- United States

- /

- Energy Services

- /

- NYSE:VTOL

Market Participants Recognise Bristow Group Inc.'s (NYSE:VTOL) Revenues Pushing Shares 27% Higher

The Bristow Group Inc. (NYSE:VTOL) share price has done very well over the last month, posting an excellent gain of 27%. Looking back a bit further, it's encouraging to see the stock is up 53% in the last year.

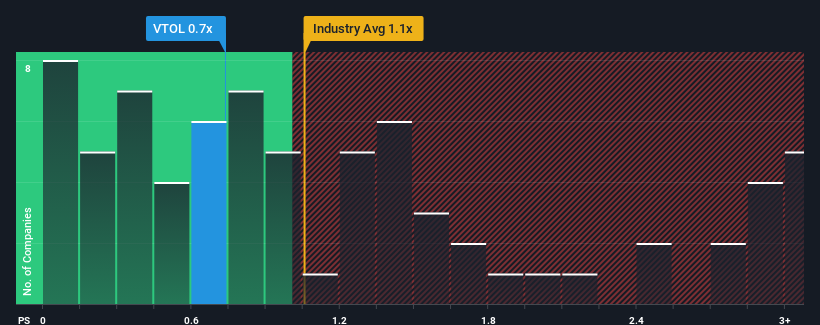

Even after such a large jump in price, it's still not a stretch to say that Bristow Group's price-to-sales (or "P/S") ratio of 0.7x right now seems quite "middle-of-the-road" compared to the Energy Services industry in the United States, where the median P/S ratio is around 1.1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Bristow Group

What Does Bristow Group's P/S Mean For Shareholders?

Bristow Group could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Bristow Group.Is There Some Revenue Growth Forecasted For Bristow Group?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Bristow Group's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 9.2% last year. The latest three year period has also seen a 14% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 13% as estimated by the two analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 11%, which is not materially different.

With this in mind, it makes sense that Bristow Group's P/S is closely matching its industry peers. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What We Can Learn From Bristow Group's P/S?

Bristow Group appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look at Bristow Group's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

You should always think about risks. Case in point, we've spotted 3 warning signs for Bristow Group you should be aware of, and 1 of them can't be ignored.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Bristow Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:VTOL

Bristow Group

Provides vertical flight solutions to integrated, national, and independent offshore energy companies and government agencies.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives