- United States

- /

- Oil and Gas

- /

- NYSE:WTI

Undervalued Small Caps With Recent Insider Buying Across Regions

Reviewed by Simply Wall St

In recent days, the U.S. stock market has shown signs of recovery, with major indices like the Dow and S&P 500 snapping a four-session losing streak amid anticipation of key earnings reports. As investors navigate this environment, small-cap stocks often present unique opportunities due to their potential for growth and value discovery. In this context, understanding market trends and economic indicators is crucial for identifying promising small-cap investments that align with current conditions.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Hanmi Financial | 10.8x | 3.2x | 33.38% | ★★★★★☆ |

| PCB Bancorp | 8.7x | 2.8x | 31.11% | ★★★★★☆ |

| Shore Bancshares | 9.3x | 2.5x | 47.07% | ★★★★★☆ |

| Peoples Bancorp | 9.9x | 1.8x | 47.42% | ★★★★★☆ |

| MVB Financial | 10.0x | 1.9x | -8.06% | ★★★★☆☆ |

| S&T Bancorp | 10.9x | 3.7x | 40.42% | ★★★★☆☆ |

| Farmland Partners | 6.1x | 7.6x | -33.82% | ★★★★☆☆ |

| Citizens & Northern | 12.8x | 3.1x | 46.12% | ★★★☆☆☆ |

| German American Bancorp | 14.2x | 4.6x | 48.27% | ★★★☆☆☆ |

| CS Disco | NA | 2.6x | 40.27% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

