- United States

- /

- Oil and Gas

- /

- NYSEAM:REI

Will Ring Energy's (REI) Debt Reduction Shift Its Strategic Direction or Reinforce Discipline?

Reviewed by Sasha Jovanovic

- Ring Energy, Inc. recently reported mixed fiscal second quarter results and announced plans to reduce its debt by approximately US$18 million during the third quarter.

- Analysts maintained strong positive sentiment on the company following these announcements, highlighting confidence in Ring Energy's ongoing financial management and operational adjustments.

- We'll examine how Ring Energy's renewed debt reduction strategy may alter the company's investment narrative and future outlook.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Ring Energy Investment Narrative Recap

Ring Energy attracts shareholders who see value in disciplined cost management and efficient production from mature assets, even as the company faces the challenges of high leverage and commodity price cycles. The recently announced US$18 million debt reduction plan in Q3 2025 directly targets the most pressing short-term risk, balance sheet strength, yet rising debt costs and production decline risk still loom; this news helps but does not fully resolve core issues.

Of the recent announcements, the debt reduction strategy is most relevant. By prioritizing balance sheet improvement over rapid production growth, Ring Energy is working to address the upper-end leverage concerns identified by analysts and investors, which remains the critical short-term variable influencing both downside risk and potential future upside.

However, investors should also be aware that, despite these positives, ongoing structural pricing pressures and dependency on mature assets mean that...

Read the full narrative on Ring Energy (it's free!)

Ring Energy's narrative projects $395.2 million in revenue and $31.2 million in earnings by 2028. This requires 7.4% yearly revenue growth and a $38.1 million decrease in earnings from the current $69.3 million.

Uncover how Ring Energy's forecasts yield a $2.50 fair value, a 123% upside to its current price.

Exploring Other Perspectives

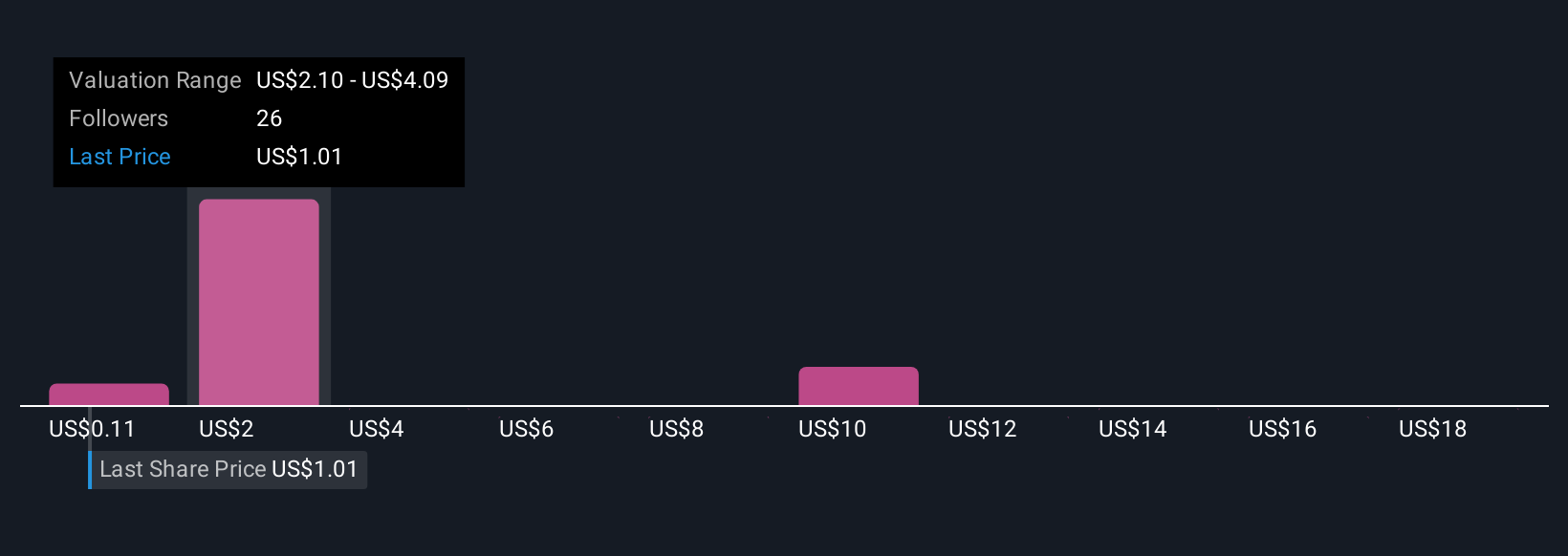

Twelve members of the Simply Wall St Community estimated Ring Energy’s fair value from just US$0.11 up to US$530.48 per share, reflecting striking variance among private investors. Given this, the company’s significant debt reduction goals may be seen very differently by each participant, highlighting the importance of exploring a spectrum of views before considering any position in Ring Energy.

Explore 12 other fair value estimates on Ring Energy - why the stock might be a potential multi-bagger!

Build Your Own Ring Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ring Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Ring Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ring Energy's overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:REI

Ring Energy

An independent oil and natural gas company, engages in the acquisition, exploration, development, and production of oil and natural gas properties.

Undervalued with acceptable track record.

Similar Companies

Market Insights

Community Narratives