- United States

- /

- Oil and Gas

- /

- NYSE:XOM

Exxon Mobil's (NYSE:XOM) Surprise on Earnings goes Unnoticed by Investors

Exxon Mobil Corporation(NYSE:XOM) posted a positive earnings result for the second quarter in the row. However, the stock price is not following the suit, remaining lodged around US$58, following a dip in July.

We think that the softer headline numbers might be getting counterbalanced by some positive underlying factors.

Recent Developments

Exxon Mobil just delivered Q2 results:

- GAAP earning per share of US$1.10 (beat by US$0.12)

- Revenue was US$67.74b (beat by US$3.78b)

- Cash flow from operations was US$9.7b (vs. 8.37b consensus)

The company claims that the cash flow from operations covered capital investments, debt reduction, and dividend payments. The company reduced debt by almost US$7b since year-end 2020, and the current dividend yield is 6.04%

Looking Toward Q3

The company continues recovering after the turbulent last year. Plans for Q3 include:

- Higher volumes due to reduced planned maintenance

- Further reduction of debt (deleveraging)

- Finalizing asset sale in the U.K North Sea

See our latest analysis for Exxon Mobil

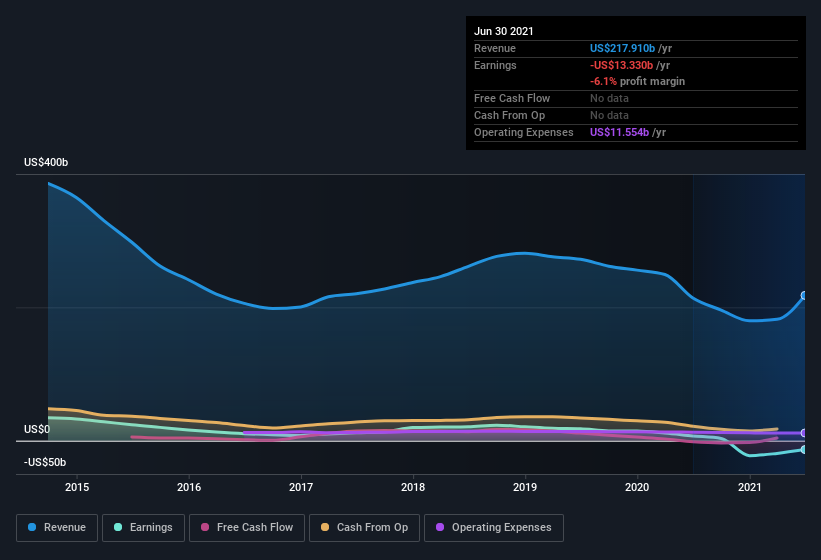

The Impact Of Unusual Items On Profit

Importantly, our data indicate that Exxon Mobil's profit was reduced by US$25b, due to unusual items, over the last year. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. When we analyzed most listed companies worldwide, we found that significant unusual items are often not repeated. And that's hardly a surprise, given these line items are considered unusual. In the twelve months to June 2021, Exxon Mobil had a significant unusual items expense. As a result, we can surmise that the unusual items made its statutory profit significantly weaker than it would otherwise be.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability based on their estimates.

An Unusual Tax Situation

Just as we noted the unusual items, we must inform you that Exxon Mobil received a tax benefit which contributed US$3.4b to the bottom line. It's always a bit noteworthy when a company is paid by the tax man, rather than paying the tax man. The receipt of a tax benefit is a good thing on its own. However, our data indicate that tax benefits can temporarily boost statutory profit in the year it is booked, but subsequently, profit may fall back. Assuming the tax benefit is not repeated every year, we could see its profitability drop noticeably, all else being equal.

Our Take On Exxon Mobil's Performance

In the last year, Exxon Mobil received a tax benefit, which boosted its profit in a way that might not be much more sustainable than turning prime farmland into gas fields. Having said that, it also had an unusual item reducing its profit. Considering all those mentioned above, we'd venture that Exxon Mobil's profit result is a pretty good guide to its true profitability, albeit a bit on the conservative side. However, the company is improving the margins, especially in the upstream business sensitive to petroleum price changes.

Finally, many investors buy Exxon Mobil for the dividend. While the company can afford to raise the dividend right now, it is patiently waiting to see the latest issue with the Delta variant resolve itself. A new lockdown is a real threat to the petroleum industry as it would decimate the demand, and the company is rightfully waiting to be in the clear.

While earnings quality is essential, it's equally important to consider the risks facing Exxon Mobil at this point. For example, we've discovered 1 warning sign that you should run your eye over to get a better picture of Exxon Mobil.

In this article, we've looked at several factors that can impair the utility of profit numbers as a guide to a business. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity orthis list of stocks that insiders are buying.

Valuation is complex, but we're here to simplify it.

Discover if Exxon Mobil might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:XOM

Exxon Mobil

Engages in the exploration and production of crude oil and natural gas in the United States, Guyana, Canada, the United Kingdom, Singapore, France, and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives