- United States

- /

- Oil and Gas

- /

- NasdaqGM:HPK

Insider Buying Highlights These 3 Undervalued Small Caps In United States

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, yet it is up 32% over the past year with earnings expected to grow by 15% per annum in the coming years. In such a dynamic environment, identifying stocks that are potentially undervalued with insider buying can be an intriguing strategy for investors looking to capitalize on future growth opportunities.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Vital Energy | 4.4x | 0.6x | 49.34% | ★★★★★☆ |

| Franklin Financial Services | 9.7x | 1.9x | 39.22% | ★★★★☆☆ |

| MYR Group | 35.0x | 0.5x | 41.05% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Orion Group Holdings | NA | 0.3x | -112.37% | ★★★☆☆☆ |

| HighPeak Energy | 12.6x | 1.6x | 32.65% | ★★★☆☆☆ |

| Sabre | NA | 0.5x | -64.63% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -206.04% | ★★★☆☆☆ |

| National Vision Holdings | NA | 0.4x | -39.37% | ★★★☆☆☆ |

| Industrial Logistics Properties Trust | NA | 0.7x | -232.46% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

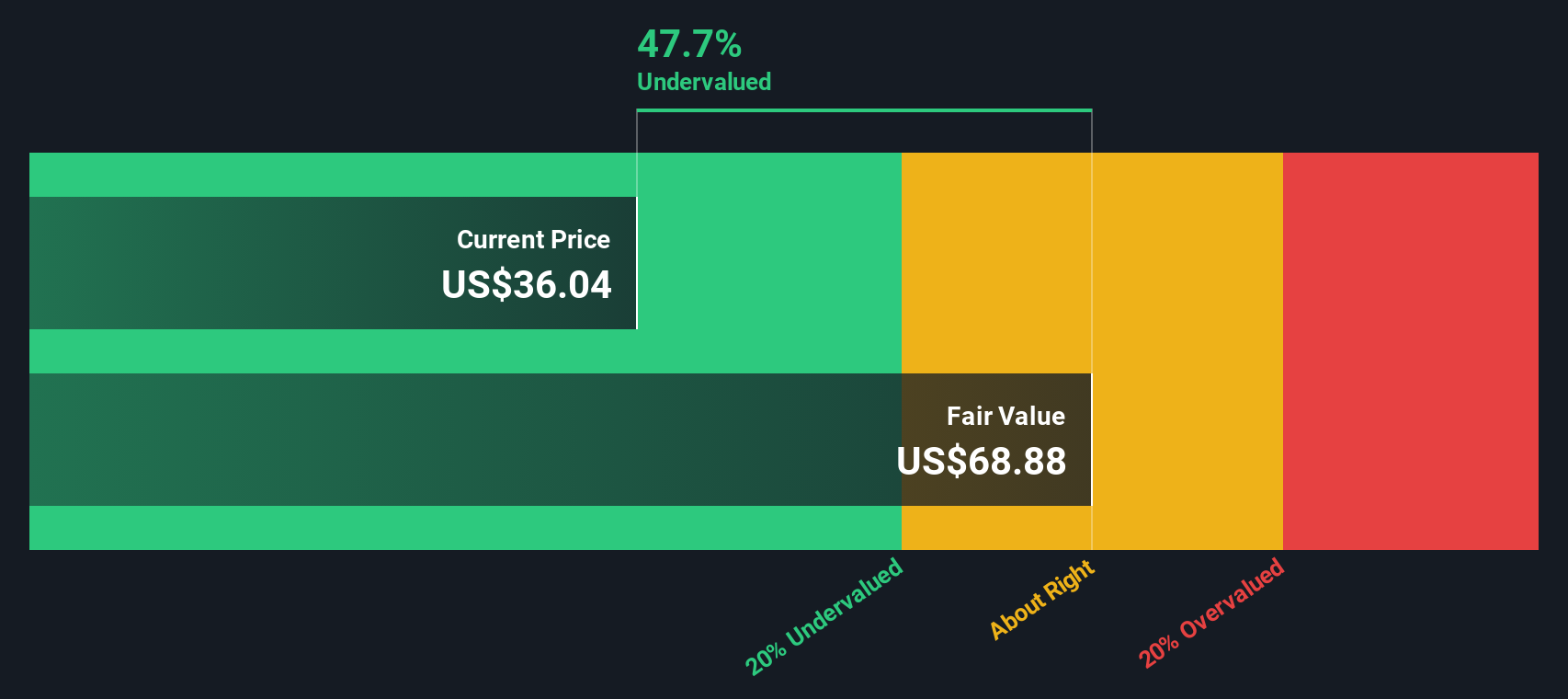

HighPeak Energy (NasdaqGM:HPK)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: HighPeak Energy is engaged in the development, exploration, and production of oil and natural gas with a market capitalization of approximately $2.06 billion.

Operations: The company derives its revenue primarily from oil and natural gas development, exploration, and production. Over recent periods, it has shown a gross profit margin peaking at 85.71% and generally remaining above 82%. Operating expenses have been significant, with depreciation and amortization being a notable component.

PE: 12.6x

HighPeak Energy, a smaller company in the energy sector, has seen its revenue rise to US$275.27 million in Q2 2024 from US$240.76 million the previous year, although net income slightly decreased to US$29.72 million. They declared a quarterly dividend of US$0.04 per share and repurchased 413,449 shares for US$5.79 million between April and June 2024, indicating insider confidence in their future prospects despite lower profit margins and reliance on external borrowing for funding.

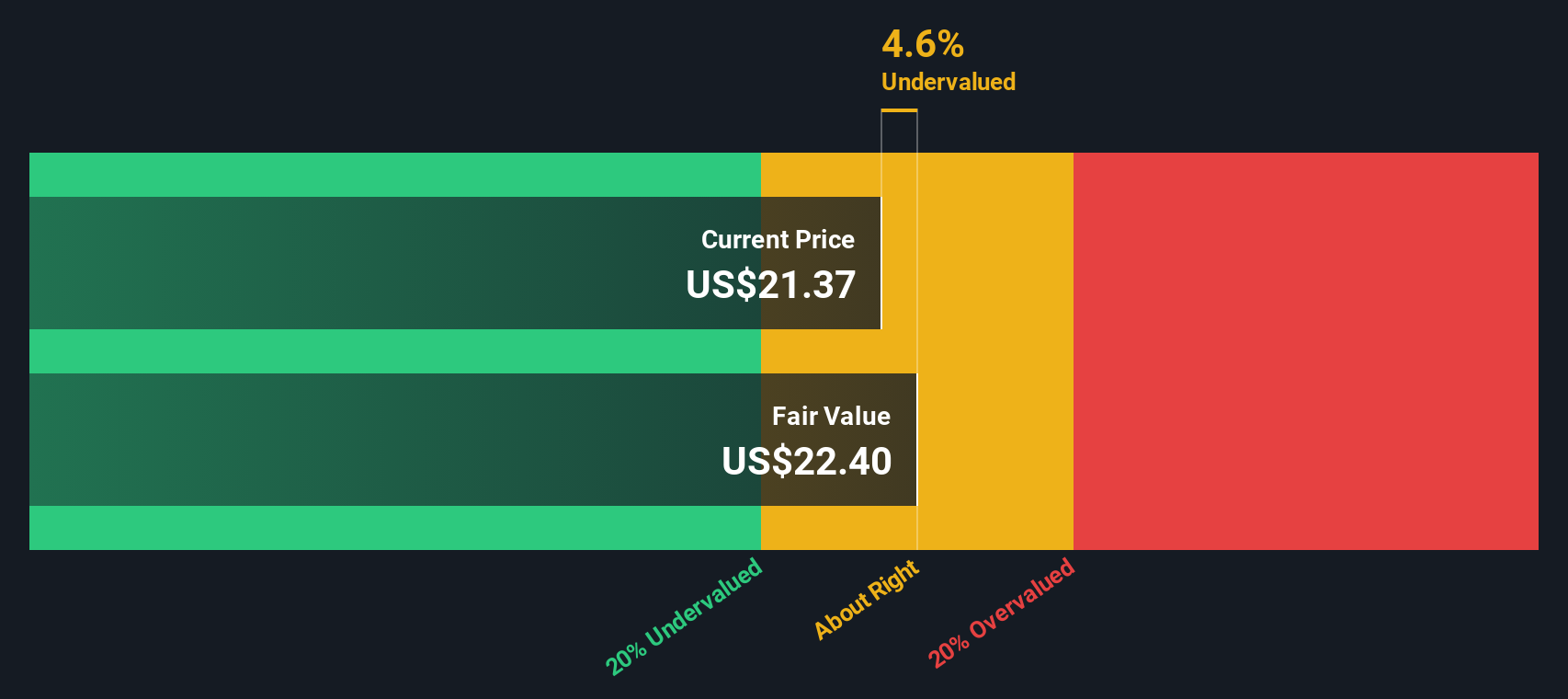

NewAmsterdam Pharma (NasdaqGM:NAMS)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: NewAmsterdam Pharma is a biotechnology company focused on developing transformative therapies for cardiovascular diseases, with a market cap of $0.97 billion.

Operations: The company generates revenue primarily from its biotechnology segment, with recent figures showing $7.42 million. Despite consistently achieving a gross profit margin of 100%, it faces significant operating expenses, notably in research and development, which reached $165.47 million as of the latest period. This has resulted in a net income margin decline to -30.90%.

PE: -7.1x

NewAmsterdam Pharma, a small player in the pharmaceutical industry, recently gained traction by being added to the S&P Global BMI Index on September 23, 2024. Despite reporting a net loss of US$39 million for Q2 2024 and facing high-risk funding challenges due to reliance on external borrowing, they show promise with a forecasted revenue growth of 70.6% annually. The successful Phase 3 BROOKLYN trial demonstrated significant LDL-C reduction with obicetrapib, positioning them for potential advances in treating hypercholesterolemia.

- Click here and access our complete valuation analysis report to understand the dynamics of NewAmsterdam Pharma.

Evaluate NewAmsterdam Pharma's historical performance by accessing our past performance report.

Vital Energy (NYSE:VTLE)

Simply Wall St Value Rating: ★★★★★☆

Overview: Vital Energy is engaged in the exploration and production of oil and natural gas, with a market capitalization of approximately $1.10 billion.

Operations: Vital Energy generates revenue primarily from exploration and production activities, with a recent figure of $1.84 billion. The cost of goods sold (COGS) was $532.99 million, resulting in a gross profit margin of 71.01%. Operating expenses include significant allocations for depreciation and amortization, which reached $613.53 million in the latest period.

PE: 4.4x

Vital Energy, with its niche focus, showcases insider confidence through recent share purchases. Despite a challenging year marked by shareholder dilution and high debt levels, the company reported US$476 million in Q2 revenue, up from US$335 million last year. However, net income dropped to US$36.7 million from US$294.81 million due to large one-off items affecting results. Production guidance for 2024 has been raised significantly following an acquisition, indicating potential growth ahead despite current financial hurdles.

- Get an in-depth perspective on Vital Energy's performance by reading our valuation report here.

Review our historical performance report to gain insights into Vital Energy's's past performance.

Next Steps

- Unlock our comprehensive list of 55 Undervalued US Small Caps With Insider Buying by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HighPeak Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:HPK

HighPeak Energy

An independent oil and natural gas company, engages in the exploration, development, and production of crude oil, natural gas, and natural gas liquids reserves in the Permian Basin in West Texas and Eastern New Mexico.

Fair value with limited growth.