- United States

- /

- Oil and Gas

- /

- NYSEAM:LEU

Centrus Energy (LEU): Evaluating Valuation After Approval to Uplist to the New York Stock Exchange

Reviewed by Simply Wall St

Centrus Energy (LEU) just secured approval to move its listing from NYSE American to the New York Stock Exchange, with trading set to begin December 4, 2025. This change represents a meaningful visibility and liquidity upgrade for shareholders.

See our latest analysis for Centrus Energy.

The listing upgrade comes after a volatile run, with a 90 day share price return of 33.45 percent and a 30 day pullback of 22.57 percent, yet a powerful 5 year total shareholder return of 1451.29 percent. This suggests momentum is pausing rather than broken.

If Centrus has you rethinking where growth might come from next, this could be a good moment to explore fast growing stocks with high insider ownership.

With the stock already up sharply over the past few years and trading only slightly below analyst targets, investors now face a key question: is there still upside left, or is future growth already in the price?

Most Popular Narrative: 3.3% Undervalued

With Centrus Energy last closing at $265.58 against a narrative fair value of $274.58, the valuation case leans modestly positive but hinges on ambitious execution.

The current valuation assumes Centrus will rapidly scale capacity to meet rising demand just as Russian supply exits the Western market. However, timelines for building new cascades are long (first cascade takes 42 months, subsequent cascades take months each) and highly dependent on the allocation and timing of DOE funding. Any holdup in these government awards or in private capital inflows could lead to prolonged periods of underutilized cash, lower revenue, and diminished operating leverage, thus pressuring future margins and earnings.

Curious how a business facing shrinking earnings, rising margins, and aggressive capacity build out still screens as underpriced on a premium multiple? The most followed narrative stitches together revenue acceleration, margin reset, and a surprisingly rich future valuation to reach that fair value. Want to see which assumptions do the heavy lifting and how sensitive the outcome is to even small execution delays? The full narrative lays out the blueprint in detail.

Result: Fair Value of $274.58 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this blueprint could unravel if government contracts arrive slower than expected, or if non nuclear alternatives cap long term demand just as capacity ramps.

Find out about the key risks to this Centrus Energy narrative.

Another Take on Valuation

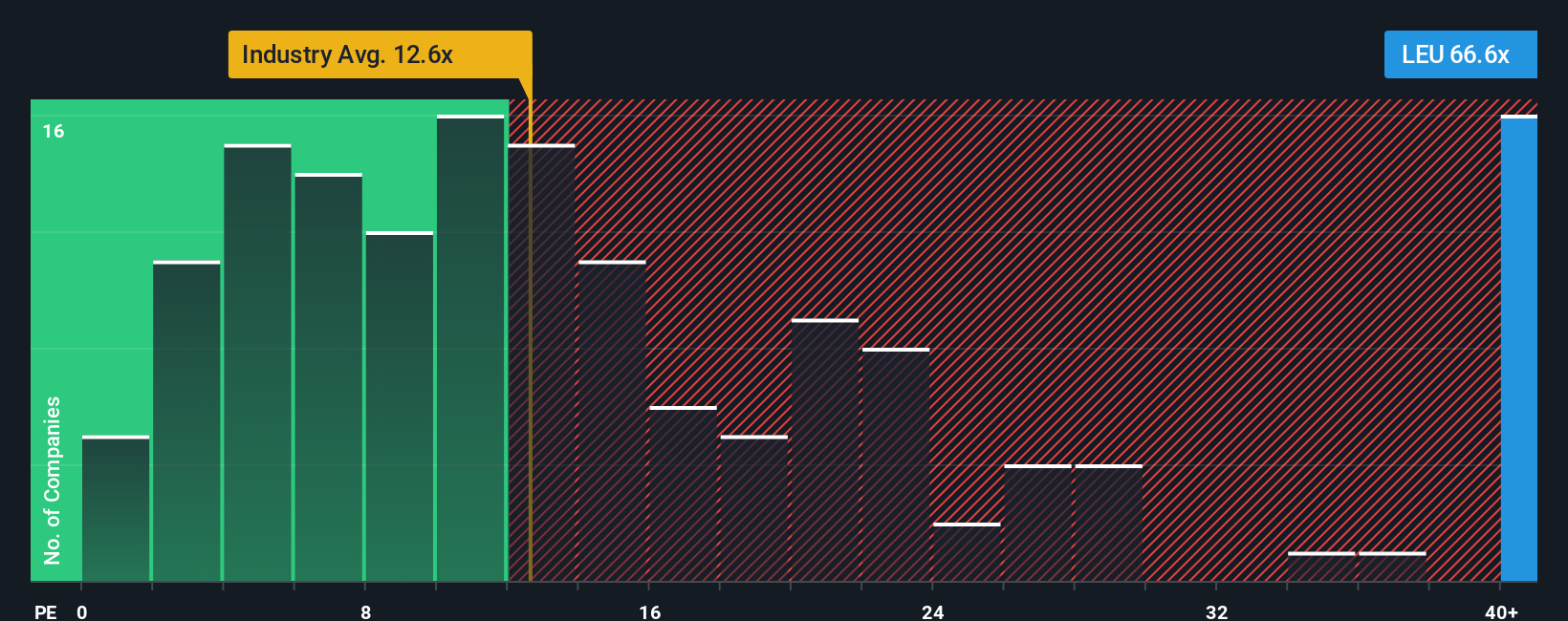

While the narrative fair value suggests Centrus Energy is 3.3 percent undervalued, the earnings multiple paints a harsher picture. At a price to earnings ratio of 42.5 times, the stock trades at more than triple the US Oil and Gas industry average of 13.5 times and well above peers at 16.1 times, versus a fair ratio of just 10.9 times. That gap implies sentiment could shift quickly if growth or margins wobble. Investors are left to decide whether they are paying up for a rare asset or simply overpaying for a hot story.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Centrus Energy Narrative

If you see the story differently or want to stress test the numbers yourself, you can build a custom Centrus view in minutes: Do it your way.

A great starting point for your Centrus Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing edge?

Before you move on, put Simply Wall St to work for you and line up your next moves with targeted ideas you will not want to overlook.

- Explore potential bargain entries by scanning these 927 undervalued stocks based on cash flows that the market has not fully priced for their cash flow strength.

- Identify the next wave of innovation by zeroing in on these 24 AI penny stocks that are positioned to benefit from structural AI adoption.

- Develop an income-focused approach by reviewing these 14 dividend stocks with yields > 3% that provide regular payout opportunities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:LEU

Centrus Energy

Supplies nuclear fuel components for the nuclear power industry in the United States, Belgium, Japan, the Netherlands, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Staggered by dilution; positions for growth

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026