- United States

- /

- Oil and Gas

- /

- NYSE:XOM

Is Exxon Mobil (XOM) Still Undervalued After Its Recent Grind Higher? A Fresh Look at the Valuation

Reviewed by Simply Wall St

Exxon Mobil (XOM) has been quietly grinding higher, and with shares recently closing near $118, investors are starting to ask whether the stock’s next leg is driven more by cash flows or sentiment.

See our latest analysis for Exxon Mobil.

That steady climb has been underpinned by a 7.85% 3 month share price return and a solid 5 year total shareholder return of 227.5%, hinting that confidence in Exxon Mobil’s cash generation and energy transition strategy is still building, not fading.

If Exxon Mobil’s recent move has you thinking about what else could be setting up for the next leg higher, it might be worth exploring fast growing stocks with high insider ownership as a curated list of potential ideas.

With shares trading at a modest discount to analyst targets yet boasting hefty historical returns, the key question now is whether Exxon Mobil still offers mispriced value or whether the market is already discounting years of future growth.

Most Popular Narrative Narrative: 10.8% Undervalued

With Exxon Mobil last closing at $117.80 against a narrative fair value of $132.00, the gap points to meaningful upside if the thesis plays out.

The BUY recommendation is not based on a speculative bet on higher oil prices, but on the company's fundamental transformation, operational excellence, and disciplined capital allocation that is expected to generate sustainable, industry leading returns. The market currently undervalues the durability of XOM's cash flow, the significant synergies from the Pioneer acquisition, and the long term potential of its Low Carbon Solutions business.

Curious how a mature energy giant earns a premium style valuation without relying on sky high oil assumptions? The secret sits in its cash engine, synergy math, and a surprisingly ambitious profit multiple for the next chapter.

Result: Fair Value of $132.0 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent commodity price volatility or a faster than expected energy transition could pressure Exxon Mobil’s cash flows and challenge the current valuation thesis.

Find out about the key risks to this Exxon Mobil narrative.

Another View on Value

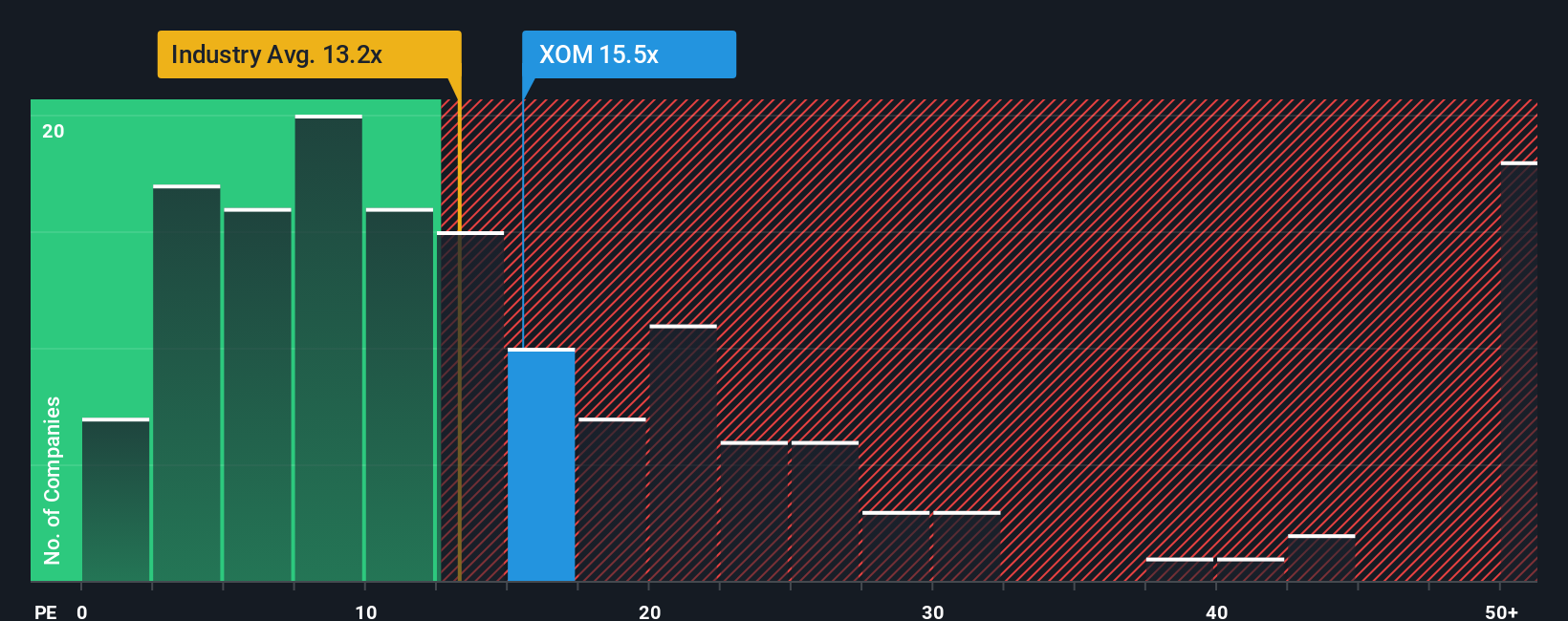

Step away from narrative fair value and Exxon Mobil looks a lot less cheap. At 16.6 times earnings versus 13.6 times for the US Oil and Gas industry and 24.3 times for peers, the stock already commands a premium, even if the fair ratio of 24.4 times hints at further room to rerate. Is that premium a cushion or a trap if sentiment turns?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Exxon Mobil Narrative

If this take does not quite fit your view, or you would rather dig into the numbers yourself, you can build a custom narrative in minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Exxon Mobil.

Ready for your next investing move?

Before you settle on Exxon Mobil alone, put Simply Wall St’s screener to work and line up your next wave of opportunities so you are never reacting late.

- Capture potential mispricings early by scanning these 912 undervalued stocks based on cash flows that the market may be overlooking despite strong cash flow potential.

- Ride structural growth trends by targeting these 25 AI penny stocks capitalizing on real world artificial intelligence adoption, not just hype.

- Strengthen your income stream by zeroing in on these 14 dividend stocks with yields > 3% that can support long term, compounding returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Exxon Mobil might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XOM

Exxon Mobil

Engages in the exploration and production of crude oil and natural gas in the United States, Guyana, Canada, the United Kingdom, Singapore, France, and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026