- United States

- /

- Oil and Gas

- /

- NYSEAM:REI

The Ring Energy, Inc. (NYSEMKT:REI) Analysts Have Been Trimming Their Sales Forecasts

The analysts covering Ring Energy, Inc. (NYSEMKT:REI) delivered a dose of negativity to shareholders today, by making a substantial revision to their statutory forecasts for this year. There was a fairly draconian cut to their revenue estimates, perhaps an implicit admission that previous forecasts were much too optimistic.

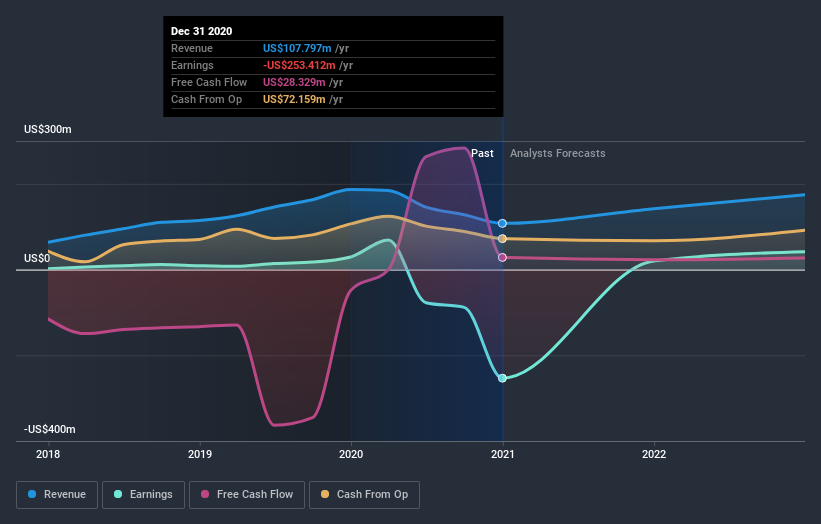

After the downgrade, the four analysts covering Ring Energy are now predicting revenues of US$128m in 2021. If met, this would reflect a meaningful 18% improvement in sales compared to the last 12 months. Before the latest update, the analysts were foreseeing US$142m of revenue in 2021. It looks like forecasts have become a fair bit less optimistic on Ring Energy, given the substantial drop in revenue estimates.

Check out our latest analysis for Ring Energy

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Ring Energy's past performance and to peers in the same industry. It's pretty clear that there is an expectation that Ring Energy's revenue growth will slow down substantially, with revenues to the end of 2021 expected to display 18% growth on an annualised basis. This is compared to a historical growth rate of 34% over the past five years. By way of comparison, the other companies in this industry with analyst coverage are forecast to grow their revenue at 8.1% annually. So it's pretty clear that, while Ring Energy's revenue growth is expected to slow, it's still expected to grow faster than the industry itself.

The Bottom Line

The clear low-light was that analysts slashing their revenue forecasts for Ring Energy this year. They're also forecasting more rapid revenue growth than the wider market. Given the stark change in sentiment, we'd understand if investors became more cautious on Ring Energy after today.

Of course, this isn't the full story. We have estimates for Ring Energy from its four analysts out until 2022, and you can see them free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

When trading Ring Energy or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSEAM:REI

Ring Energy

An independent oil and natural gas company, engages in the acquisition, exploration, development, and production of oil and natural gas properties.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives