- United States

- /

- Oil and Gas

- /

- NYSE:WES

Has Western Midstream Run Its Course After A 314% Surge And Capital Allocation Shift?

Reviewed by Bailey Pemberton

- Wondering if Western Midstream Partners is still good value after such a big multi year run? This article will walk through whether the current price makes sense or if the market is getting ahead of itself.

- After climbing an impressive 313.7% over 5 years and 97.3% over 3 years, the units have cooled lately, with a 1 year gain of 8.8%, a modest 0.4% return year to date, a 1.3% rise over 30 days, and a slight 1.5% dip in the last week.

- Recent headlines have focused on Western Midstream Partners fine tuning its capital allocation, including ongoing debt reduction and targeted growth projects that support long term throughput. There has also been continued attention on its relationship with key producers and contract structures, which helps explain why the market has been reassessing both its growth potential and risk profile.

- Right now, Western Midstream Partners scores a solid 5 out of 6 on our valuation checks, suggesting it still looks undervalued on most measures. Next we will unpack those different valuation approaches before looking at an even better way to think about what the units are really worth.

Approach 1: Western Midstream Partners Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth by projecting the cash it can generate in the future and discounting those cash flows back to today, using a required rate of return.

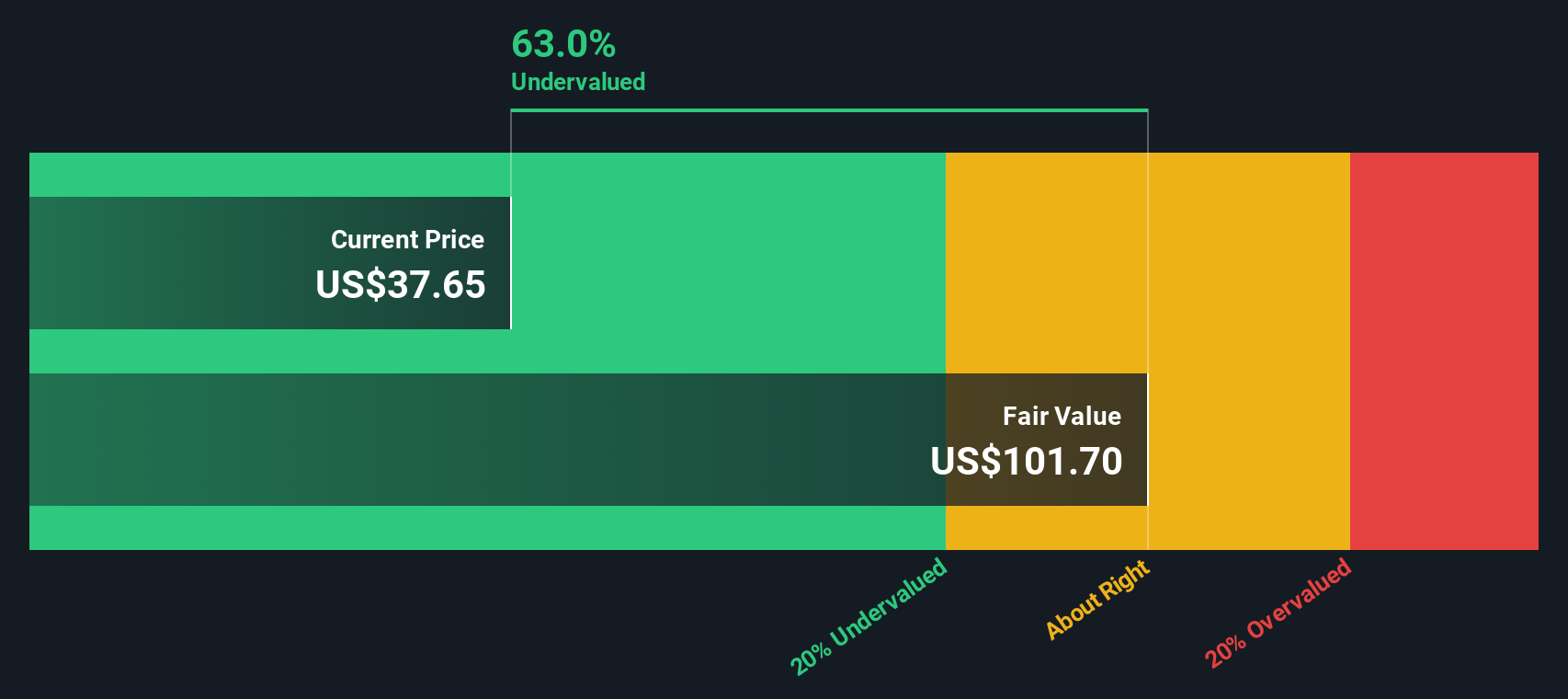

For Western Midstream Partners, the latest twelve month Free Cash Flow stands at about $1.41 billion, a strong base for an income focused midstream business. Analysts provide detailed forecasts for the next few years, and beyond that Simply Wall St extrapolates the trend, with projected Free Cash Flow reaching roughly $2.35 billion by 2035. These steadily rising cash flows, calculated in $ and discounted using a 2 Stage Free Cash Flow to Equity model, lead to a fair value estimate of about $113.07 per unit.

Compared with the current market price, this DCF view indicates the units are trading at roughly a 65.1% discount, which points to a substantial margin of safety if the cash flow path proves broadly accurate.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Western Midstream Partners is undervalued by 65.1%. Track this in your watchlist or portfolio, or discover 907 more undervalued stocks based on cash flows.

Approach 2: Western Midstream Partners Price vs Earnings

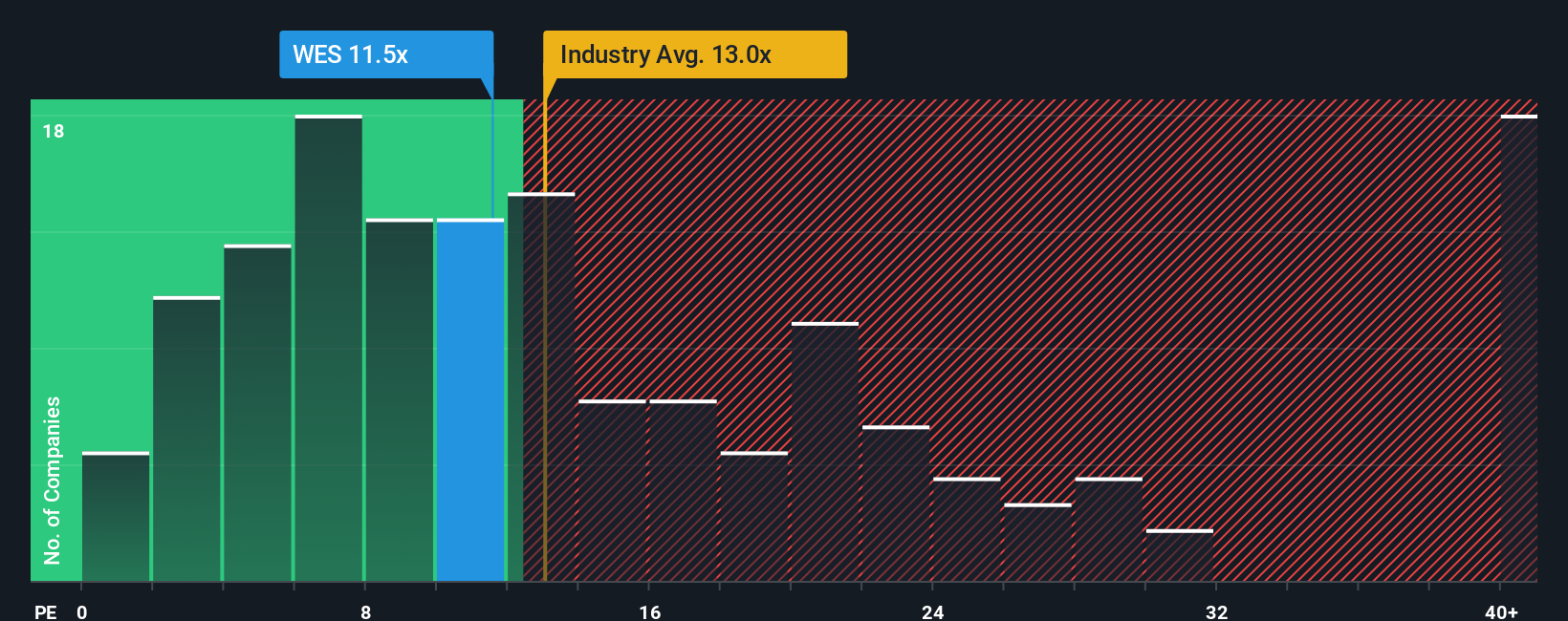

For profitable companies like Western Midstream Partners, the Price to Earnings (PE) ratio is a straightforward way to gauge whether investors are paying a reasonable price for each dollar of earnings. In general, faster growing and lower risk businesses tend to deserve a higher normal or fair PE ratio, while slower growth or higher risk names should trade on lower multiples.

Western Midstream Partners currently trades on a PE of about 12.4x, which is slightly below the broader Oil and Gas industry average of around 13.3x and well below the peer group average of roughly 19.9x. Rather than relying only on those broad comparisons, Simply Wall St also uses a proprietary Fair Ratio, which estimates what PE you would expect for this specific business given its earnings growth outlook, profit margin, industry, market cap and risk profile. For Western Midstream Partners, that Fair Ratio comes out at about 19.4x and suggests the units trade closer to high quality peers than the headline multiple implies. With the actual PE meaningfully below this Fair Ratio, the stock appears undervalued on an earnings basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1448 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Western Midstream Partners Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives, a simple way to attach your story about Western Midstream Partners, including your assumptions for future revenue, earnings, margins and risk, to a financial forecast that flows through to a Fair Value you can compare against today's price. This is all within an easy tool on Simply Wall St's Community page that millions of investors use to inform their decisions, and it automatically updates as new news or earnings arrive. For example, a bullish investor might build a Narrative around strong long term throughput and water partnership potential, arriving at a fair value closer to 46 dollars per unit. In contrast, a more cautious investor could emphasize project execution and volume risks, using lower revenue and margin assumptions that point to a fair value nearer 36 dollars.

Do you think there's more to the story for Western Midstream Partners? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Western Midstream Partners might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WES

Western Midstream Partners

Operates as a midstream energy company primarily in the United States.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)