- United States

- /

- Biotech

- /

- NasdaqGM:NAMS

Three Undervalued Small Caps In United States With Insider Buying To Consider

Reviewed by Simply Wall St

The United States market has seen a significant rise of 30% over the past year, although it remained flat in the last week, with earnings expected to grow by 15% annually. In this context, identifying stocks that are perceived as undervalued and have insider buying can be an intriguing strategy for investors seeking opportunities amidst these market conditions.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Hanover Bancorp | 9.2x | 2.1x | 49.65% | ★★★★★☆ |

| Franklin Financial Services | 9.8x | 1.9x | 38.79% | ★★★★☆☆ |

| MYR Group | 36.1x | 0.5x | 39.20% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Orion Group Holdings | NA | 0.3x | -114.88% | ★★★☆☆☆ |

| HighPeak Energy | 12.9x | 1.6x | 31.28% | ★★★☆☆☆ |

| Sabre | NA | 0.4x | -57.60% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -205.89% | ★★★☆☆☆ |

| National Vision Holdings | NA | 0.4x | -36.08% | ★★★☆☆☆ |

| Industrial Logistics Properties Trust | NA | 0.7x | -229.57% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

HighPeak Energy (NasdaqGM:HPK)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: HighPeak Energy is engaged in the development, exploration, and production of oil and natural gas with a market capitalization of approximately $2.15 billion.

Operations: The company generates its revenue primarily from oil and natural gas development, exploration, and production. Over recent periods, it has experienced a gross profit margin ranging between 81.65% and 85.29%. The cost of goods sold (COGS) as a portion of revenue has fluctuated but remains significant in determining profitability. Operating expenses include substantial components such as depreciation and amortization (D&A) and general & administrative expenses.

PE: 12.9x

HighPeak Energy, a smaller U.S. stock, recently reported second-quarter revenue growth to US$275.27 million, up from US$240.76 million the previous year, though net income slightly decreased to US$29.72 million from US$31.83 million. They have shown insider confidence through share repurchases totaling 978,989 shares for US$14.55 million by June 2024 and increased production guidance for the year to 45,000-49,000 Boe/d. Despite lower profit margins and reliance on external borrowing for funding, earnings are projected to grow annually by 17%.

- Delve into the full analysis valuation report here for a deeper understanding of HighPeak Energy.

Examine HighPeak Energy's past performance report to understand how it has performed in the past.

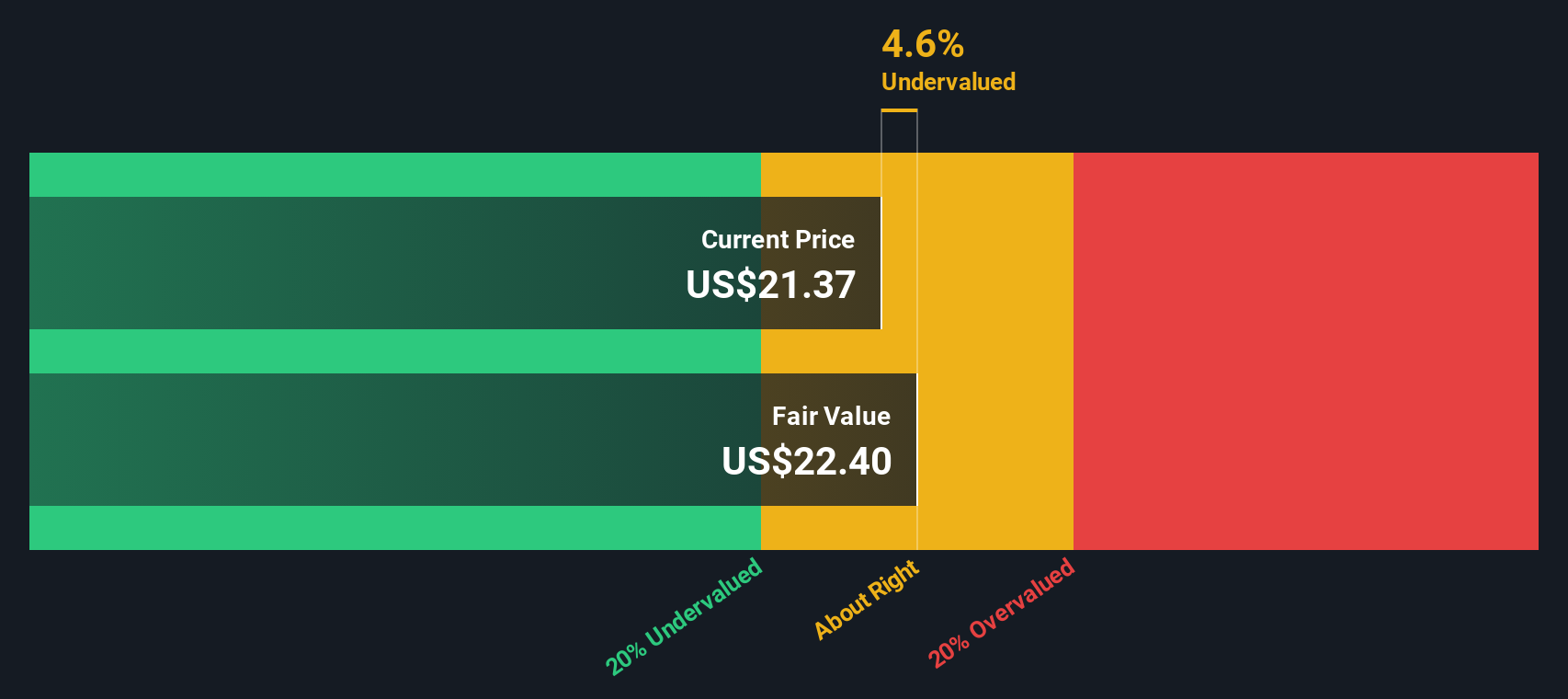

NewAmsterdam Pharma (NasdaqGM:NAMS)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: NewAmsterdam Pharma is a biotechnology company focused on developing transformative therapies for cardiovascular diseases, with a market cap of $0.48 billion.

Operations: The company generates revenue primarily from the biotechnology sector, with recent figures indicating $7.42 million. Despite consistently achieving a gross profit margin of 100%, it faces significant operating expenses, notably in research and development, which reached $165.47 million in the latest period. This high expenditure contributes to substantial net losses, with a recent net income margin of -30.90%.

PE: -7.0x

NewAmsterdam Pharma, a small player in the pharmaceutical industry, recently showcased insider confidence with share purchases over the past six months. Despite reporting a net loss of US$39 million for Q2 2024, its revenue increased to US$2.28 million from US$1.72 million year-on-year. The company is gaining traction with its inclusion in the S&P Global BMI Index and positive Phase 3 BROOKLYN trial results for obicetrapib, indicating potential growth opportunities despite current unprofitability and reliance on external funding sources.

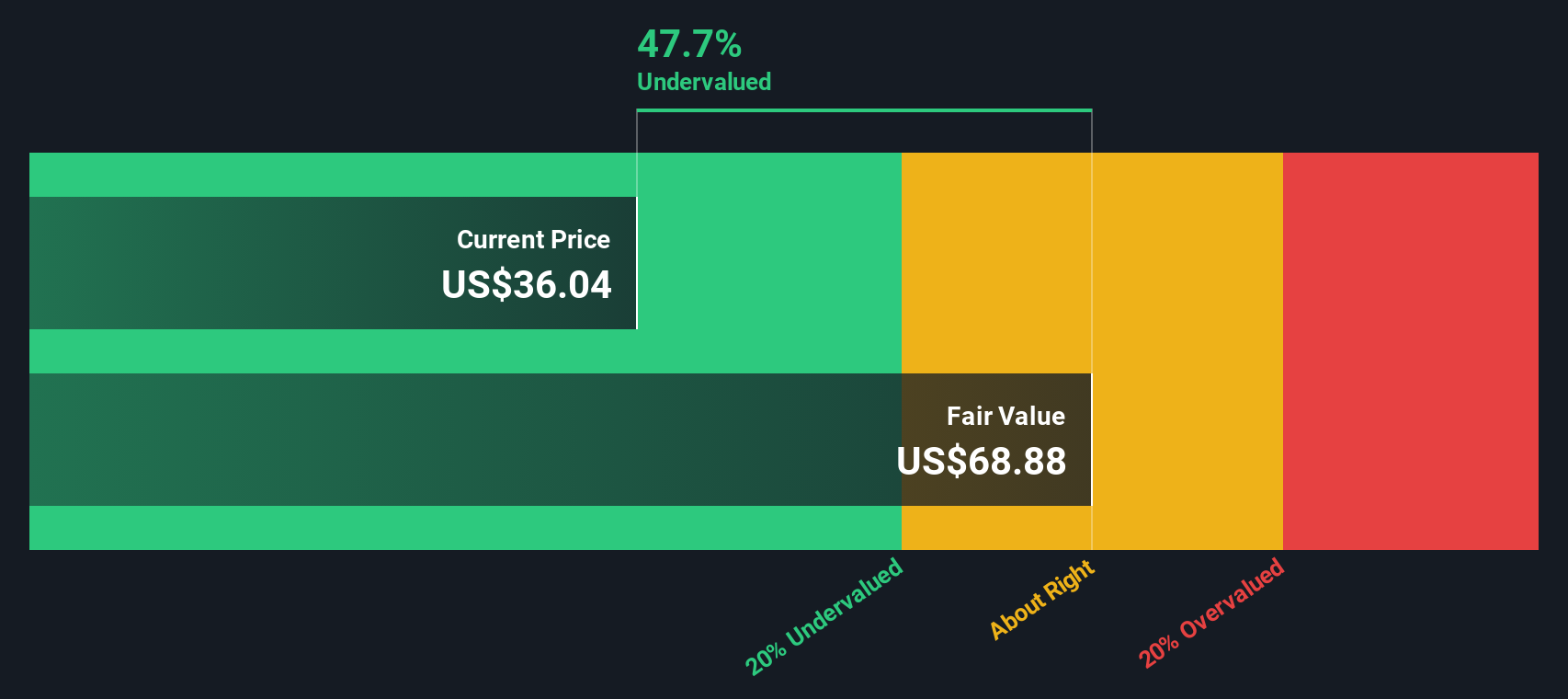

Vital Energy (NYSE:VTLE)

Simply Wall St Value Rating: ★★★★★☆

Overview: Vital Energy is engaged in the exploration and production of energy resources, including midstream and marketing operations, with a market capitalization of $1.17 billion.

Operations: Vital Energy generates revenue primarily through its exploration and production activities, including midstream and marketing operations, with recent figures reaching $1.84 billion. The company's gross profit margin has shown variability, recently recorded at 71.01%. Operating expenses are a significant component of the cost structure, with general and administrative expenses being a notable part of this category.

PE: 4.5x

Vital Energy, a smaller U.S. company, is catching attention for its potential value despite challenges. Recent insider confidence was shown through share purchases in the past year, indicating belief in future prospects. The company's revenue rose to US$476 million in Q2 2024 from US$335 million the previous year, although net income saw a sharp decline due to large one-off items affecting results. Production guidance has been raised for 2024, suggesting growth potential amidst financial hurdles like high debt levels and reliance on external funding sources.

- Unlock comprehensive insights into our analysis of Vital Energy stock in this valuation report.

Evaluate Vital Energy's historical performance by accessing our past performance report.

Taking Advantage

- Click through to start exploring the rest of the 51 Undervalued US Small Caps With Insider Buying now.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NewAmsterdam Pharma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:NAMS

NewAmsterdam Pharma

A late-stage biopharmaceutical company, develops therapies to enhance patient care in populations with metabolic disease.

Flawless balance sheet and fair value.