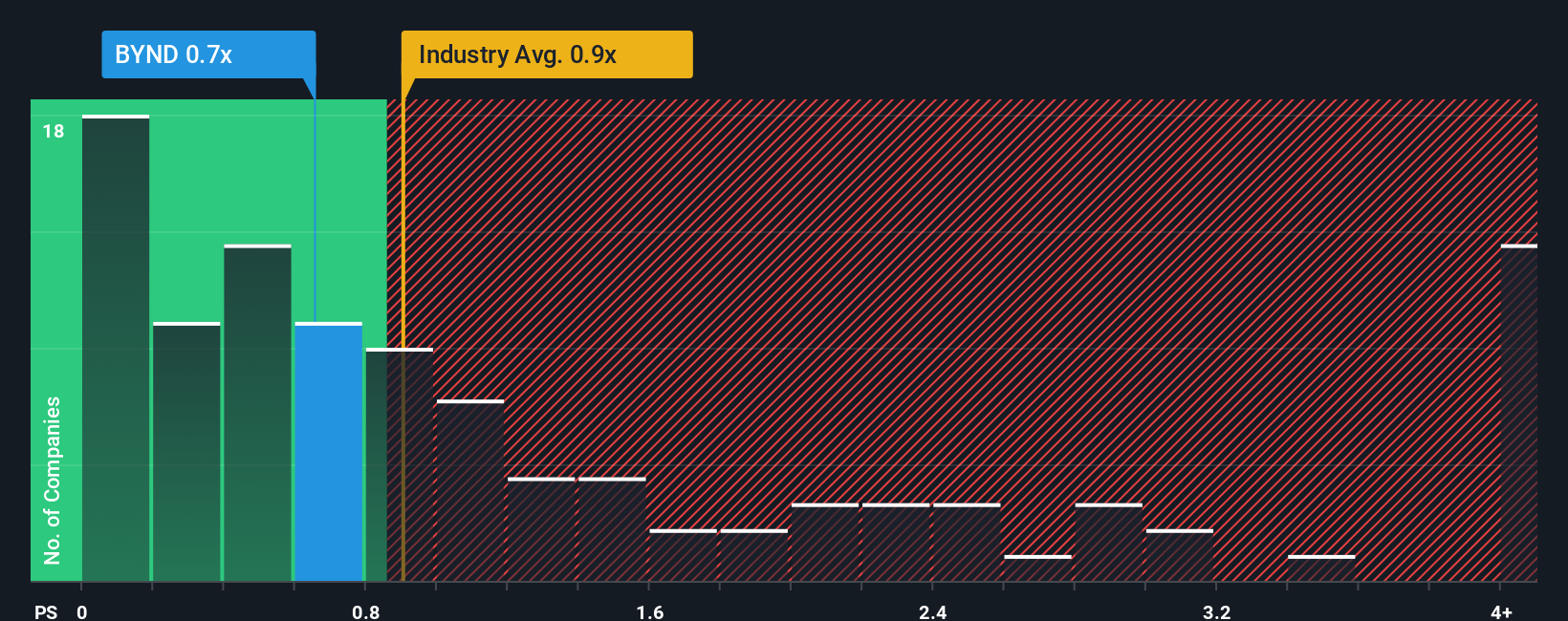

While the narrative fair value hints at upside, a simple sales based check tells a harsher story. Beyond Meat trades on a price to sales ratio of about 1.7 times versus 0.7 times for both the US Food industry and its peers, which is well above a 0.7 times fair ratio. If the market drifts back toward that fair ratio, today’s price could still be exposed. Which version of value do you trust more, the story or the simple math?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Beyond Meat Narrative

If you are unconvinced by this framing or prefer to dig into the numbers yourself, you can build a custom view in minutes: Do it your way.

A great starting point for your Beyond Meat research is our analysis highlighting 4 important warning signs that could impact your investment decision.

Ready for your next investing move?

Put this research to work by scanning fresh opportunities on Simply Wall St, where targeted screeners surface ideas you might regret missing later.

- Capture potential bargains early by reviewing these 907 undervalued stocks based on cash flows that our models flag as trading below their estimated intrinsic value.

- Position yourself for innovation led growth by checking out these 26 AI penny stocks shaping the future of automation, data, and intelligent software.

- Strengthen your income stream by focusing on these 13 dividend stocks with yields > 3% that pair attractive yields with solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Beyond Meat might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BYND

Beyond Meat

A plant-based meat company, engages in the development, manufacture, marketing, and sale of plant-based meat products under the Beyond brand name in the United States and internationally.

Slight risk with imperfect balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)