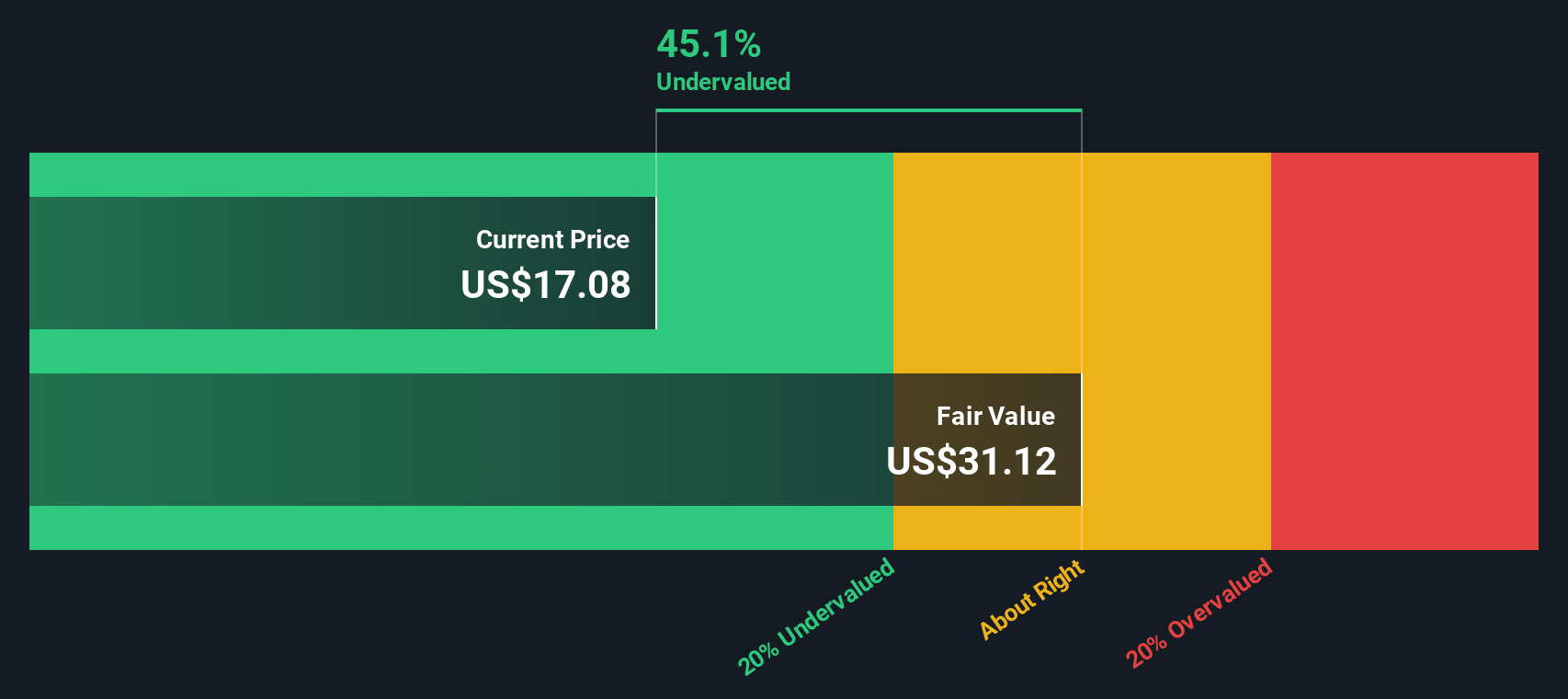

Eagle Bancorp (EGBN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Eagle Bancorp operates as a bank holding company providing commercial banking services, with a market capitalization of $0.89 billion.

Operations: Eagle Bancorp's revenue primarily stems from its banking operations. Over recent periods, the net income margin has shown significant variability, with a notable decline into negative territory in 2024 and 2025. Operating expenses are a substantial portion of costs, with general and administrative expenses consistently being the largest component.

PE: -4.3x

Eagle Bancorp, a small company with a market cap under US$1 billion, is navigating through significant leadership changes as CEO Susan G. Riel plans to retire in 2026. Despite reporting a net loss of US$67.51 million for Q3 2025 and reduced net interest income of US$68.16 million, the company anticipates growth in net interest income for 2026 due to improved funding costs. Recent insider confidence was demonstrated by share purchases throughout the year, signaling potential optimism about future performance amidst current challenges.

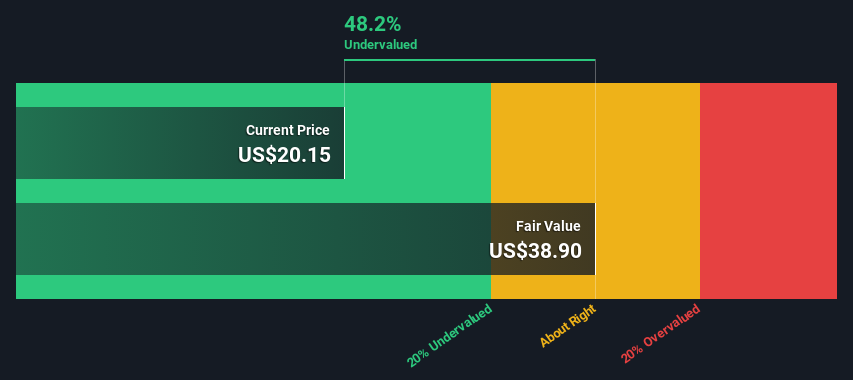

PCB Bancorp (PCB)

Simply Wall St Value Rating: ★★★★★☆

Overview: PCB Bancorp operates as a bank holding company providing community banking services primarily to small and medium-sized businesses, with a market capitalization of approximately $0.18 billion.

Operations: PCB Bancorp generates revenue primarily from the banking industry, with a recent figure of $107.74 million. The company's net income margin has shown variability, recently recorded at 31.97%. Operating expenses are significant, with general and administrative expenses being the largest component at $49.68 million in the latest period.

PE: 8.7x

PCB Bancorp, a smaller player in the banking sector, has seen its net interest income rise to US$26.98 million in Q3 2025 from US$22.72 million a year prior, reflecting solid financial health. The company repurchased 106,463 shares for US$2.28 million between July and September 2025, signaling confidence in its valuation. Insider confidence is evident with recent share purchases by insiders earlier this year. With earnings projected to grow annually by 8.21%, PCB's future looks promising for potential value seekers.

- Unlock comprehensive insights into our analysis of PCB Bancorp stock in this valuation report.

Understand PCB Bancorp's track record by examining our Past report.

