- United States

- /

- Food

- /

- NasdaqGS:BYND

Beyond Meat, Tesla and British American Tobacco: Our lukewarm take on recent earnings and news

Reviewed by Michael Paige

(“What’s a lukewarm take?” you ask – well, it’s definitely not a hot take – we would like to think it’s a more considered, insightful, and useful take on the news.)

Beyond Meat gets squeezed

Beyond Meat’s ( Nasdaq: BYND ) share price rose 14% in the last two sessions while the rest of the market fell. It’s also up nearly 30% since late November. With no notable news flow, It seems the stock, which has a short float of about 42%, has been caught up in a short squeeze.

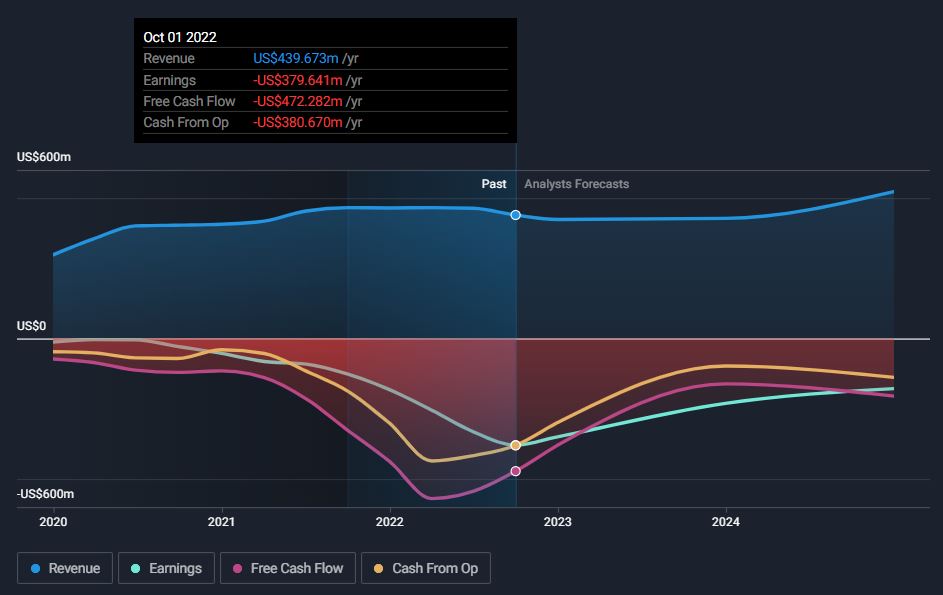

Our take : Beyond’s third-quarter earnings were better than hoped, but the company is still in a dire position. Negative cash flow for the last 12 months is higher than revenue (the margin is -107%) and the net income margin is -86%. Based on current analyst forecasts the company will still be some way off profitability in 2026.

In the meantime, the company will need to raise cash to cover ongoing losses and to shore up its balance sheet.

If there is a bullish scenario it must be the potential for Beyond Meat to be acquired - not that there seem to be any offers on the table. And, if there was an offer the price might not be any higher than the current share price.

Stock prices can run a long way when short positions are squeezed and short interest is high, but they typically retrace just as quickly.

Tesla - Approaching value territory?

Tesla’s ( Nasdaq: TSLA ) share price continues to slide on reports of production cuts at its Shanghai factory. Tesla itself hasn’t confirmed the story and sold a record 100,291 China-made vehicles in November. Whether the demand is falling or not, the stock price which is 58% off its high remains under pressure. The company’s price-to-earnings ratio is also the lowest its been since the company first reported a profit.

Our take: Tesla’s outlook is becoming less clear, but the valuation could soon attract investors who pay more attention to value. So what would a reasonable valuation be, assuming earnings growth is within the range projected by analysts?

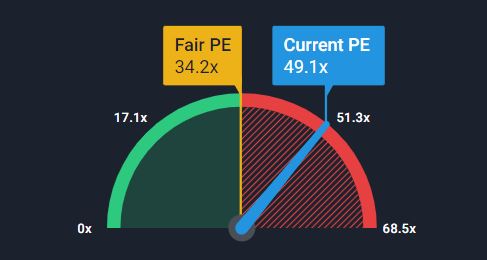

The current P/E, assuming full-year EPS is about $4 is 43x. That looks very low if the recent growth rate continues. But analysts are already expecting quite a sharp slowdown.

If we average all the EPS estimates from analysts polled by S&P Global we see expected growth of 42% in 2023 and 32% a year out to December 2024. That puts the forward multiples at 31x for 2023 and 27x for 2024. Those multiples probably look low - but might not seem as low if growth was decelerating that quickly.

The Simply Wall Street DCF model (which uses the same EPS estimates), puts the estimated fair value at $156, about 9% below the current price.

Simply Wall Street’s Fair P/E ratio is 34.2x, which implies a stock price of $140. The fair P/E approximates the expected P/E ratio by accounting for earnings growth forecasts, profit margins, and risk factors. A price of $140 would in turn imply a discount of 11% to the DCF estimate above - ie. a fairly small margin of safety.

The bottom line is that the current price probably isn’t low enough to offer a decent margin of safety - but ultimately this will all depend on how EPS growth actually plays out.

British American Tobacco - all about the dividend

British American Tobacco ( LSE: BATS ) released a trading update on Thursday. The company said it expects revenue growth of 2 to 4 percent at constant currency rates for the full year and, and that diluted EPS would be up in the mid-single digits.

BAT is moving its focus to non-combustible (vape) products, but the bulk of its revenue still comes from traditional tobacco products. It will be a while before the new category can really move the needle, and in the meantime, the company operates in an industry in decline in many countries. Revenues have increased by around 4% a year over the last decade and earnings haven’t done much better.

Our take: While BAT doesn’t offer investors much in the way of growth, it does offer dividends. With a steady net income margin of 20%, its been able to steadily increase its dividend and yield, which is now approaching 7%. The cash payout ratio is 49%, so it is pretty well covered too.

Valuation is complex, but we're here to simplify it.

Discover if Beyond Meat might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.

About NasdaqGS:BYND

Beyond Meat

A plant-based meat company, engages in the development, manufacture, marketing, and sale of plant-based meat products under the Beyond brand name in the United States and internationally.

Moderate risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives