- United States

- /

- Oil and Gas

- /

- NYSE:WTI

W&T Offshore (NYSE:WTI shareholders incur further losses as stock declines 10% this week, taking three-year losses to 63%

If you love investing in stocks you're bound to buy some losers. But long term W&T Offshore, Inc. (NYSE:WTI) shareholders have had a particularly rough ride in the last three year. Unfortunately, they have held through a 64% decline in the share price in that time. And the ride hasn't got any smoother in recent times over the last year, with the price 50% lower in that time. The falls have accelerated recently, with the share price down 25% in the last three months.

With the stock having lost 10% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

View our latest analysis for W&T Offshore

Because W&T Offshore made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over the last three years, W&T Offshore's revenue dropped 5.1% per year. That's not what investors generally want to see. The share price decline of 18% compound, over three years, is understandable given the company doesn't have profits to boast of, and revenue is moving in the wrong direction. Of course, it's the future that will determine whether today's price is a good one. We'd be pretty wary of this one until it makes a profit, because we don't specialize in finding turnaround situations.

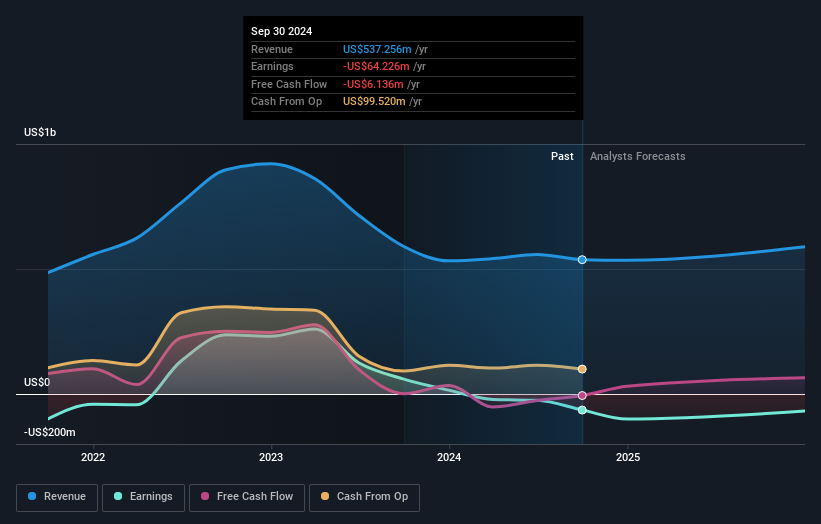

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at W&T Offshore's financial health with this free report on its balance sheet.

A Different Perspective

While the broader market gained around 26% in the last year, W&T Offshore shareholders lost 49% (even including dividends). Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 10% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that W&T Offshore is showing 3 warning signs in our investment analysis , and 2 of those don't sit too well with us...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if W&T Offshore might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:WTI

W&T Offshore

An independent oil and natural gas producer, engages in the acquisition, exploration, and development of oil and natural gas properties in the Gulf of Mexico.

Undervalued low.

Similar Companies

Market Insights

Community Narratives