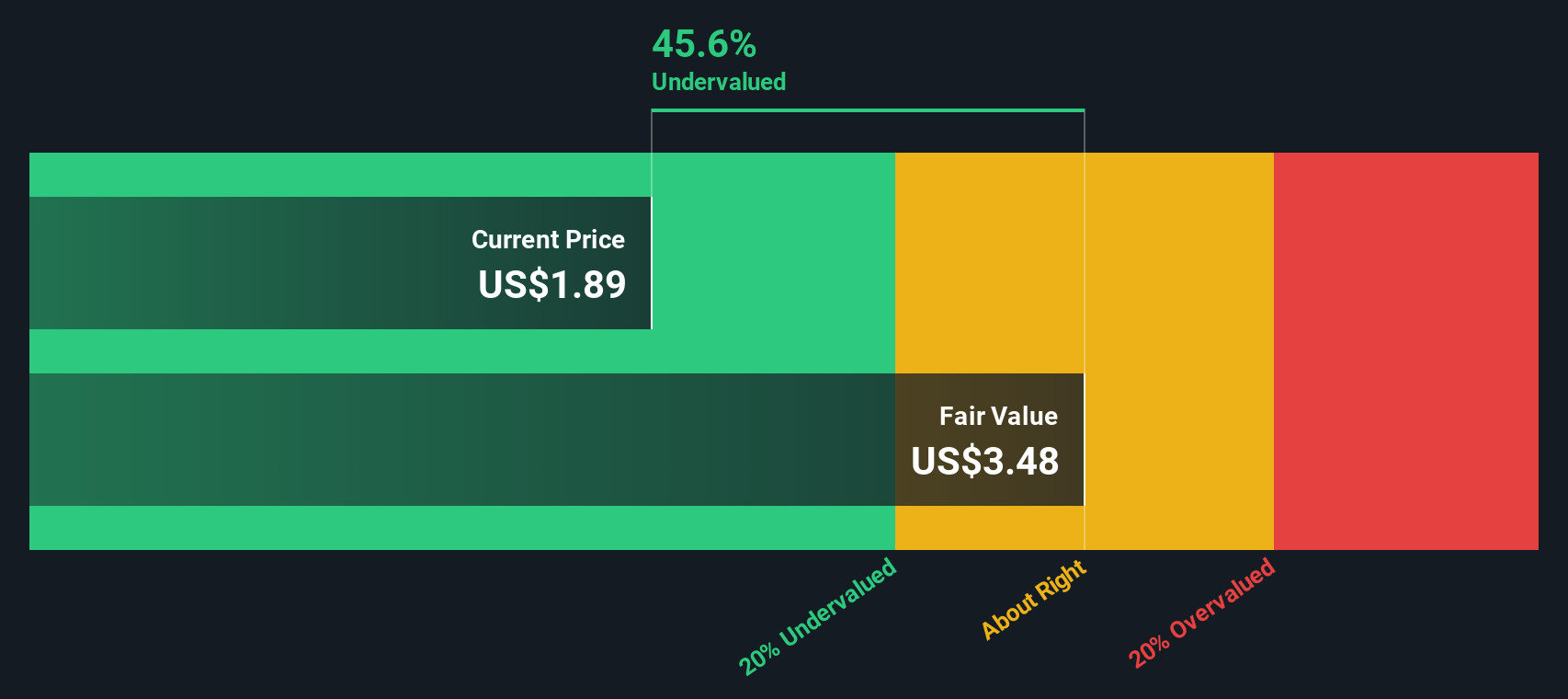

W&T Offshore (WTI)

Simply Wall St Value Rating: ★★★★★☆

Overview: W&T Offshore is an independent oil and natural gas producer focused on exploration and production activities in the Gulf of Mexico, with a market cap of approximately $0.83 billion.

Operations: The primary revenue stream for the company is derived from oil and gas exploration and production, with recent quarterly revenues at $500.09 million. Cost of goods sold (COGS) was reported at $311.30 million, impacting the gross profit margin, which stood at 37.75%. Operating expenses include significant allocations to general and administrative costs, which were $80.14 million in the latest period analyzed.

PE: -1.9x

W&T Offshore, a smaller player in the energy sector, has faced challenges with profitability and relies on external borrowing for funding. Despite a volatile share price over recent months and negative equity, insider confidence is evident through recent share purchases. The company’s production guidance for Q4 2025 suggests steady output across oil, NGLs, and natural gas. However, financial results show a net loss of US$71.47 million in Q3 2025 despite increased production levels compared to previous quarters.

- Click here to discover the nuances of W&T Offshore with our detailed analytical valuation report.

Explore historical data to track W&T Offshore's performance over time in our Past section.

Make It Happen

- Access the full spectrum of 66 Undervalued US Small Caps With Insider Buying by clicking on this link.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if W&T Offshore might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WTI

W&T Offshore

An independent oil and natural gas producer, engages in the acquisition, exploration, and development of oil and natural gas properties in the Gulf of America.

Undervalued with slight risk.

Similar Companies

Market Insights

Community Narratives